This paper has been produced by Commodity Evolution’s research department, analysing the macroeconomic and technical environment in order to provide an overall view on primary aluminium.

This paper has been produced by Commodity Evolution’s research department, analysing the macroeconomic and technical environment in order to provide an overall view on primary aluminium.

It is not news that the London Metal Exchange (LME) has seen a sharp increase in Russian aluminium stocks in its warehouses. However, the rise in Russian metal remains a major source of concern for the company. After all, it could potentially affect aluminium prices on the exchange, which producers, consumers and traders often use as a benchmark for contracts.

Rusal, a Russian aluminium producer, accounts for 5.4 per cent of the world’s total aluminium supply. Many expect the company’s production to be around 70 million tonnes this year. However, its products account for a large percentage of LME stocks.

So far, the LME seems hesitant to exclude Russian metals from trading and storage in its warehouses. However, producers and other market participants continue to loudly support sanctions against Russian metals. For example, Alcoa CEO Roy Harvey recently warned that Russian aluminium would invade LME warehouses. If his prediction came true, it could seriously damage the LME’s benchmarking reputation.

The problem of excess Russian aluminium in LME warehouses could lead to a reputational crisis. Moreover, Russia currently produces more than half of the aluminium in LME warehouses and the percentage of Russian aluminium stocks in LME warehouses has been growing since January 2023.

When the US imposed taxes on Russian metal imports at the end of February, the inflow of Russian metal into US-registered warehouses stopped. Due to the war in Ukraine, European and Asian companies do not want Russian aluminium.

Alcoa Corporation recently requested that the LME act to delist Russian-origin products in order to preserve the reputation and integrity of the exchange. Alcoa’s Executive Vice President and Chief Commercial Officer, Kelly Thomas, said that coupled with the humanitarian crisis caused by Russia’s invasion of Ukraine, the presence of so many Russian stocks seriously threatens global aluminium prices and calls into question the reliability of the LME’s aluminium contract.

So far this year, the amount of Russian aluminium in LME warehouses continues to increase. In March, it reached 53% after having reached 46% in February and 41% in January. April saw a brief decline to 52%. In May, however, the figure rose again to 68%. Given the current situation, many analysts expect this figure to rise further.

The global aluminium market continues to observe the growth in the percentage of Russian metal in LME-registered warehouses. Since most consumers want to avoid Russian metal whenever possible, this balance between supply and demand may soon have an impact on global aluminium prices.

ALUMINIUM: THE CLASSIFICATION OF THE METAL AS A STRATEGIC RAW MATERIAL IS PROPOSED

The use of aluminium is increasingly critical and widespread in a large number of production sectors, so much so that EU countries, led by France and Germany, are proposing to classify the metal as a ‘strategic raw material‘. In this way, EU countries expect to obtain faster approvals for any official aluminium-related procedures and greater access to finance for the industry, which in turn will benefit domestic companies.

According to the report published by the Financial Times, the proposed amendment to the EU’s Critical Materials Act suggests putting bauxite, alumina and aluminium at the top of the list of priorities, as they are a key part of metal processing and find application in a wide range of products such as cans or solar panels.

The European Commission first proposed the amendment in March as part of its green economy activities. Diplomats from several European countries, such as Germany, Greece, France and Slovenia, supported the proposal to include aluminium and its raw materials.

Many others also supported the proposal, arguing that these materials are crucial for the energy and digital transition and that the EU is heavily dependent on bauxite imports. Many other trade groups are lobbying for the classification of aluminium, emphasising its importance in solar panels, wind turbines and grid technologies.

If aluminium, alumina and bauxite are classified as strategic raw materials, the authorisation time for mining bauxite and alumina will be reduced to 24 months and for aluminium processing to 12 months. On the other hand, the EU will have to increase domestic extraction to 10% and domestic processing to 40% of total consumption.

The list of priorities will be finalised after several rounds of negotiations between the member states, the Commission and the European Parliament.

CBAM: SIGNIFICANT CHALLENGE FOR INDIAN INDUSTRY

On the CBAM (Cross Border Adjustment Mechanism) front, the EU’s implementation poses a significant challenge to India’s aluminium industry and the global aluminium price. The move stems from the EU’s desire to tackle carbon emissions and achieve zero emissions by 2050.

