The Russia-Ukraine war and the economic sanctions imposed on Russia by the European Union (EU) and G7 allies, including the US, have not only altered trade patterns and the supply/demand balance, but have also created a wide gap between steel prices in the Western world and Asia.

The Russia-Ukraine war and the economic sanctions imposed on Russia by the European Union (EU) and G7 allies, including the US, have not only altered trade patterns and the supply/demand balance, but have also created a wide gap between steel prices in the Western world and Asia.

The main reason for the wide price differential is that demand for steel in Asia is met by the strong presence of Chinese and South-East Asian producers, while in the West, especially in the EU, supply remains limited due to reduced capacity utilisation by steel mills.

Reduced capacity utilisation rates amid record high oil, natural gas and coal prices, as well as fears of shutdowns by some mills, are leading to higher than usual market demand as downstream industries want to secure the material.

Moreover, prices have risen significantly with the lack of import options supporting the upward movement. The EU is not ready to lift its safeguard measures despite strong protests from the downstream industry.

In the US, considering the fact that rolling mills are operating at full capacity, it is fair to expect that any increase in demand will have to be offset by imports. Import restrictions and, consequently, supplier prices have increased dramatically due to the war in Ukraine. With this, steel prices in the US are also rising.

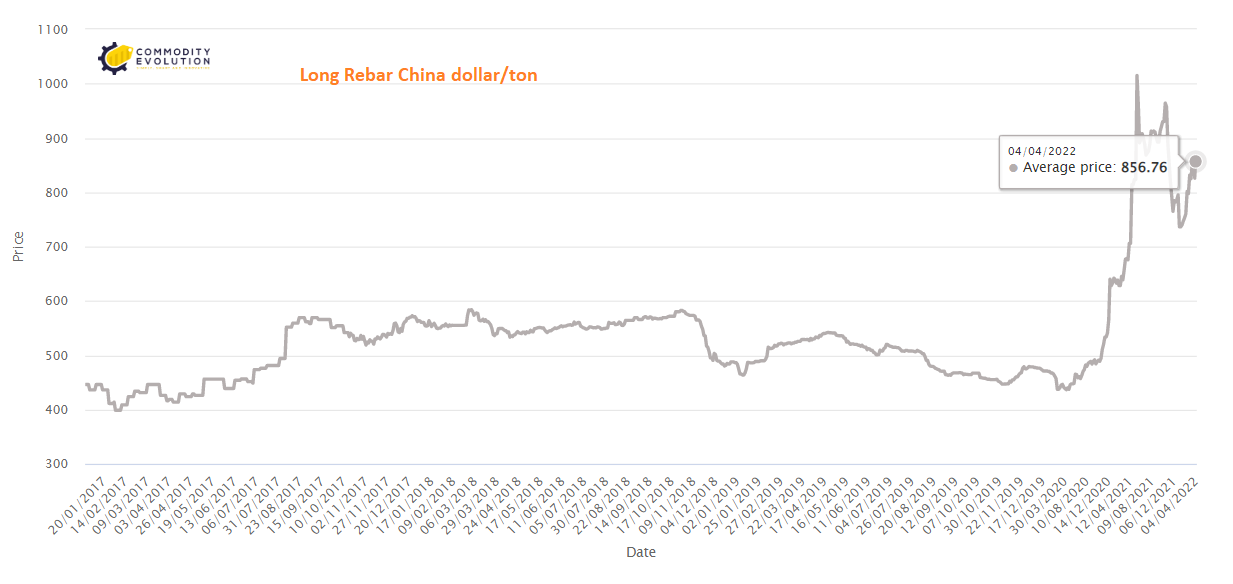

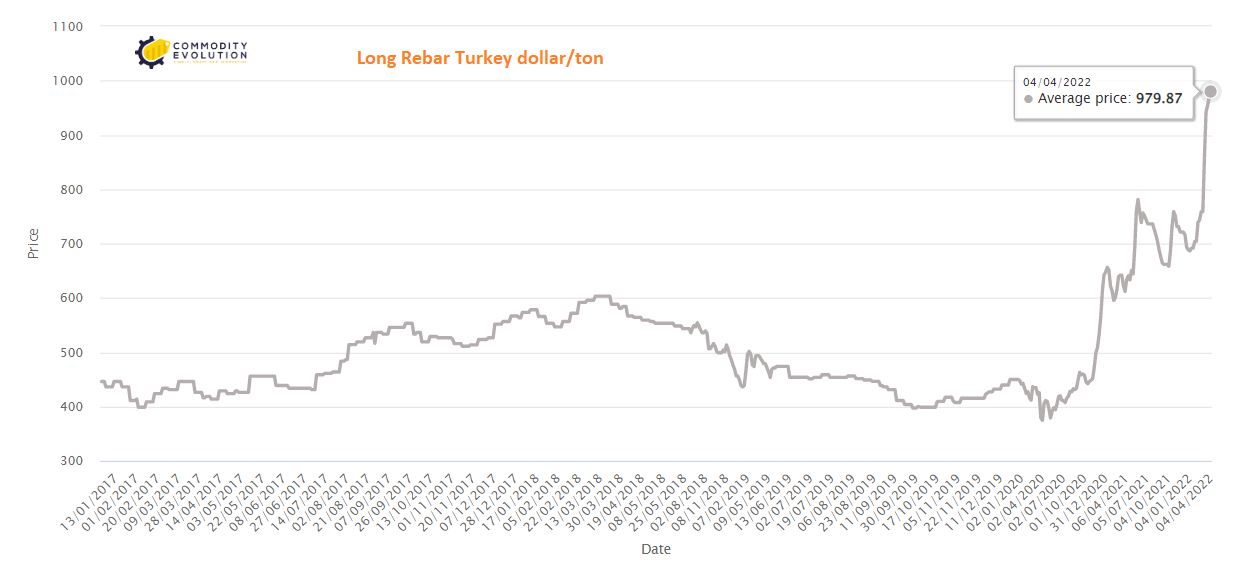

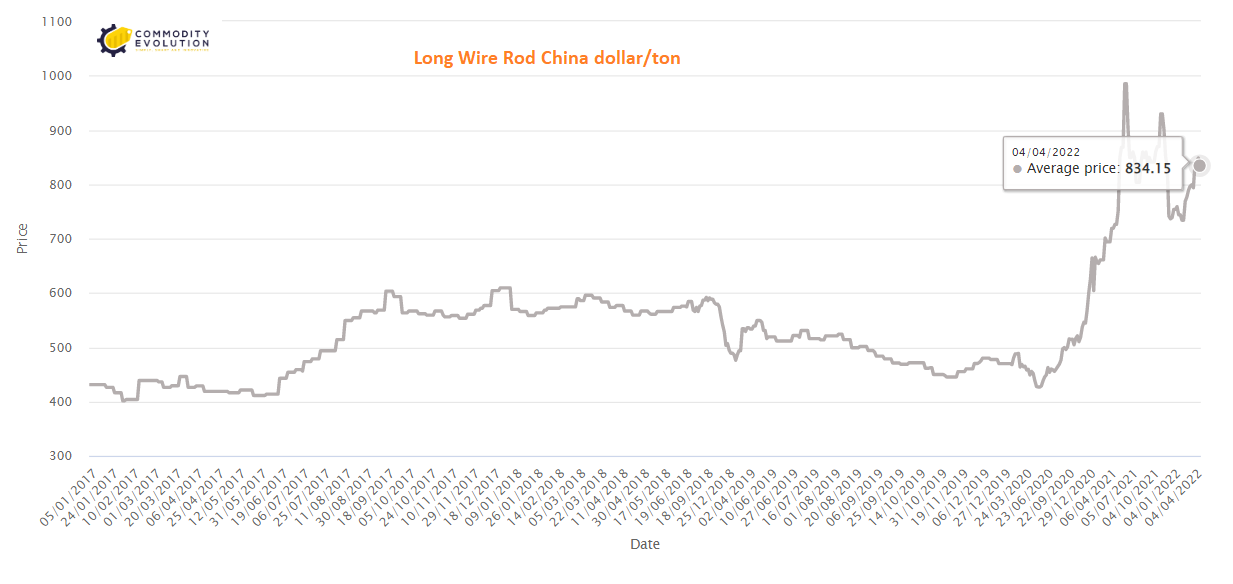

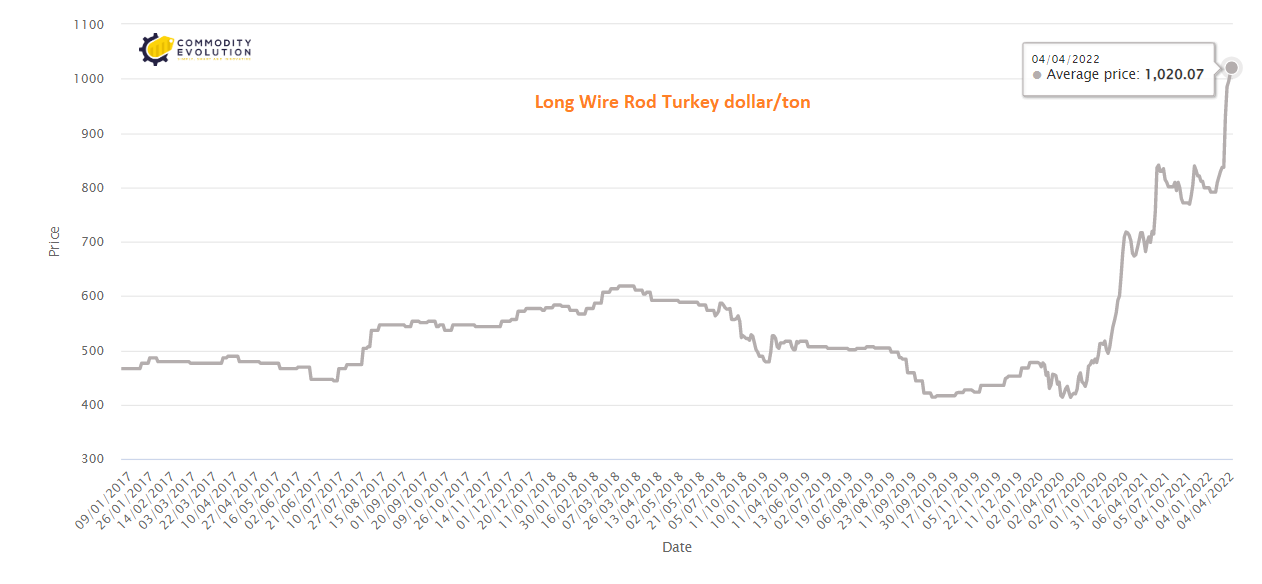

