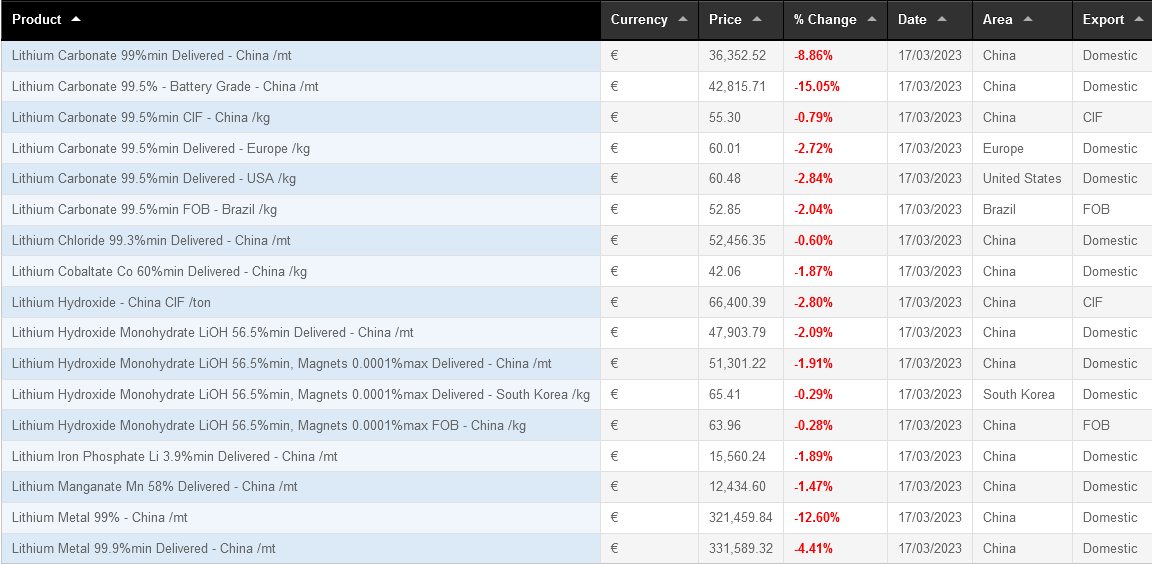

The lithium frenzy, which saw Chinese prices of the material for electric vehicle batteries soar more than 1,300 percent in just two years, has turned into a rapid descent. Prices of lithium carbonate, the benchmark product, have halved after soaring last November.

The lithium frenzy, which saw Chinese prices of the material for electric vehicle batteries soar more than 1,300 percent in just two years, has turned into a rapid descent. Prices of lithium carbonate, the benchmark product, have halved after soaring last November.

This reflects two main pressures: the prospect of much larger global supply coming on line this year and signs that breakneck growth in China’s electric vehicle sector is beginning to moderate (read more here).

Lithium carbonate prices have fallen more sharply as the outlook for supply growth this year coincides with weakening demand.

The two-year surge in prices of lithium and other battery materials has shaken the EV supply chain and triggered a rush by battery makers and automakers to lock in supplies.

Although the drop in lithium prices offers some relief to automakers and battery makers squeezed by soaring costs, the raw material still remains at high levels compared to 2020 lows.

Lithium supply is set to increase significantly this year, thanks to the start of a wave of expansions and new projects. However, there are doubts that some less established companies will be able to deliver the promised production, given the array of regulatory, technical and commercial challenges.

Chinese automaker Nio Inc. expects lithium prices to “most likely” drop to around 200,000 yuan or less in the fourth quarter. Meanwhile, prices of spodumene, the ore that produces lithium, have also plummeted.

.gif) Loading

Loading