However, as a major producer of cheap aluminium, India faces a significant setback due to the CBAM. In fact, the subcontinent produces 4.1 million tonnes of primary aluminium per year, exporting about 56% of it.

India’s annual primary aluminium production accounts for 6% of global production. The country’s competitive advantage as one of the lowest-cost aluminium producers is based on integrated operations and the use of coal-fired plants for power generation.

But primary aluminium production is an energy-intensive process within the metallurgical and mining industries.

The adoption of the CBAM by the EU puts India’s position at risk due to the country’s higher emission intensity compared to its European counterparts. Currently, the emission intensity gap between Europe and India is about 14-15 tCO2/t Al, which means that Indian producers would face an additional cost of $1,500-1,600 per tonne of aluminium.

Consequently, this new regime is likely to have significant negative effects on Indian aluminium producers.

With EU Regulation No. 956 of 10 May 2023, published in the Official Journal on 16 May, the Carbon Border Adjustment Mechanism (CBAM) enters into force

In response to the challenges posed by the CBAM, several Indian manufacturers, including Vedanta, Hindalco and NALCO, have taken steps to address greenhouse gas emissions. For instance, Vedanta recently set a target to reduce absolute emissions by 25 per cent by 2030 compared to fiscal year 2021 levels.

Similarly, Hindalco aims to reduce specific GHG emissions by 25% by 2025, using FY2012 as a benchmark.

However, despite these efforts, capacity expansion in Middle Eastern countries is expected to give producers in the region a competitive advantage over their Indian counterparts once the CBAM comes into effect. This poses additional challenges to Indian producers trying to maintain their competitiveness in the face of growing opposition.

The EU currently plans to implement the CBAM as of 1 October 2023. According to CRISIL, a research and rating agency, the new policy is contributing to an increasingly bleak outlook for Indian aluminium producers. Besides potentially affecting the price of aluminium, exporters are likely to see their competitiveness in the European market eroded.

To remain competitive, Indian aluminium exporters must adopt sustainable practices and technologies that effectively reduce emissions. This shift to sustainability is crucial for Indian manufacturers to meet the challenges imposed by the CBAM. It ensures their continued presence and success in the international market.

The Indian aluminium industry is likely to face difficult times due to various factors. These include weak demand and a low aluminium price. Despite expectations of a recovery in the second quarter of 2023, demand for aluminium in sectors such as building, construction and packaging has remained subdued.

The drop in international thermal coal prices is further impacting Indian aluminium producers. It has reduced their cost advantage over other global producers. Indian producers generally benefit from cheap domestic coal. However, their global counterparts rely on Australian and South African thermal coal or natural gas, making their production costs comparatively higher.

The imminent implementation of the CBAM adds an additional layer of concern. The CBAM will cover sectors such as iron and steel, cement, aluminium, fertilisers, etc. Under this policy, EU importers must declare the carbon emissions embedded in products every quarter. Initially, a 100 per cent allowance will apply, but the mechanism introduces new complexities and potential costs for industry.

