The primary aluminum market balance closed with a deficit of 981 thousand tons. This follows a deficit of about 1.734 mln tons recorded for the entire previous year. Global aluminum production in the first ten months of this year increased by nearly 378 thousand tons compared to the same period last year. China’s production of 33.3 mln tons accounted for about 59 percent of global aluminum production. China’s net exports of semi-finished aluminum products increased by 20.8% to 4.901 mln tons in January-October 2022, compared with the corresponding ten-month period of the previous year.

The primary aluminum market balance closed with a deficit of 981 thousand tons. This follows a deficit of about 1.734 mln tons recorded for the entire previous year. Global aluminum production in the first ten months of this year increased by nearly 378 thousand tons compared to the same period last year. China’s production of 33.3 mln tons accounted for about 59 percent of global aluminum production. China’s net exports of semi-finished aluminum products increased by 20.8% to 4.901 mln tons in January-October 2022, compared with the corresponding ten-month period of the previous year.

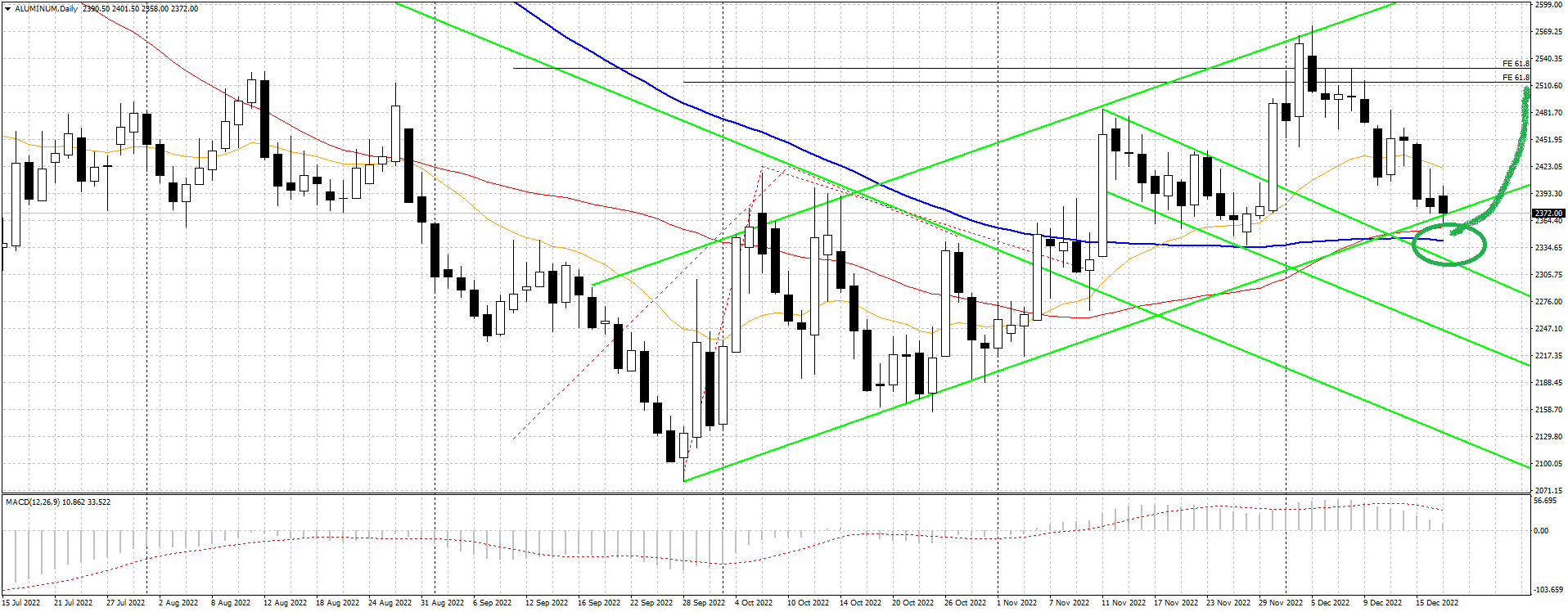

Analyzing London-listed aluminum prices (LME) shows a momentary pause in the uptrend that started from the lows in late September 2022. Currently, quotations are close to an important support in the area of $2,360/mt, the lower part of the bullish channel valid precisely from when the rebound started (September 2022). It will be crucial to monitor this price level for new indications of directionality. In fact, only the holding of this level will be able to favor the continuation of the current price uptrend toward the first short-term targets set in the $2,620/ton area.

The current settling phase could be a good time for the buying office to start (if it has not been done before) sourcing, as it is believed that this stalemate could end very quickly in favor of new rises.

.gif) Loading

Loading