Alumina is essential for the production of primary aluminium. It is obtained from bauxite ore through the Bayer process and serves as the primary raw material in the Hall-Héroult process, which extracts the non-ferrous metal, aluminium, from its powder form. The production of alumina is energy-intensive, but is necessary because of its importance in the production of primary aluminium.

Alumina is essential for the production of primary aluminium. It is obtained from bauxite ore through the Bayer process and serves as the primary raw material in the Hall-Héroult process, which extracts the non-ferrous metal, aluminium, from its powder form. The production of alumina is energy-intensive, but is necessary because of its importance in the production of primary aluminium.

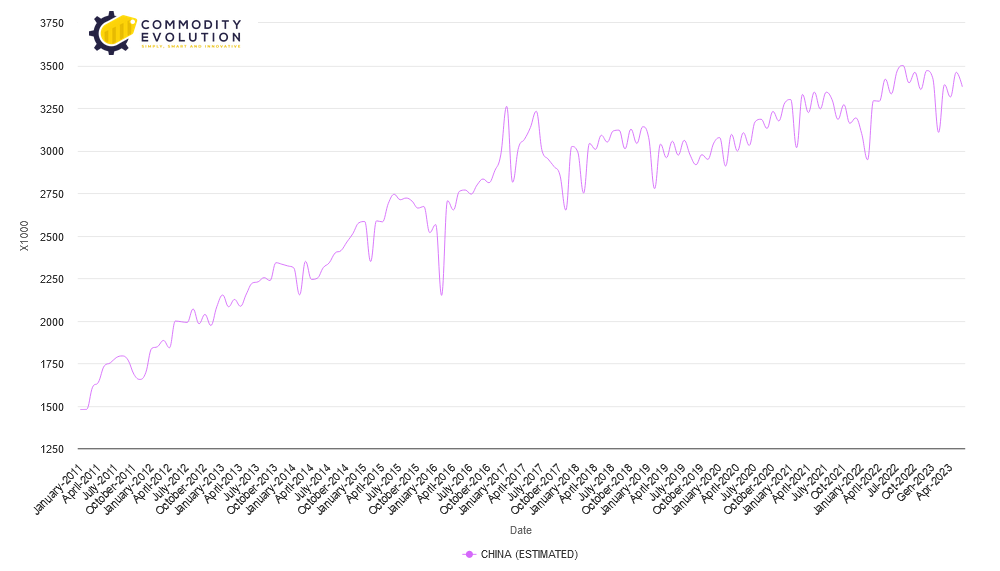

Last year, global alumina production increased slightly from the previous year to 139.2 million tonnes. Almost all of the alumina production, about 93.7%, comes from metallurgical grade sources, while only a small portion is chemical grade. China has been a major contributor to this increase in production, with an estimated production of 78.8 million tonnes of alumina, or about 57% of global production.

Some of the major alumina-producing countries and companies are listed below:

China – In November 2022, China’s alumina production capacity was about 76.6 million tonnes. However, capacity utilisation of alumina refineries dropped to around 79% from 81% in October 2022 due to high infection levels in China, pollution-related disruptions and lower operating rates. China is estimated to have produced 6.7 million tonnes of alumina in November 2022, with the metallurgical grade accounting for 95% of total production.