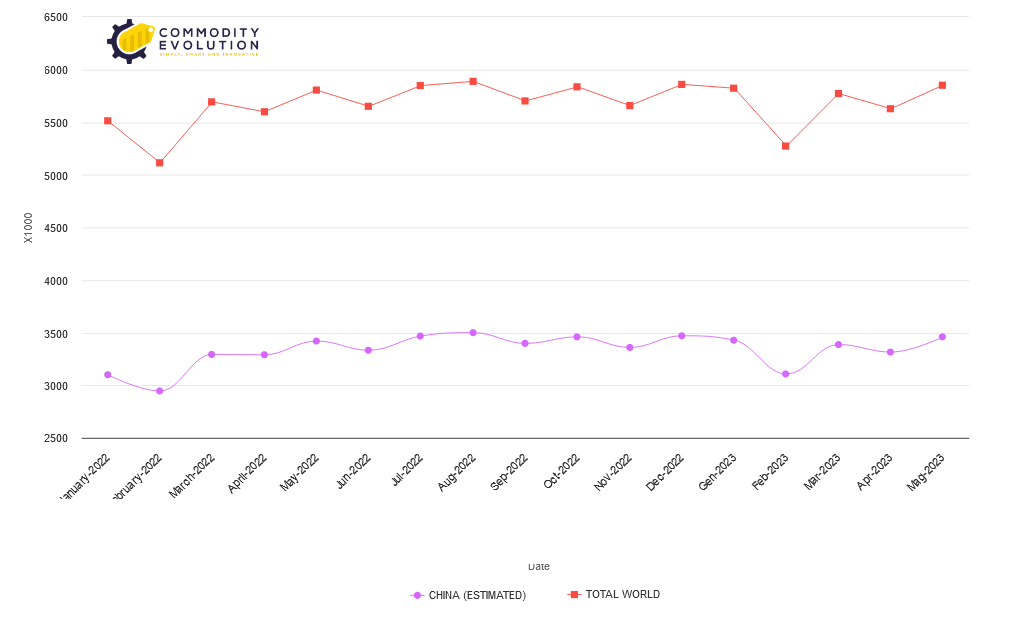

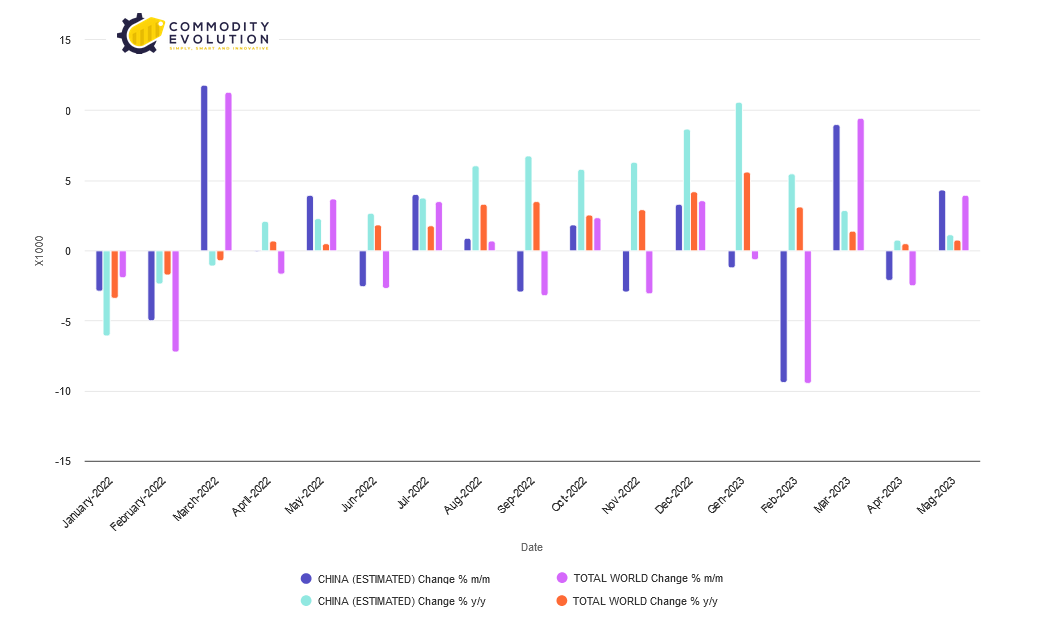

ALUMINIUM: THE PRODUCTION FRONT

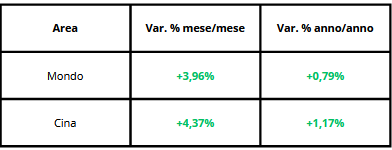

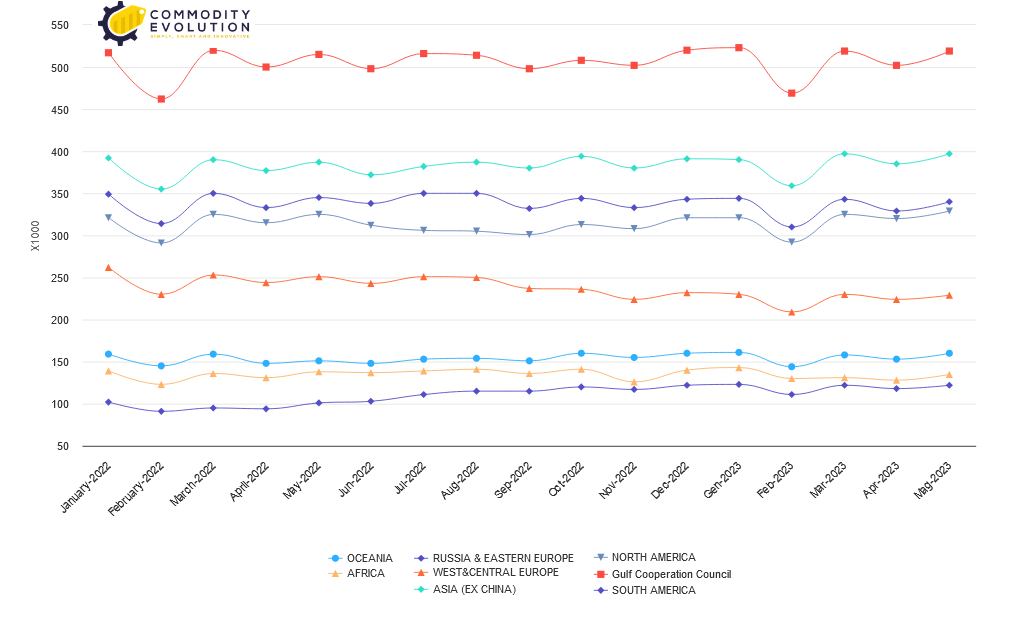

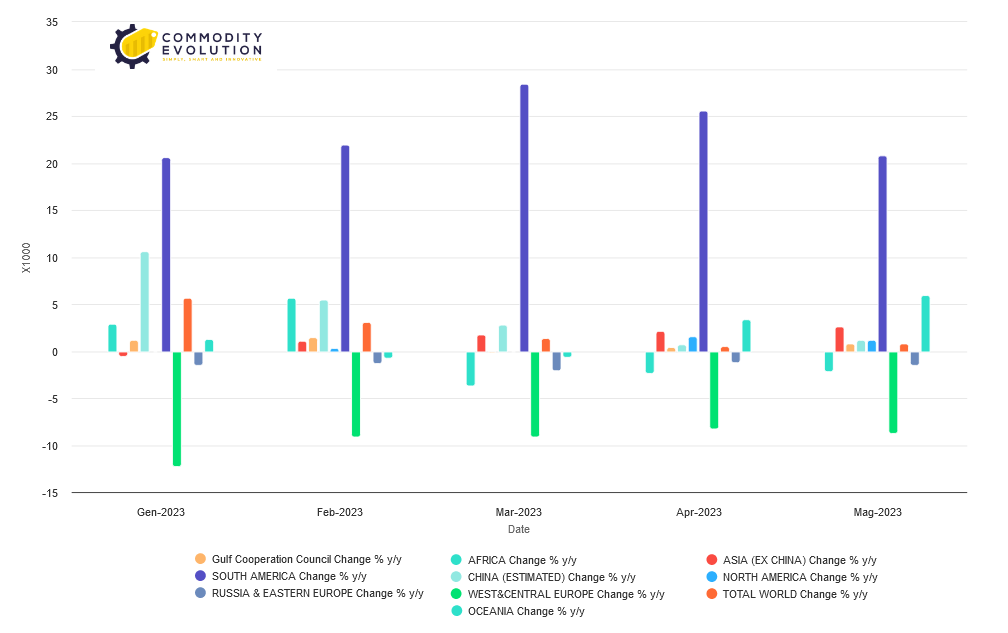

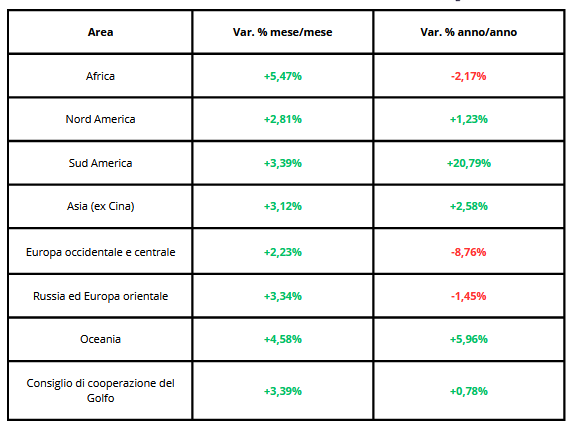

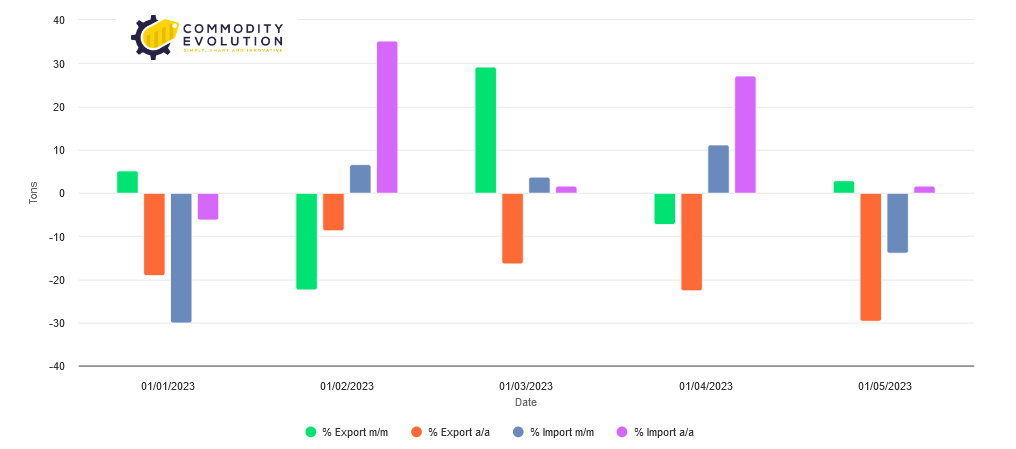