As a result, there is a price imbalance between Asia and the rest of the world. The difference between the prices of reinforcing bar and wire rod of Turkish origin and the prices of reinforcing bar and wire rod of Chinese, Vietnamese or Malaysian origin is over $100 per tonne.

European steel prices are now the highest and Asian prices, especially Chinese prices, are substantially lower. Therefore, the steel trade is changing direction from selling to Asia to buying. Asian suppliers have a strong incentive to increase exports. Some Indian steel mills, for example, are trying to allocate 35-40% of their total production to exports.

Due to stable global steel prices, Chinese mills have become active in the export market, particularly HRC’s exports to South East Asia, with European buyers booking steel slabs from China at much lower prices than in Europe.

The conflict led to severe sanctions on Russia by the EU and quarterly import quotas from Russia and Belarus were redistributed among other countries. This has pushed up export quotas for hot rolled coils (HRC) for other exporting countries. The HRC quota for Indian mills increased to 273,178 t (+39%) and that of cold rolled coil (CRC) to 86,589 t (+1%) for Q2 2022.

For the EU, the redistribution of quotas is simply a change in import allocations from one country to another, which does not affect total imports that are limited due to safeguard measures.

Russia exported 15.9mnt of semi-finished steel and 16.8mnt of finished steel in 2021. About 45% of steel production from Russia and about 75% from Ukraine is exported to other countries. According to the European Steel Association, the EU imported 3.2mnt of finished steel products from Russia in 2020 and an estimated 3.7mnt in 2021 in addition to imports of semi-finished steel. Russia was the EU’s second largest supplier after Turkey.

