Aluminum prices have been on an upward trend (as widely anticipated by Commodity Evolution’s research department) for the past 2 days thanks to the clearing of traders’ positions ahead of the end of the third quarter, while daily data showed falling stockpiles and the dollar on a downward trend. Benchmark aluminum on the London Metal Exchange (LME) 3-month trades at $2,338/mt (today at 2:37 p.m. ET), registering +2.54%.

Aluminum prices have been on an upward trend (as widely anticipated by Commodity Evolution’s research department) for the past 2 days thanks to the clearing of traders’ positions ahead of the end of the third quarter, while daily data showed falling stockpiles and the dollar on a downward trend. Benchmark aluminum on the London Metal Exchange (LME) 3-month trades at $2,338/mt (today at 2:37 p.m. ET), registering +2.54%.

We have seen many impressive movements today, but the rally, at least in aluminum and copper, is driven by position closures as we are at the end of the week, month and quarter.

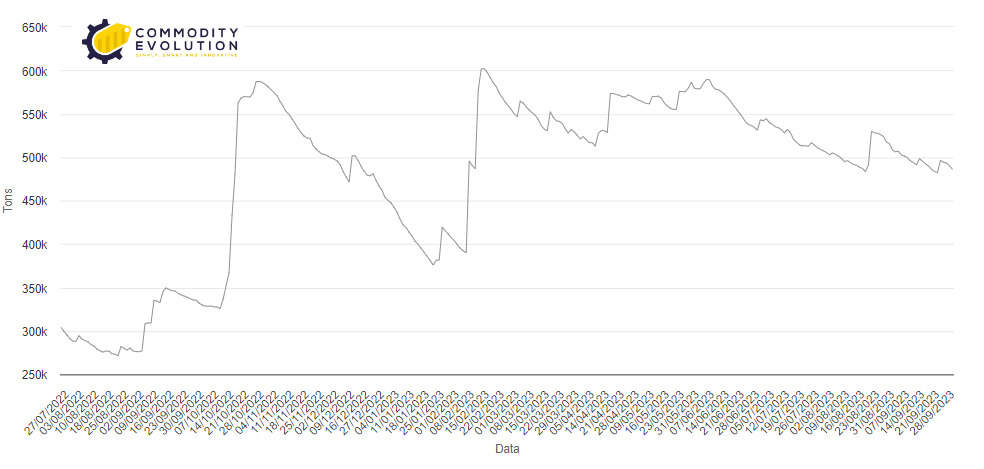

Traders are taking profits, those on the sell side are buying back positions. Mandated aluminum stocks in LME-registered warehouses fell to 173,875 tons, the lowest since August 2022, after new write-offs of 51,000 tons in Gwangyang, South Korea.

The weakening of the U.S. dollar index has also made metals more attractive to buyers holding other currencies. China, the main metals consumer, has started its public vacation week, but crucial data-the official September manufacturing PMI and the unofficial Caixin PMI-are expected over the weekend. The Reuters poll predicts an official PMI at 50.0 compared to 49.7 in August.

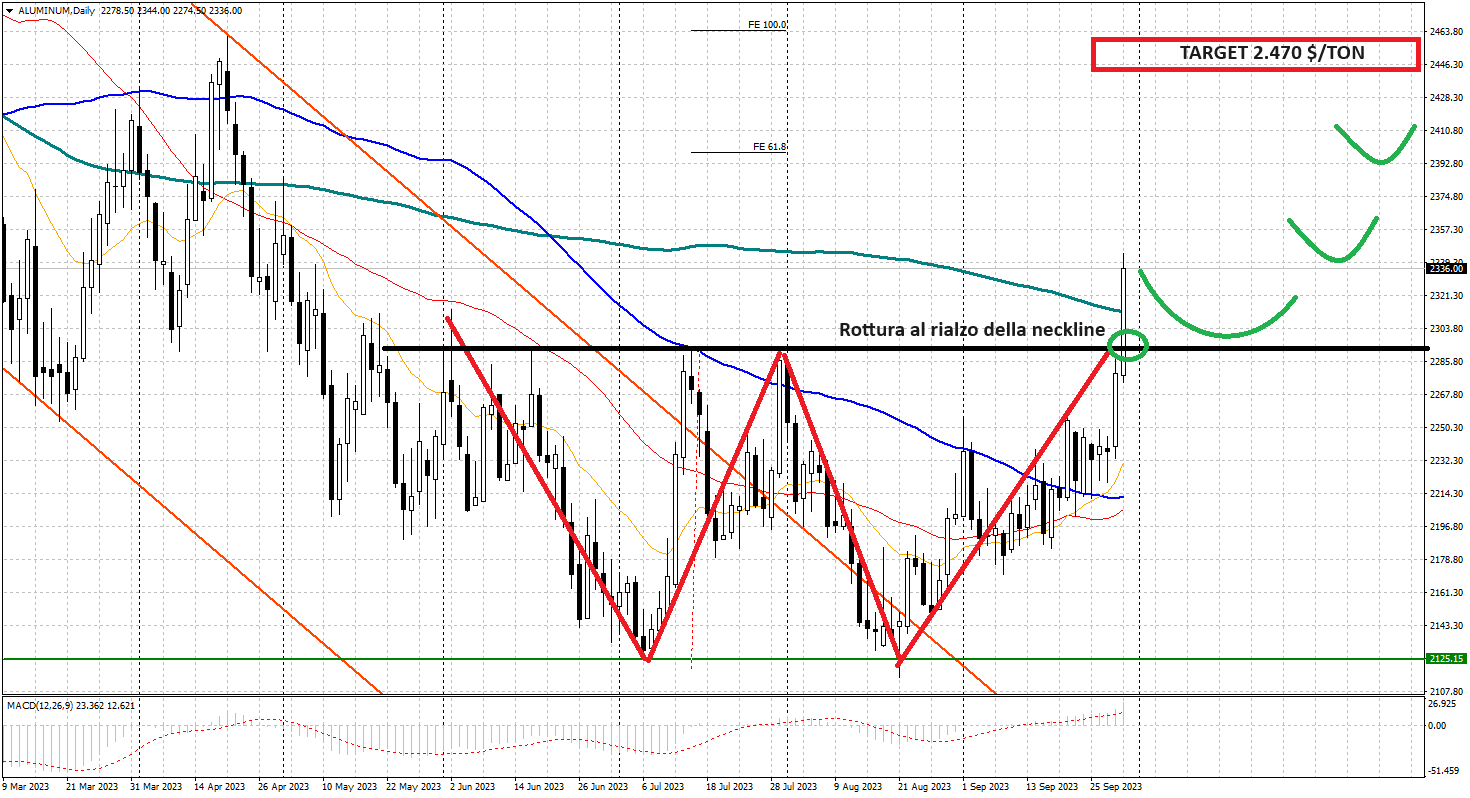

The current upward break of the “neckline” at $2,285/mt confirmed the completion of the double minimum in formation (upward reversal pattern). After a possible settling phase thereafter, the next bullish targets are identified in the $2,470/ton area first.

.gif) Loading

Loading