On the production front, the International Aluminium Institute’s latest report shows a recovery on both a monthly and year-on-year basis for Chinese production, up +4.37% and +1.17% respectively. There was also a recovery in world production of +3.96% (m/m) and +0.79% (y/y).

As for the rest of the world, there was a year-on-year decline in Africa (-2.17%), Western and Central Europe (-8.76%) and Russia and Eastern Europe (-1.45%).

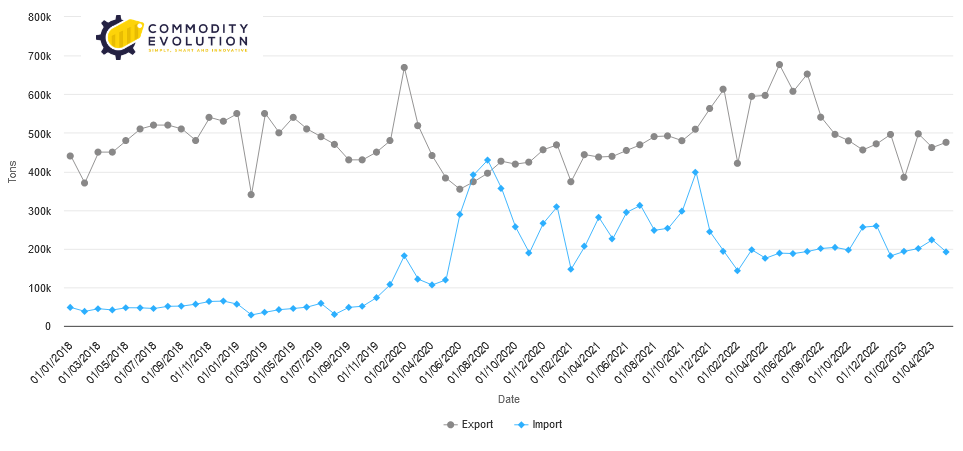

Analysing China’s trade balance for ‘Unwrought aluminium and aluminium products’ shows a recovery on a monthly basis of exports of +2.94% while on a year-on-year basis the figure shows a decline of -29.74%.

