Glencore bought only a small portion of the potential 6.9 million tonnes of aluminium it could have purchased in the 2020-2022 period under its contract with Russia’s Rusal, which could be extended to 2025.

Glencore bought only a small portion of the potential 6.9 million tonnes of aluminium it could have purchased in the 2020-2022 period under its contract with Russia’s Rusal, which could be extended to 2025.

Commodities group Glencore, under pressure to stop buying metal from Rusal due to Moscow’s invasion of Ukraine, said last year that it would not agree new contracts for the Russian material, but would fulfil existing obligations.

An early end to the contract could open up large quantities of supplies from Rusal, the world’s largest aluminium producer outside China, to Glencore’s rivals, such as trading company Trafigura.

Rusal’s annual reports show that Glencore bought $2.87 billion worth of aluminium under the contract over the 2020-2022 period, which Reuters calculates would amount to about 1.1 million metric tonnes based on the London Metal Exchange’s average cash price for each year.

The 1.1 million tonnes is an estimate because the price would also include regional premiums, which could not be included as destinations were not provided.

Many participants at last week’s aluminium conference in Barcelona were puzzled by the scope of the agreement, under the impression that the contract would end next year.

Neither Glencore nor Rusal said whether an option under the contract to extend the purchases to the end of 2025 from the original September 2020 deadline to the end of 2024 would be exercised.

The contract includes Glencore’s right to purchase up to 6.9 million tonnes over the life of the contract, but volumes so far last year have not approached that figure, according to Rusal’s annual reports.

The purchases are in stark contrast to the maximum permitted quantity for the 2020-2022 period of 3.61 million tonnes. Many companies refuse to buy Russian material because of the war in Ukraine, even though there are no government sanctions on Rusal or Russian aluminium.

Glencore has a long relationship with Rusal, having participated in the 2007 merger that created the current group. The Swiss group also owns a 10.55% stake in Rusal’s parent company, EN+ Group ENPG.MM, and Glencore has stated that ‘there is no realistic way to exit’ the stake in the current environment.

The contract allows Rusal to defer up to 10% of each annual tonne to 2025, in which case the term will be extended to the end of 2025. Rusal’s aluminium sales to Glencore do not reach the contract limits.

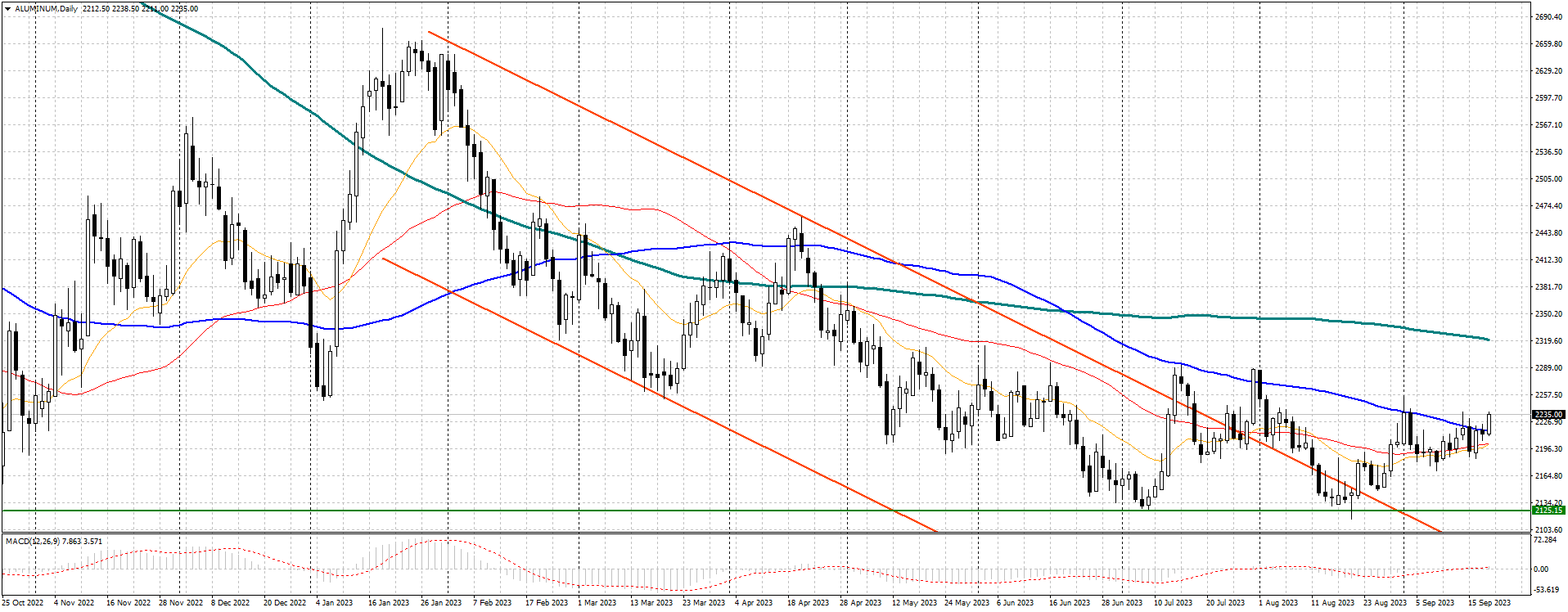

In the meantime, primary aluminium traded on the London Metal Exchange (LME) is showing a reaction phase (+0.93%) at $2,236/mt (11:03 a.m. Italy time), with a high probability of revisiting the first fundamental level at $2,290/mt, an area above which the current rebound may extend towards the next targets in the $2,450/mt area.

.gif) Loading

Loading