Aluminum prices broke out of their sideways trend last month with strong upward action. Prices rose during the first half of November, followed by a modest retracement before continuing to climb. In early November, China seemed to vacillate between easing virus control measures and continuing zero-COVID. The possibility of China reopening, albeit slowly, saw base metal prices rise.

Aluminum prices broke out of their sideways trend last month with strong upward action. Prices rose during the first half of November, followed by a modest retracement before continuing to climb. In early November, China seemed to vacillate between easing virus control measures and continuing zero-COVID. The possibility of China reopening, albeit slowly, saw base metal prices rise.

Unfortunately, the subsequent return of the blockades soon caused prices to retrace. In late November, however, protests triggered another reversal on Beijing’s part. In an act of appeasement, the government lifted the blockades despite the increase in cases. Metal prices reacted bullishly and resumed their respective upward trends. For aluminum prices, this translated into a 9.61 percent increase between November and December.

Markets have been quick to price in the return of Chinese demand, although much of this is speculation. Historically, China consumes about half of all raw materials. Freeing up its consumers and ending shutdowns could boost demand. However, it is unknown to what extent and at what rate Chinese demand will return to growth.

China remains plagued by both short-term and long-term problems. In the short term, the end of the zero-COVID regime seems easier said than done. Experts have warned of an “exit wave” that could easily overwhelm the state health care system. The population faces additional risks from low vaccination rates and general exposure due to the strong virus control measures of the past three years.

Of course, any backward step by the state to mitigate the spread of the virus appears politically impractical. As far as aluminum prices are concerned, the reality of China’s change of course will likely result in more volatility until the situation stabilizes in the coming months. Until that time, the true market conditions will remain ambiguous.

In addition to aluminum, China’s reopening will also mean the return of its energy demand. This could trigger an imminent turnaround for WTI crude oil prices, which have remained largely down since June. So far, the energy crisis has been concentrated in Europe and has resulted in large cuts in European aluminum capacity.

The spread may not trigger further global capacity loss. However, higher energy prices would also mean higher production costs. For energy-intensive metals, such as aluminum, this could represent a new price threshold.

Chinese demand looks set to increase, but it is not known to what extent. Indeed, the China of 2023, after COVID, is likely to look very different from the China of 2019. In addition to the costs of an economically restrictive approach to the virus, China remains plagued by high levels of debt, the ongoing real estate crisis, and an aging population.

Given this, China’s construction and real estate sectors have long been an engine of economic growth for the country. Construction spending also accounts for about 25 percent of global aluminum demand. Although China has repeatedly intervened to support its struggling real estate sector, it will not be able to counter a long-term slowdown in demand.

The WTO recently ruled against the United States in a trade dispute over tariffs on imported steel and aluminum (read the news here). The tariffs were imposed by the Trump administration in 2018 and included a 10 percent duty on aluminum imports. Subsequently, both the EU and the UK negotiated tariff rate quotas (TRQs). These allowed limited volumes of aluminum to be imported into the U.S. duty-free starting in 2022.

Meanwhile, China, Norway, Switzerland and Turkey filed a complaint with the WTO, arguing that the tariffs violate international trade rules. According to reports, the WTO-appointed panel found that “the measures were not taken in times of war or other emergency situations in international relations.” In fact, the United States initially imposed the duties for national security reasons.

Nevertheless, the WTO ruling is unlikely to cause significant change. Adam Hodge, spokesman for the Office of the U.S. Trade Representative, said, “We do not intend to remove Section 232 duties as a result of these disputes.” Due to the U.S. refusal to approve the judges from 2019, the WTO Appellate Body is currently unable to decide whether or not to approve the duties.

