The Aluminium Association of Canada, the European Aluminium and the Japan Aluminium Association have published a joint paper for the Group of 7 (G7) trade ministers ahead of their meeting in Osaka, Japan, next October.

The Aluminium Association of Canada, the European Aluminium and the Japan Aluminium Association have published a joint paper for the Group of 7 (G7) trade ministers ahead of their meeting in Osaka, Japan, next October.

The document, Aluminium Supply Chain Pathways to Net Zero GHG Emissions and Fair Global Markets: Priority Action Areas, emphasises the essential role of aluminium in the transition to a low-carbon economy and outlines pathways for the decarbonisation of the sector, while addressing market distortions caused by non-market economies such as China.

“Global demand is projected to increase by up to 80 per cent by 2050; as much aluminium will need to be produced in the next decade as has been produced in the last hundred years,” the report states. “The transition to zero greenhouse gas emissions and increased supply of responsibly produced aluminium in the United States, Europe, Canada and Japan will require massive new investments in alternative clean energy systems, near-zero greenhouse gas-emitting production technologies and near-100 per cent recycling rates for pre-consumer scrap and end-of-life products.”

The briefing defines four priority action areas to support this necessary market transition:

- Decarbonisation of electricity: The decarbonisation of the electricity grid is essential to any effort to bring the aluminium sector to net zero emissions. In recent decades, the global industry has shifted towards building new plants in locations with access to renewable energy, and this trend must continue. The transition will also require significant public investment in new, efficient energy infrastructure;

- Production technologies: New production technologies, including inert anode fusion and carbon capture, use and storage (CCUS), can significantly reduce industry emissions in the medium term. Governments should prioritise research and development (R&D) funding, supported by international scientific and technological collaboration, to boost these programmes;

- Material efficiency: Although about 75 per cent of all aluminium ever produced remains in use globally today, opportunities remain to increase aluminium recycling, which is critical for a low-carbon future. The industry is supporting consumer education, policy incentives, public-private partnerships to increase supply, and accelerating research and development on material selection to enable an aluminium recycling rate close to 100%;

- Market-based incentives: Governments must continue to provide market-based incentives to decarbonise the sector, secure supply chains and ensure a global level playing field. Continued and enhanced trade enforcement is essential to this effort. Border adjustment programmes for carbon also play an important role. Governments and industry must also work together to prevent supply chain risks caused by the concentration of critical minerals in a few key countries

In a letter to world trade ministers, the associations note: ‘The aluminium industry is not only an energy-intensive and trade-exposed industry, but also a critical source of material for clean energy technologies: a low-carbon circular economy requires access to sustainable, secure and resilient aluminium supply chains.

On behalf of our member companies and the 1.75 million workers they support directly and indirectly in the United States, Europe, Canada, and Japan, we pledge to work closely together to pursue our common interests.”

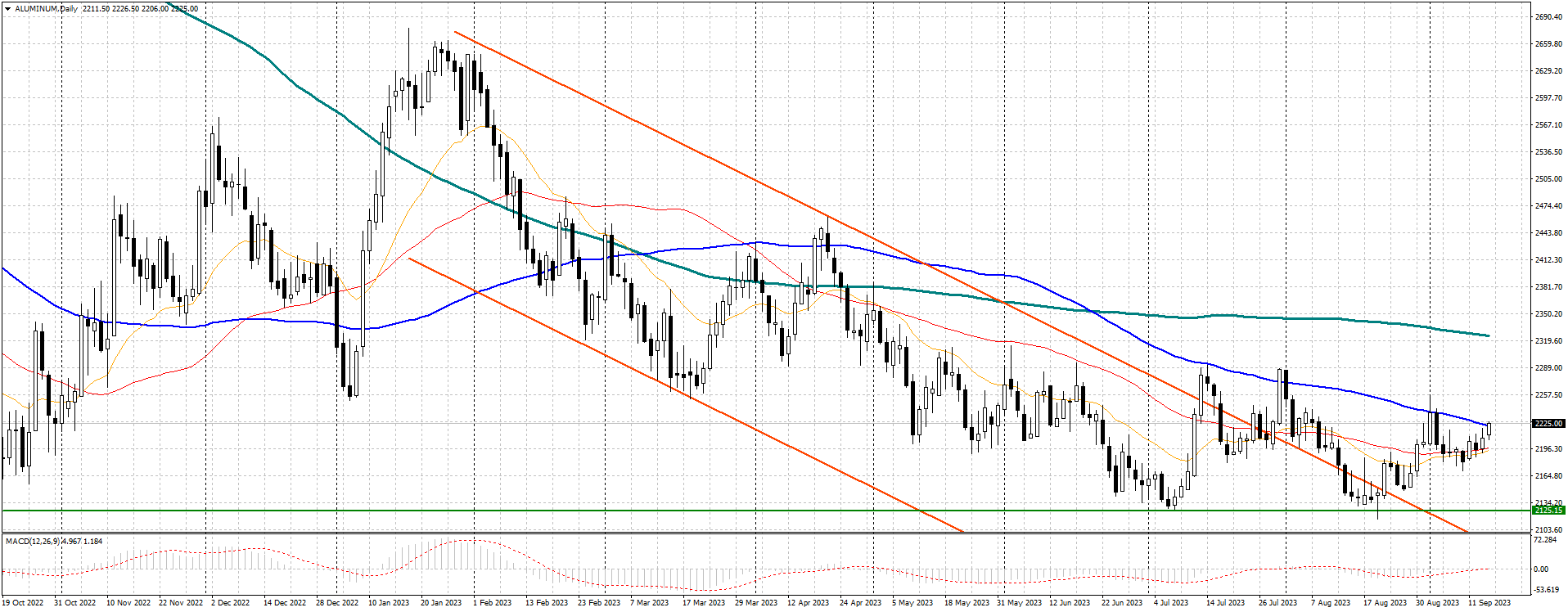

At the moment, 3-month $/ton aluminium quoted on the LME is showing a rebound phase, with prices close to the 100-day moving average in the $2,226/ton area. The current price strength could easily break through this level and then move upwards, at least to the $2,300/mt area.

This price level (2,300 $/ton) represents to a very important zone, which is considered a trigger line of the double minimum forming on a weekly basis. The possible perforation of this level (2,300 $/ton) to the upside would complete the reversal pattern of the descent, in favour of greater extensions at least up to the 2,400 $/ton area.

.gif) Loading

Loading