On the import side, a sharp drop of -14% is observed on a monthly basis while on a yearly basis the figure shows a slight recovery, +1.71%.

Meanwhile, Chinese aluminium producers are looking to Indonesia for smelters like nickel producers. Indonesia has shown interest in hosting aluminium smelters as it did with nickel. Indonesia wants to stop exporting aluminium raw materials and is working to convince foreign investors to build domestic smelters.

Moreover, as imposed by President Xi Jinping’s government, the cap on China’s domestic production capacity has reached its limit. A new Chinese-backed aluminium plant has already started operation in the south-east Asian country. The project is also supported by Tsingshan Group Holding, the company behind the billions of dollars of Chinese investment in the development of nickel plants in Indonesia.

Chinese aluminium companies must exit China if they want to expand, given the capacity cap.

China contributes more than half of global aluminium production, after dramatic market growth over the past century. But expansion has reached a limit, with the government imposing an annual capacity cap of 45 million tonnes to prevent oversupply and eliminate old and inefficient plants.

LET US ANALYSE THE PRICE COMPONENT

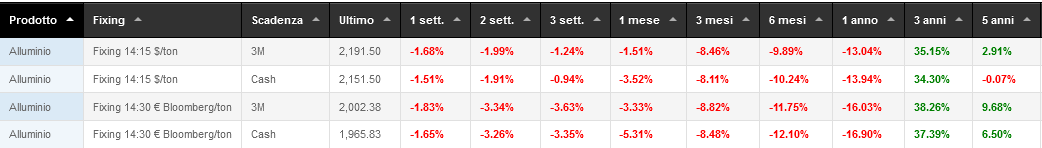

Downturn for aluminium, both in $ and €, on time horizons up to one year.

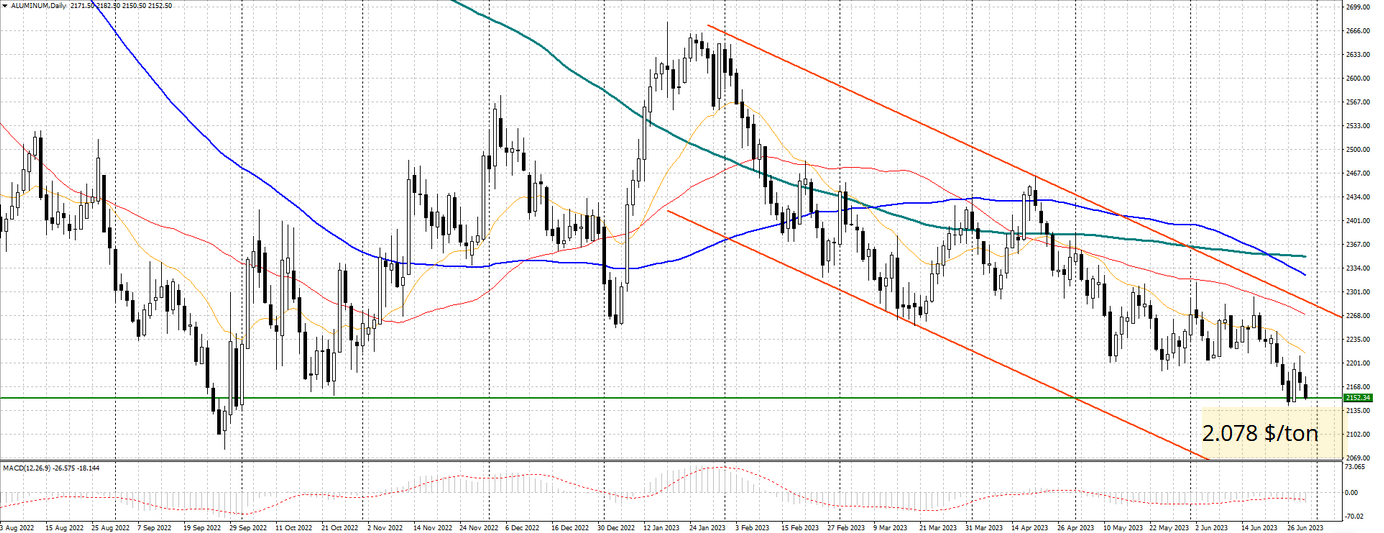

The weak phase of primary aluminium’s $ recovery since the beginning of the year 2023 reached fundamental support in the $2,150/mt area (generating a decline of 18.15%).