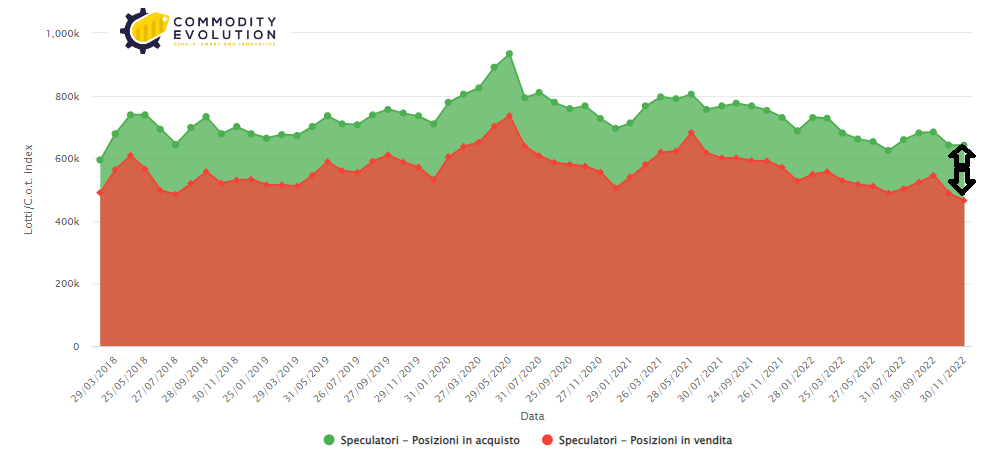

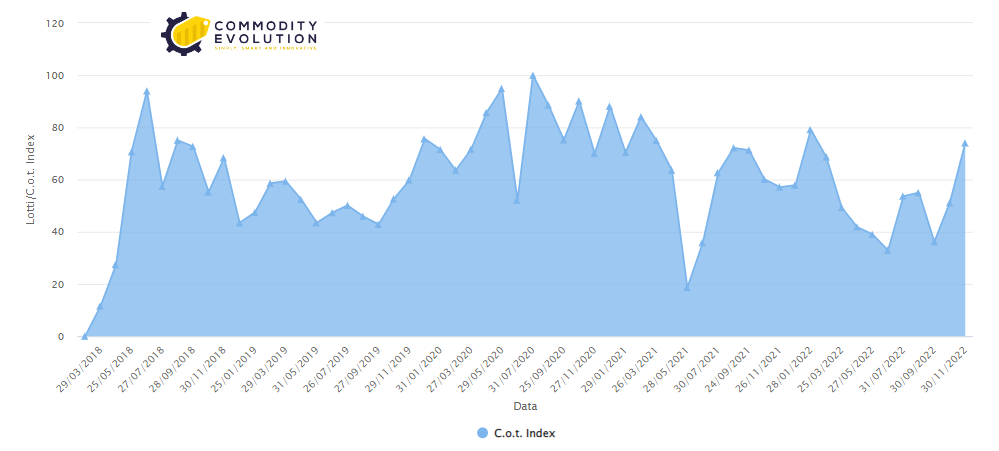

Analyzing the data from the COT report, released by the London Stock Exchange (Lme), it is possible to see that net speculative positions (difference between buy and sell positions) are in a definite upward phase, at 176,590,00 lots (buy positions have decreased by only 0.08% while sell positions have dropped by 4.75%).

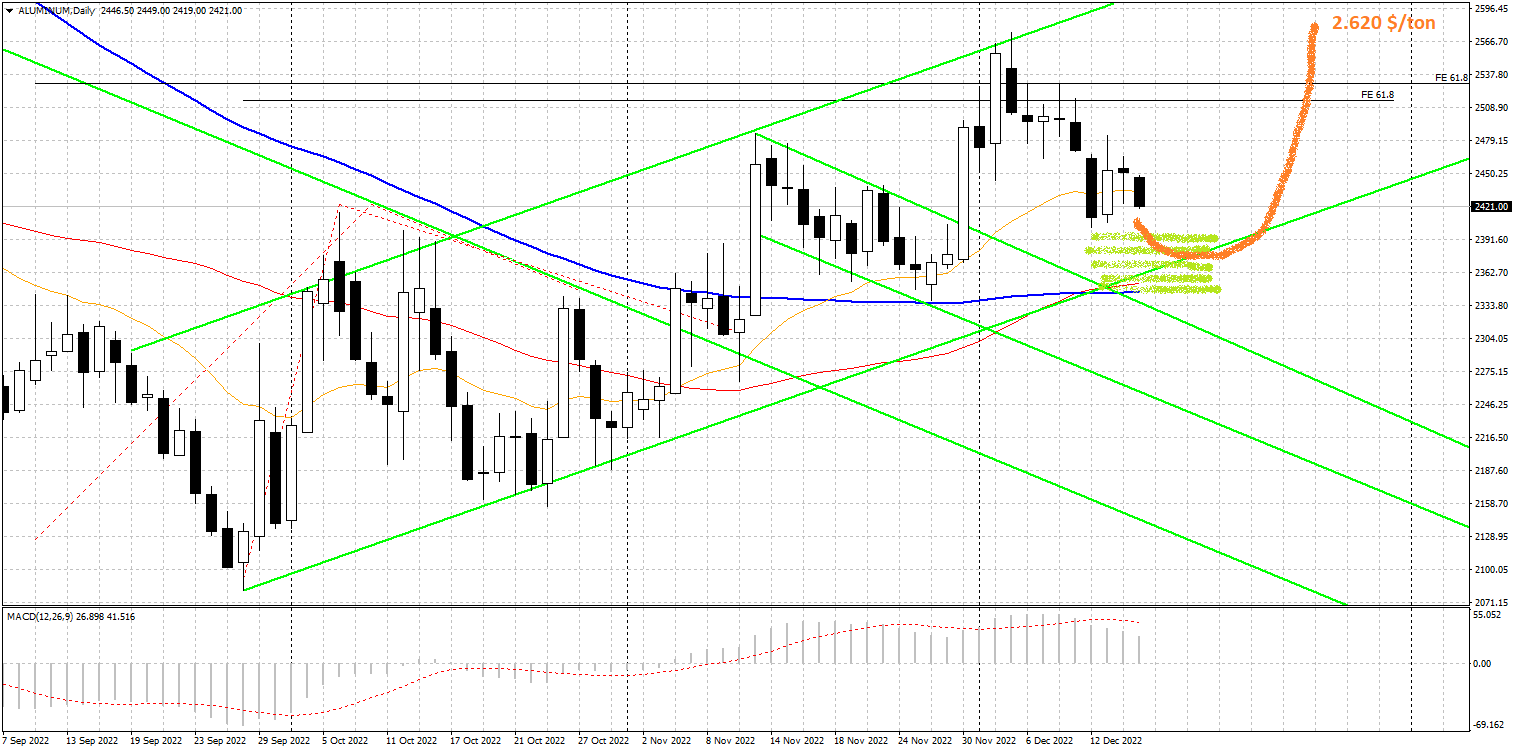

On the technical/chart front, Commodity Evolution’s research department confirms the current goodness of the quarterly trend that started in late September 2022. Despite potential settling/flexion phases, which are physiological during a bullish trend, prices are set to rise, at least in the short term. Before that, settling toward $2,360/mt would therefore not be surprising before witnessing a resumption of the uptrend in the direction of the targets suggested several weeks ago, which are identified in the $2,620/mt area.

.gif) Loading

Loading