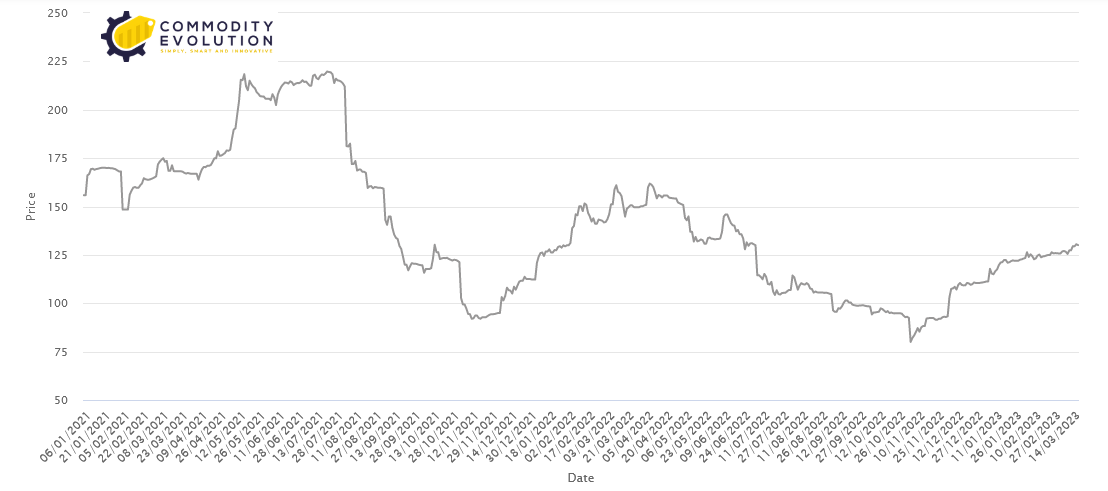

The price of iron ore continue to rise steadily, reaching $130/mt enlla Tuesday’s survey. The rise is largely due to improved profitability of steel mills and positive demand forecasts in China, the world’s largest steel producer.

The price of iron ore continue to rise steadily, reaching $130/mt enlla Tuesday’s survey. The rise is largely due to improved profitability of steel mills and positive demand forecasts in China, the world’s largest steel producer.

However, these increases in iron ore prices have been limited by regulatory concerns.

The most traded May iron ore on China’s Dalian Commodity Exchange closed day trading up 0.5 percent, at 134.63 U.S. dollars (929 yuan) a ton. According to Reuters, this came after the ore posted its fifth consecutive weekly gain on Friday.

What is the reason for the rise in the price of iron ore?

The main explanation is that almost everyone in the steel industry believes that 2023 will be a good year for Chinese steel mills. In fact, thanks to rising profits and a more positive outlook for the domestic economy, Chinese steel mills continue to move with confidence.

Most have increased production or resumed operations after lengthy stages of routine maintenance.

Australia’s Fortescue Metals recently forecast an increase in demand for iron ore in the coming year. Here, the company cited China’s support for the real estate and construction sectors.

Fortescue reported “really good” demand for its lower-grade iron ore after the Chinese New Year. According to CEO Fiona Hicks, this is a surprising result considering the compressed margins of steel producers.

Many of the attendees at the China Iron and Steel Association (CISA) conference a few weeks ago were optimistic that China’s steel industry would surge thanks to pent-up demand after the COVID-19 pandemic.

According to experts, the expected rebound in the property market should be supported by the relative stability of other sectors. Examples given include automobiles and shipping. High demand could lead to increased imports of iron ore and coking coal from several countries, including Australia, possibly impacting the price of iron ore.

The China Automobile Dealers Association has already predicted an increase in passenger car sales of about 28 million units. This is roughly comparable to the pre-COVID years.

Meanwhile, the World Steel Association recently predicted that global steel consumption will reach 1.814 billion tons in 2023. Currently, it predicts that about half of this total will come from China.

Whatever happens, Chinese authorities are already taking steps to control the accumulation of iron ore. Beijing recently warned trading companies against storing large volumes of iron ore at ports. They were also considering raising port storage fees for large cargoes.

In fact, a few days ago, China’s National Development and Reform Commission met with industry experts to discuss ways to curb price increases.

The NDRC is instrumental in monitoring not only iron ore prices, but also market price hikes in coal, soybean and numerous other commodities.

Meanwhile, China’s iron ore imports in the first two months of 2023 grew 7.3 percent year-on-year. According to data provided by the Customs Department, China imported 194 million tons of ore in January and February. This is significantly higher than the 181.1 million tons imported in the same period in 2022.

.gif) Loading

Loading