In the future, the supply scenario is expected to ease in Europe as major steel mills resume production. Ukraine’s ArcelorMittal Kryvyi Rih, located in the centre of the country, is working on the gradual restart of steel and pig iron production operations that had been suspended on 4 March. The steel plant produced 4.92mnt of crude steel in 2021 and 4.6mnt of finished steel, mainly rebar, wire rod and structural.

Similarly, Ukrainian mining and steel company Metinvest is partially resuming operations at the Zaporizhstal steel plant. The steel plant will restart one of its two furnaces. In April, the steel mill is targeting at least 20,000-30,000 tonnes of crude steel production, with the aim of increasing output to 150,000 tonnes in May. In 2021, Zaporizhstal produced 3.9mnt of crude steel, which was converted into 3.3mnt of rolled products (read the full news here).

In addition, it seems that steel prices have already peaked. However, the highly uncertain outlook for the energy market is a cause for great concern. Russian President Vladimir Putin has threatened to cut off gas supplies to ‘unfriendly’ countries if they do not start paying for gas imports in Russian roubles.

In 2021, the European Union imported 155 billion cubic metres of natural gas from Russia, accounting for about 45% of the EU’s gas imports and almost 40% of its total gas consumption, according to the International Energy Agency (IEA). Russia was also Europe’s largest oil supplier with 27% of total imports in 2021.

Fuel prices have reached ten-year highs in Europe since the start of the war and general inflationary pressure is expected to keep steel prices firm until the supply scenario changes significantly.

.gif) Loading

Loading