All moving averages are above prices, not facilitating the potential for even a slight rebound. It will now be essential to monitor precisely this price level (2,150 $/ton), a static support area coinciding with the October 2022 lows. In this context, a sudden return towards the lows of the end of September 2022 at 2,078 $/tonne would not be surprising, in order to subsequently witness a first decisive recovery phase.

On the euro front, the descent is also evident, with prices in support at €1,957/mt (28 June). Should the decline in $ prices continue below 2,150 $/tonne, prices in € could potentially continue with greater intensity, at least until the next target identified in the 1,850 €/tonne area.

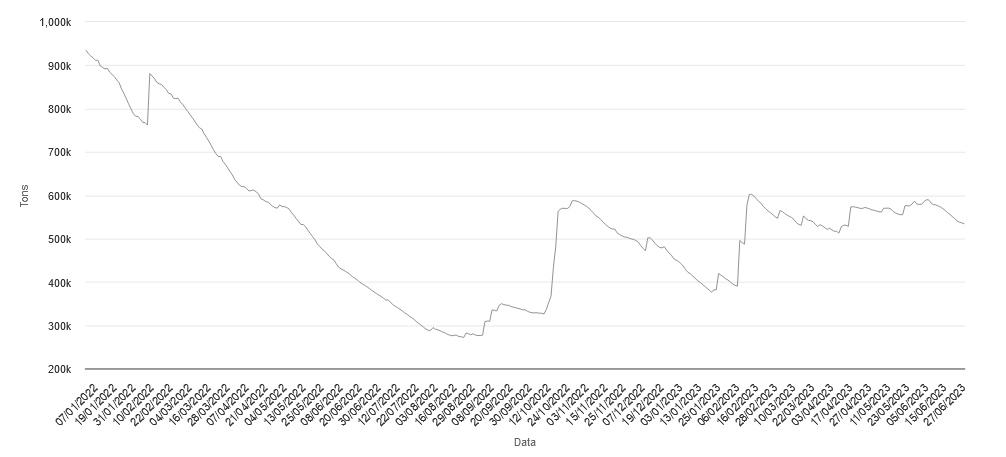

On the warehouses front, there was a 20.77% increase since the beginning of the year, with stocks rising from 442,425 tons to the current 534,350 tons on 28 June 2023.

DISCLAIMER

This document has been prepared by Commodity Evolution, for the exclusive use of the party to whom it is delivered and may not be reproduced, redistributed, directly or indirectly, to third parties or published, in whole or in part, for any reason whatsoever, without prior express consent. This document is intended for consultation by the persons to whom it is addressed and, in any case, is not intended to replace the personal judgement of the persons to whom it is addressed. While Commodity Evolution has taken the utmost care in the preparation of this document and considers its contents to be reliable, Commodity Evolution nevertheless assumes no responsibility for the accuracy, completeness and timeliness of the data and information contained in or present on the resources and data used for the purpose of its preparation. Accordingly, Commodity Evolution disclaims all liability for errors or omissions. The opinions, forecasts or estimates contained in this document are made with reference only to the date of preparation of this document, and there can be no assurance that future results or any future events will be consistent with the opinions, forecasts or estimates contained herein.Any information contained in this document may, after the date of preparation of this document, be subject to any amendment or update, without any obligation to notify such amendments or updates to those to whom this document was previously distributed. This publication is provided to you for information and illustration purposes only and in no way constitutes an offer to the public of financial products or the promotion of investment services and/or activities either to persons residing in Italy or to persons residing in other jurisdictions. Commodity Evolution, nor any of its directors, representatives or employees assumes any liability whatsoever, in whole or in part, for any damages (including, without limitation, damages for loss or loss of profits, business interruption, loss of information or other economic loss of any nature whatsoever) arising out of the use, in whatever form and for whatever purpose, of the data and information contained in this document.

.gif) Loading

Loading