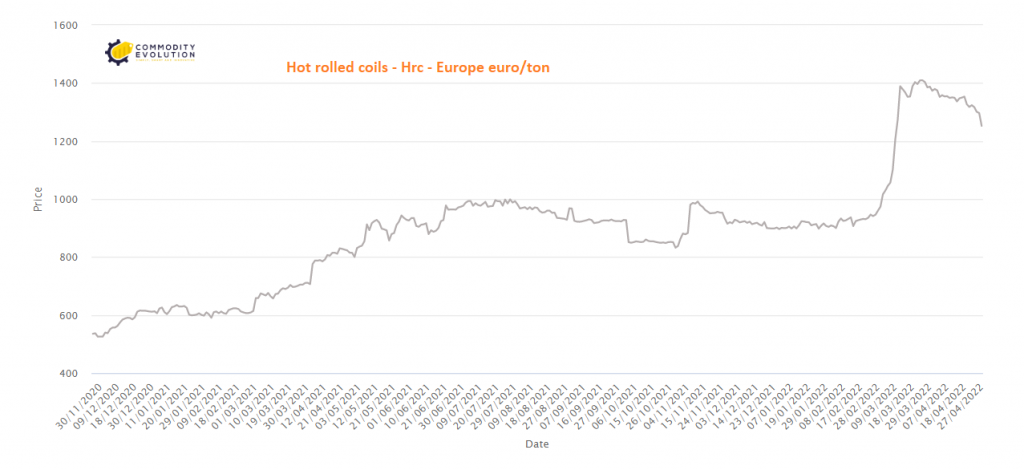

Hot-rolled coil prices in Europe have fallen and market players are increasingly convinced that the market is set to decline significantly.

Hot-rolled coil prices in Europe have fallen and market players are increasingly convinced that the market is set to decline significantly.

While several mills have offered coils at €1,300/mt exw, some offers have been as low as €1,280/mt exw. Despite this, most buyers sought to pay prices closer to EUR 1,200/tonne exw.

Negotiations remained scarce, with buyers adopting a wait-and-see approach. End-user demand is weak and inventory levels are high enough to give buyers flexibility on purchases.

While some end markets are expected to show an improvement in demand from the second half of May onwards, the outlook for the key automotive industry has not been rosy, with some now predicting that it will not recover until the end of the year at the earliest. The sector has been constrained by a shortage of microchips and other components, the latter mainly due to the aftermath of the Russian invasion of Ukraine.

In addition to the slowdown in underlying consumption, buyers are also aware that mills are under pressure to reduce prices, and this expectation adds to the lack of immediate buying interest.

Conversely, uncertainty over the cost of energy and raw materials, particularly after Russia cut off gas supplies to Poland and Bulgaria this week, could dampen mills’ willingness to reduce prices.

Steel mills have slowed production rates and may seek to export material, albeit at prices substantially below domestic levels. However, high freight rates could put more pressure on prices.

Material from Japan, South Korea and Taiwan is available at €1,000-1,050/mt, but with delivery times in September. Offers from India were heard at €1,000-1,030/mt cfr Northern Europe.

.gif) Loading

Loading