At the beginning of February, aluminium price action showed a short-term sideways trend, following a January surge that led to new period highs in the $2,678/mt area. Several months ago, the LME decided not to proceed with any restrictions on the Russian-sourced metal. However, supporters of the ban continue to indicate that the high volumes of Russian material could distort LME prices.

At the beginning of February, aluminium price action showed a short-term sideways trend, following a January surge that led to new period highs in the $2,678/mt area. Several months ago, the LME decided not to proceed with any restrictions on the Russian-sourced metal. However, supporters of the ban continue to indicate that the high volumes of Russian material could distort LME prices.

They indicated that self-sanction by companies could cause a surplus of cheap material. Meanwhile, a large delivery of Russian aluminium by commodities trader Glencore to LME warehouses will certainly test this theory.

According to a recent Reuters report, Glencore has delivered a shipment of 40,000 tonnes of Russian aluminium to LME-approved warehouses in South Korea, and more may follow. Glencore made an earlier shipment of Russian material in October, although the quantity was not disclosed (read more about ‘Aluminium: Glencore delivers 40,000 tons of Russian product to the LME‘).

Rusal, Russia’s largest producer, continues to deny selling its metal to the LME. However, Glencore has a long-term contract with Rusal for a total of 6.9 mln tonnes (1.6 mln of this began deliveries in 2021 and is expected to be completed by 2024).

Russian material flows in the LME’s warehouses would probably have a bearish impact. However, the extent of the effects remains unclear. In its decision, the LME recognised the possibility of ‘additional tonnes of Russian metal’, but saw no threat of market disruption.

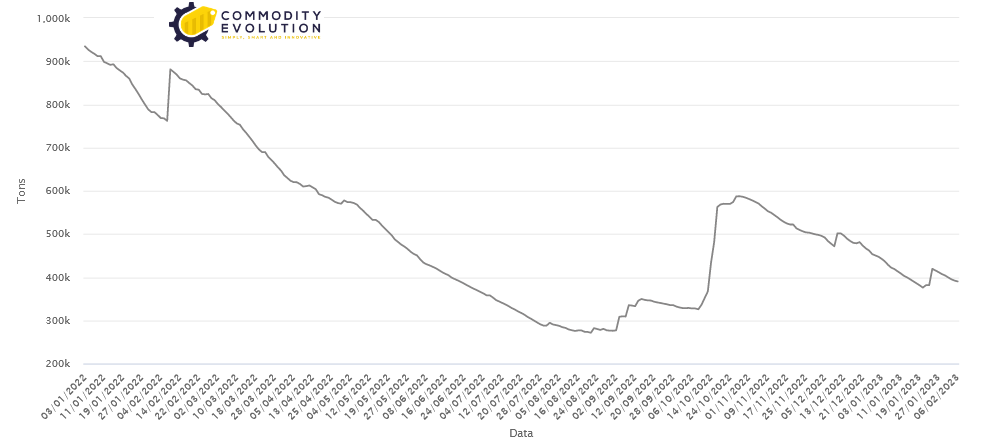

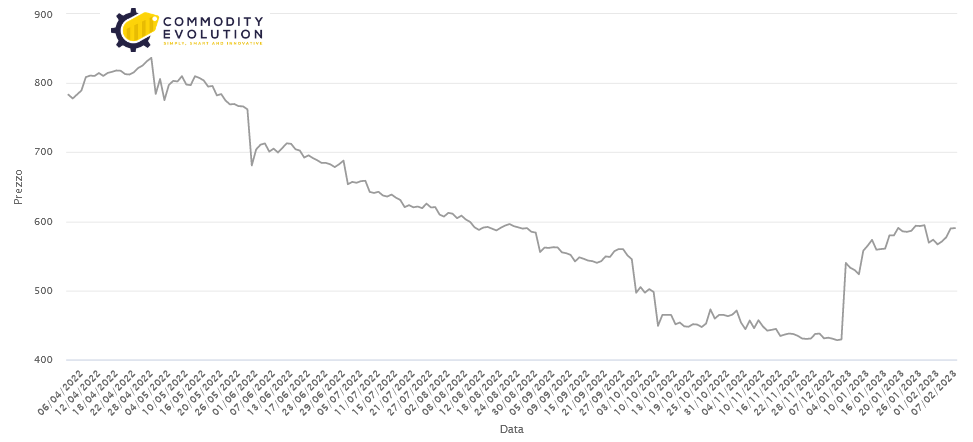

To begin with, base metal stocks currently remain low. Although LME aluminium stocks bottomed out in August, they remain almost 125% below their historical average since 1979.

Clearly, an influx of Russian material could potentially increase stocks. However, stocks have a very weak inverse correlation with aluminium prices. And if companies reject Russian-sourced metal, LME prices could fall. According to recent reports, interest in Russian material continues to grow amid increasing macroeconomic pressures. It is therefore possible that the price decline will not materialise.

In recent months, the US has significantly reduced aluminium imports from Russia. However, the US plans to add a 200% tariff on all aluminium produced in Russia. Officials have been considering the decision in recent months due to concerns that dumping of Russian material could hurt domestic industries (read more about ‘Aluminium: US considering 200% tariff on Russian metal‘).

Historically, Russia accounts for about 10% of total US aluminium imports. Recently, this figure has dropped to around 3% and could fall further once the US imposes such a large tariff.