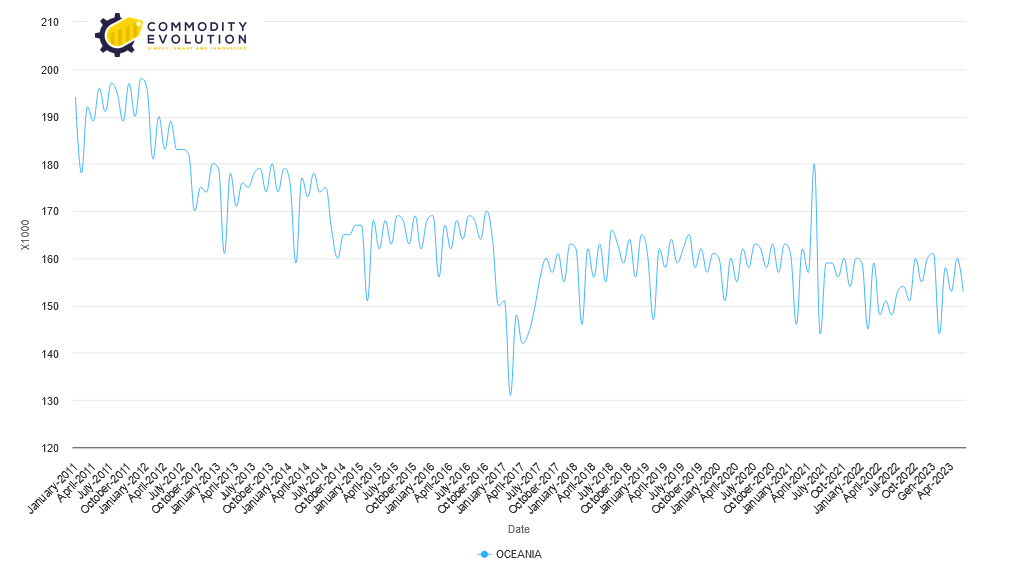

Australia – Remains a major global producer of alumina, ranking second in the world and leading in exports. In the period between 2022 and 2023, the country is expected to produce around 20.4 million tonnes, up from 20.1 million tonnes the previous year. Forecasts from government sources indicate that Australian alumina production will reach 20.9 million tonnes in 2023-24. However, in the quarter ending September 2022, there was a 7.8 per cent decline in alumina supply compared to the same period in 2021. This was mainly due to planned maintenance at several refineries and plant stability issues.

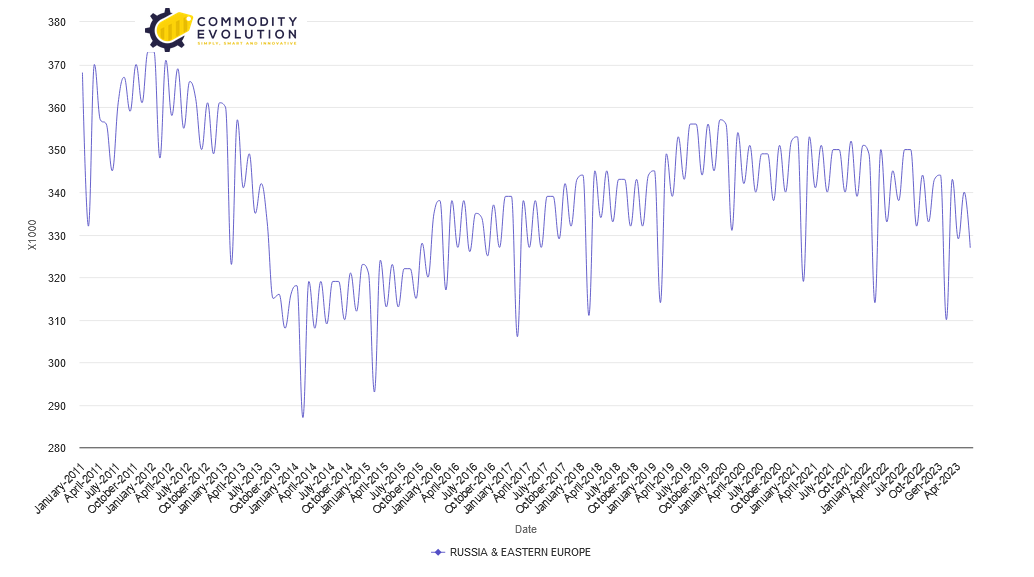

Russia – In the first half of 2022, UC RUSAL’s alumina production decreased by 2.1% compared to the same period in 2021, with 3.3 million tonnes produced instead of 4.1 million. This decline was caused by the closure of the Nikolaev alumina refinery in Ukraine and the impact of Australian government sanctions that restricted the processing of Australian bauxite and the export of 20 per cent of alumina from the Queensland Alumina Limited refinery in Queensland.

India – In the first half of the 2022-23 fiscal year, Vedanta recorded a production of 939,000 tonnes at its refinery in Lanjigarh, India. This is a decrease from the 993,000 tonnes produced in the same period of the previous fiscal year, mainly due to planned maintenance at the refinery. On the other hand, Hindalco reportedly produced 1.8 million tonnes of alumina, an increase of about 17% compared to the same period in the previous fiscal year. Finally, Nalco produced about 2.1 million tonnes during the 2021-22 fiscal year, a marginal increase from the 2.0 million tonnes produced during 2020-21.

