Copper prices are expected to rebound further in the coming months after heavy losses, thanks to increased infrastructure spending and other stimulus to the economy from China.

Copper prices are expected to rebound further in the coming months after heavy losses, thanks to increased infrastructure spending and other stimulus to the economy from China.

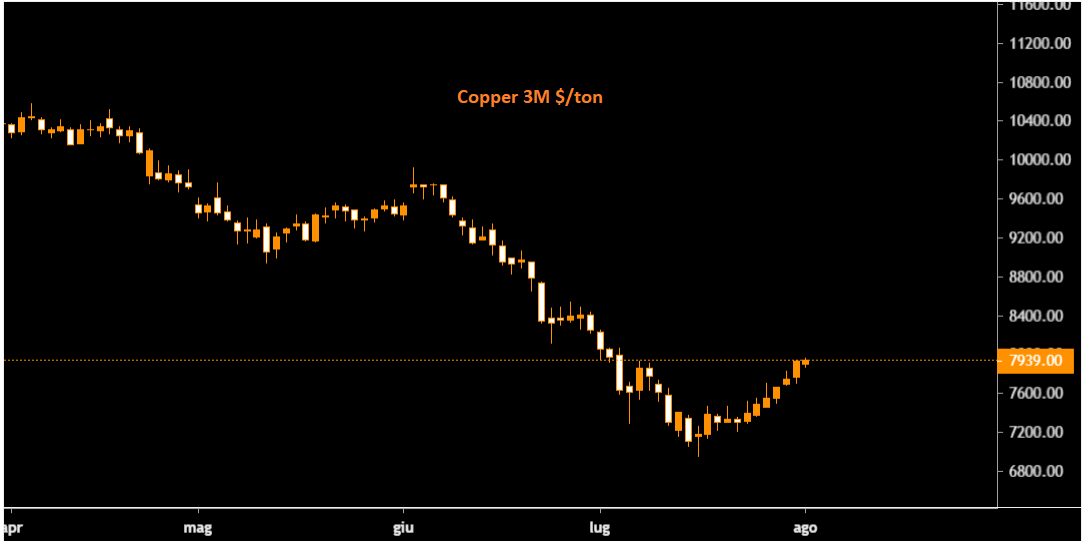

Lme-listed 3-month copper fell 36 percent in the four months after hitting a record high of $10,845 a ton in March on fears that China’s slowdown and a potential global recession could dampen demand. It has since rebounded about 10 percent (as reported on July 18 by Commodity Evolution’s research bureau – read here).

Although China’s closures remain a risk factor, the worst in terms of Chinese growth is believed to be behind us. News of more infrastructure projects and support for China’s real estate market boosted copper prices this week.

Analysts expect the supply situation to ease, having reduced estimates of an overall deficit for this year to 30,000 tons, less than a third of the 110,000 tons forecast in the April survey.

.gif) Loading

Loading