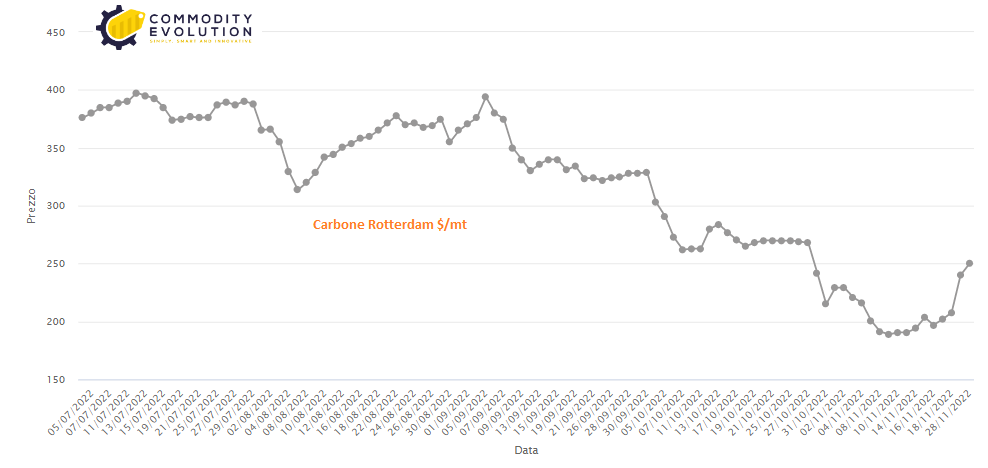

The global thermal coal market has returned to the situation before Russia’s attack on Ukraine, with prices of most types of seaborne coal falling to pre-invasion levels, while volumes have remained stable.

The global thermal coal market has returned to the situation before Russia’s attack on Ukraine, with prices of most types of seaborne coal falling to pre-invasion levels, while volumes have remained stable.

Prices of seaborne thermal coal surged after the Feb. 24 attack on Ukraine, reaching record highs amid concerns about lost exports from Russia and Ukraine and increased demand in Europe over fears of a shortage of natural gas for power generation.

But in recent weeks the grades most traded by the major exporters, Australia, Indonesia and South Africa, have fallen below or approached pre-invasion levels.

Seaborne thermal coal volumes have also stabilized in recent months, although there has been a small realignment of flows to Europe and away from Asia. The exception to the return to normalcy is Australian high-energy thermal coal shipped from Newcastle, but while this remains a popular media commodity, it covers only a small portion of the market and is focused on buyers primarily in Japan.

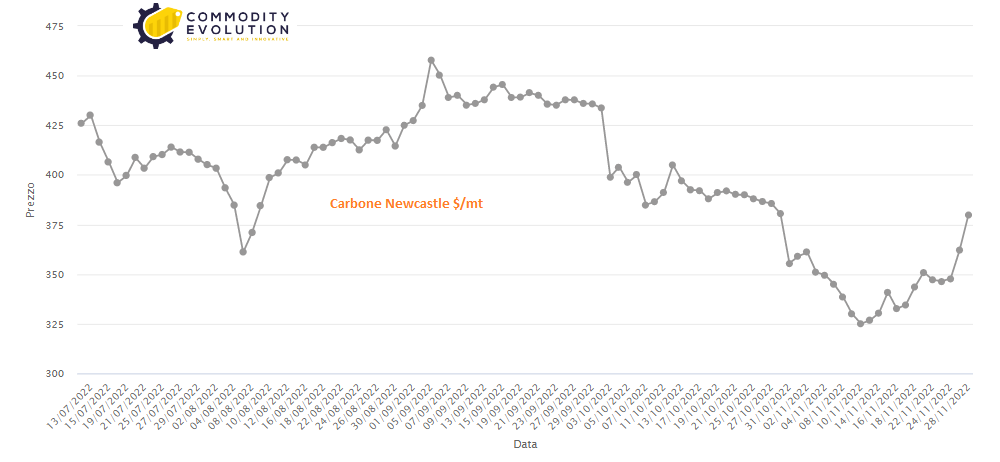

Newcastle’s daily index for coal closed at $380/mt on November 28. The price is now 16 percent higher than the $325/mt of the week of Nov. 10, which had been the lowest since April. However, this is also 17 percent lower than the all-time high of $458/mt reached on Sept. 5, indicating that fears of a winter coal shortage in Japan have subsided.

Indonesian thermal coal is popular with buyers from China, the world’s largest importer, and India, the second largest, as it tends to be cheaper than other types of coal, even though it has lower energy. South African coal has been favored by European demand, with utilities willing to pay more to secure cargoes, resulting in a shift in flows from Asian buyers, especially India.

Exports of seaborne thermal coal increased over the summer, reaching a 32-month high of 85.11 million tons in June. Since March this year, monthly seaborne thermal coal exports have exceeded those of the same month in the previous year.

This was driven by an increase in exports to Europe, which surged after the invasion, reaching 9.83 million tons in April, the highest since October 2018. Since then they have moderated somewhat, falling to 7.85 million tons in October, only slightly above the 7.27 million in October 2021.

Exports to Asia have remained broadly stable in recent months compared to 2021, with October seeing 69.12 million tons, very similar to the 69.0 in the same month last year. Overall, the message from the data is that fears of a widespread disruption of the global seaborne thermal coal market have largely failed to materialize.

Russian thermal coal exports have actually been higher in recent months than in 2021, although there has been some realignment of flows, with European Union buyers moving away from Russian cargoes, while Asian buyers have increased imports.

.gif) Loading

Loading