Arab countries – Emirates Global Aluminium’s Al Taweelah alumina refinery produced around 1.15 million tonnes of alumina, above its nominal capacity, in the first six months of 2021 and 2022. Production for the first six months of 2022 increased by 6 per cent compared to the first six months of 2021. The refinery operated by Ma’aden in Saudi Arabia is estimated to have produced around 875,000 tonnes in the first half of 2022. The refinery is expected to produce about 1.75 million tonnes by the end of the year.

Major alumina producing companies

Hydro – In the third quarter of 2022, Hydro produced 4.6 million tonnes of alumina, down slightly by 2.1% from the 4.7 million tonnes produced in the same period last year. The company has a long-term offtake agreement to receive 900,000 tonnes of alumina per year from Rio Tinto’s Yarwun refinery.

Alcoa – In 2022, Alcoa had a total alumina refining capacity of 13.8 million tonnes. However, approximately 1.0 million tonnes of capacity was reduced by Alcoa’s Pocos De Caladas plant in Brazil and San Ciprian plant in Spain. As of Q3 2022, Alcoa had shipped approximately 9.9 million tonnes of alumina. Alcoa’s total alumina shipments in 2022 are estimated to be between 13.1 and 13.3 million tonnes, slightly lower than in 2021 (13.9 million tonnes). Third-party shipments account for 70 per cent of the total in 2022. Alcoa signed a new power purchase agreement to restart the San Ciprian smelter in 2024.

Rio Tinto – From January to September 2022, Rio Tinto produced about 5.6 million tonnes. For the whole of 2022, the company is expected to produce around 7.6-7.8 million tonnes of alumina. This annual estimate is slightly lower than the 7.9 million tonnes produced in 2021. The decline in alumina production can be attributed to planned shutdowns at the Yarwun refinery and equipment stability problems at the Queensland alumina refinery.

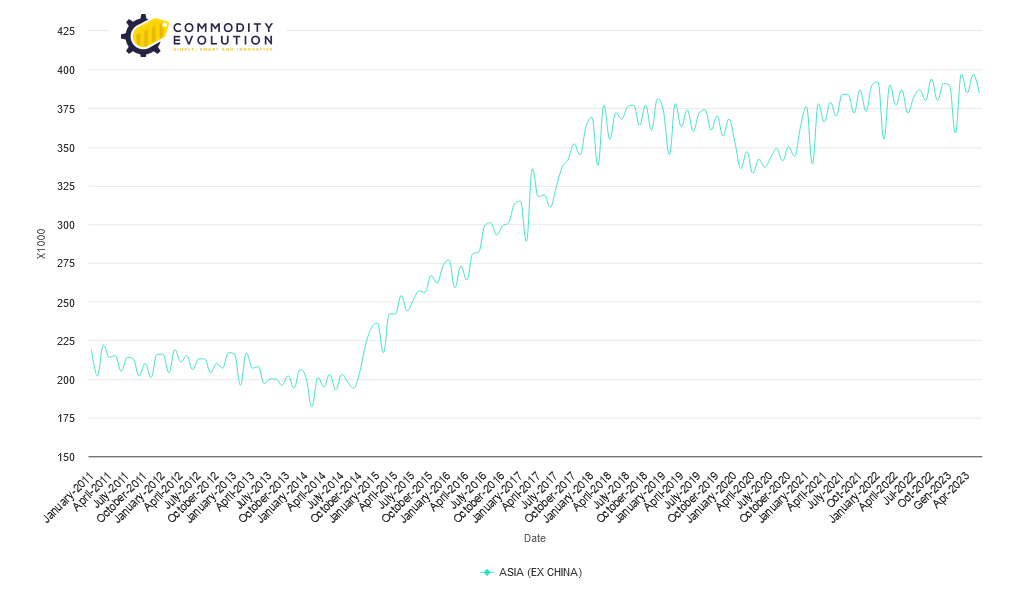

Alumina supply increased significantly in 2022, with China, Australia and the Middle East leading the industry. This growth was driven by the opening of new plants in China and the offsetting of alumina shortfalls caused by operational problems at Australian refineries with supplies from Brazil. Going forward, demand and prices for alumina will be directly proportional to demand for primary aluminium, with global economic growth expected to decelerate by 2023.

.gif) Loading

Loading