In the meantime, increased domestic supply shortages could drive up Midwest Aluminum premiums again, which corrected downward in late January. So far, the EU has given no indication that it will follow the US example.

An accumulation of Russian metal could challenge the LME as a global benchmark for aluminium prices. However, if this fails, competition from other exchanges could succeed.

The CME Group’s aluminium futures contract continues to accumulate liquidity. In 2022, average daily volume (ADV) reached a new record of 1.6 thousand contracts per day, while market participation increased by 158% year-on-year.

This momentum continued in January. At the end of the month, ADV and open interest (OI) rose to 3.2K and 1,968 contracts respectively.

Although the CME still has a long way to go to compete with the LME, its aluminium futures contract is now more liquid. Should the momentum continue, the contract could become viable as a pricing mechanism.

The March nickel squeeze caused the LME to lose liquidity in all contracts. Moreover, the LME’s reputation seems irreparably damaged. Of course, concern about the influx of Russian material into the LME’s warehouses could exacerbate this trend. In time, the CME could significantly challenge the LME’s dominance.

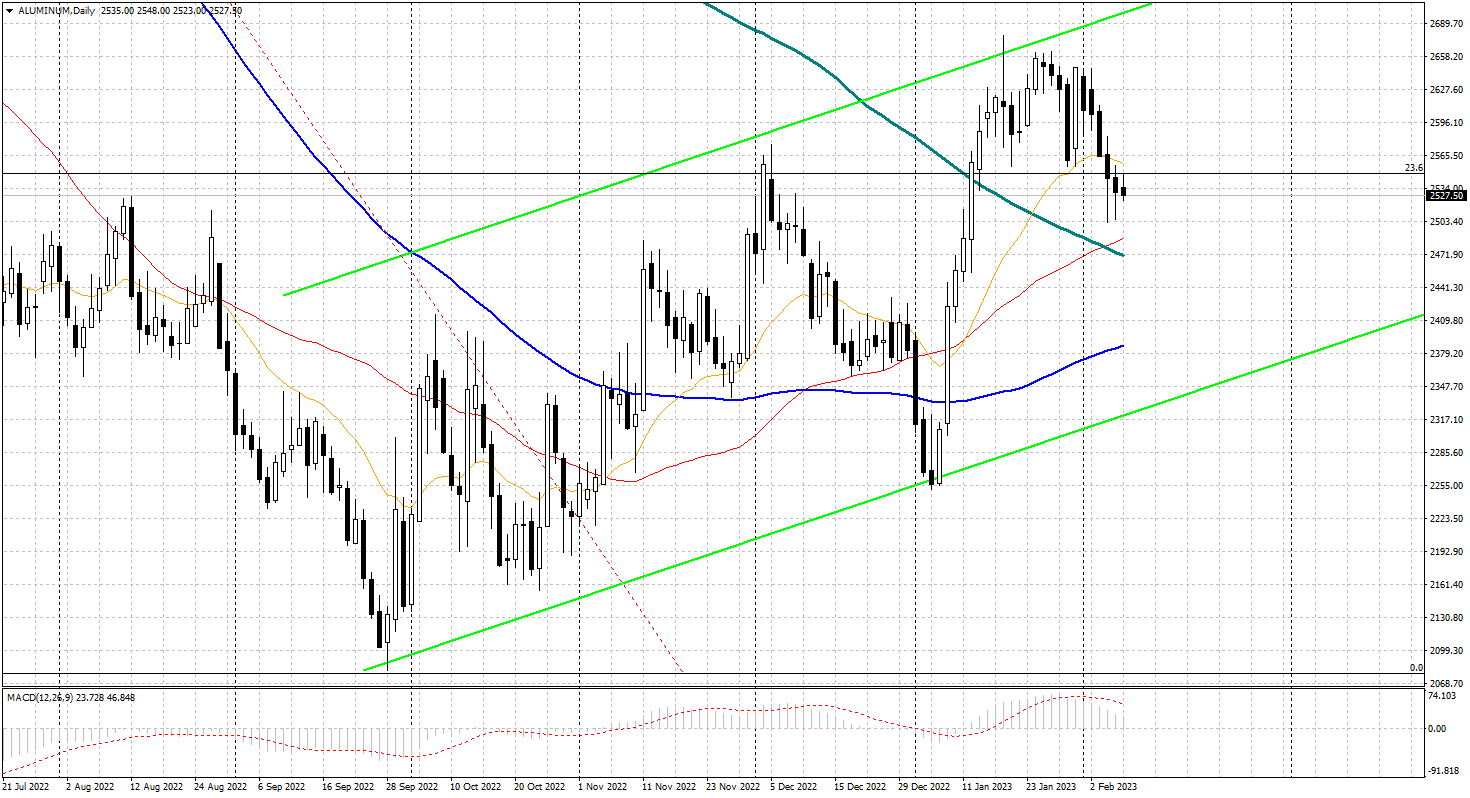

In the meantime, 3-month aluminium prices at the LME are showing a negative sideways trend in the short term, after starting a retracement from recent highs in the $2,678/mt area. Graphically, there still seems to be room for further declines, at least in the short term, with first supports identified in the $2,450/mt area.

These levels will have to be monitored carefully, to check for any new price rebounds.

.gif) Loading

Loading