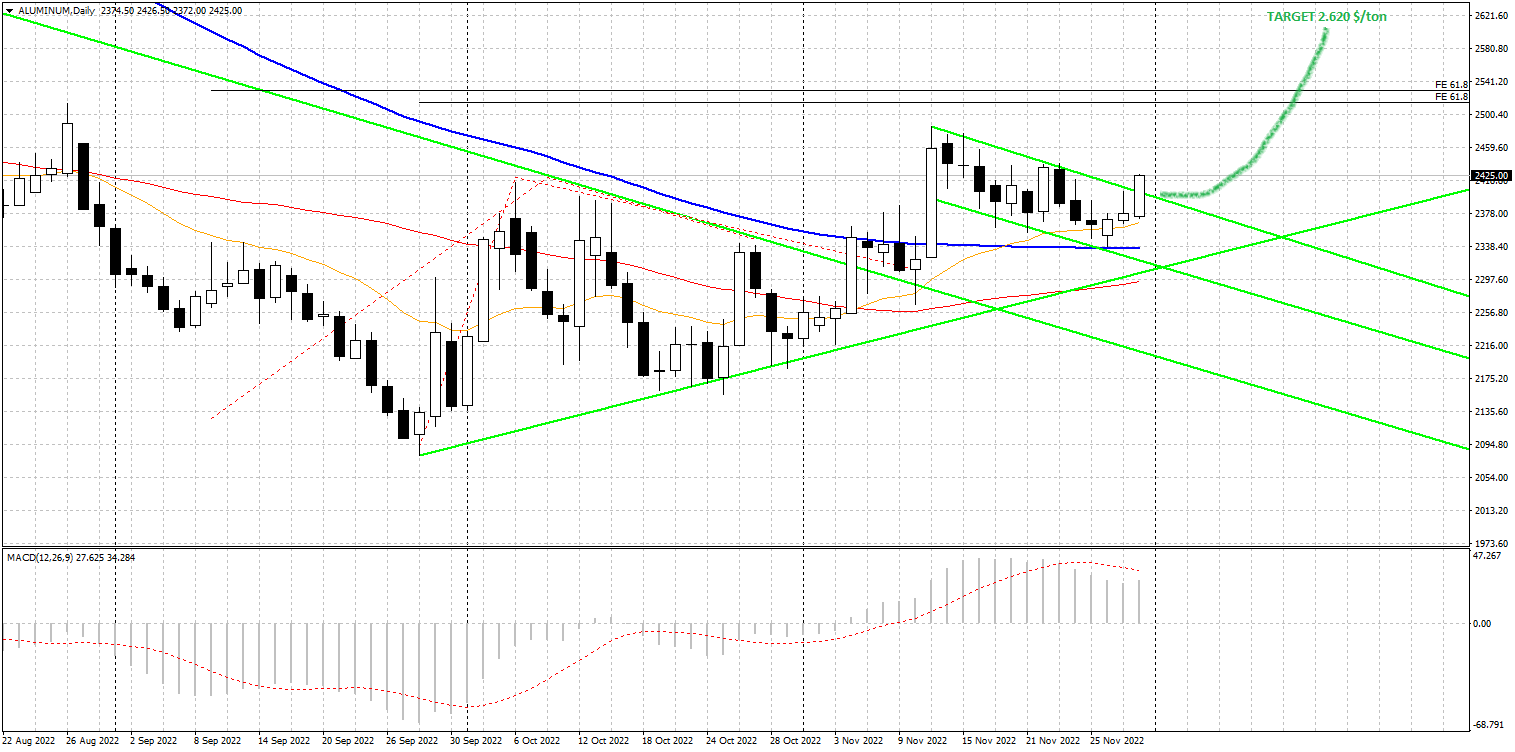

Primary aluminum listed on the London Metal Exchange continues its upward move (+1.95 percent as of 12:00 GMT+1), with the third consecutive positive session. Prices currently appear to be in the process of breaking out (breaking to the upside) of an important resistance area at $2,400/mt, represented by the top of the short channel that enclosed prices from the November 11 highs.

Primary aluminum listed on the London Metal Exchange continues its upward move (+1.95 percent as of 12:00 GMT+1), with the third consecutive positive session. Prices currently appear to be in the process of breaking out (breaking to the upside) of an important resistance area at $2,400/mt, represented by the top of the short channel that enclosed prices from the November 11 highs.

As reiterated several times in recent weeks, aluminum is showing a very good chart trend that may push prices higher than current levels. Estimated intermediate targets are identified in the $2,500/mt area and towards $2,620/mt thereafter.

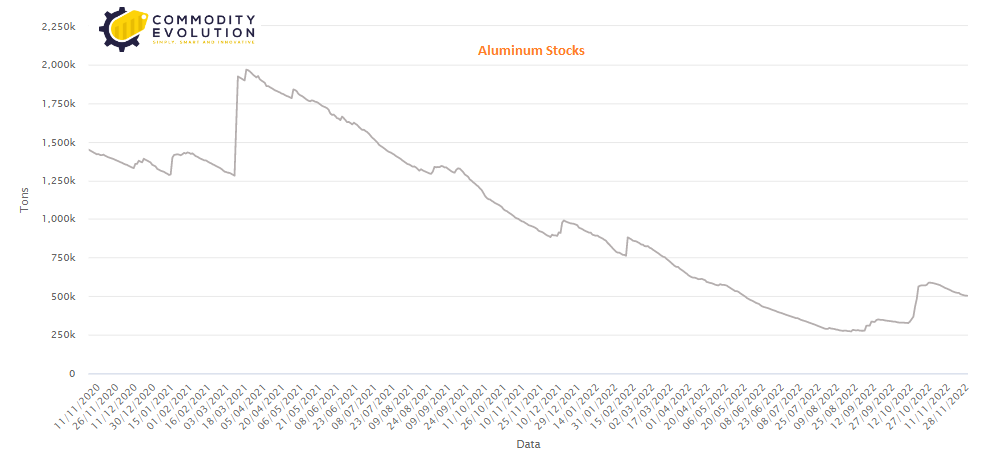

Although stocks, held in Lme warehouses, have reacted from the lows of the first week of September (+89%), over the past month stocks have fallen sharply toward 501,000 tons, down 14.65% on a monthly basis.

The market needs to be monitored carefully, because any supply orders will have to be placed very quickly so as not to end up with significantly higher prices (at least $200/mt) a few weeks from now.

Analysis and elaboration by Commodity Evolution’s research department

.gif) Loading

Loading