The expectations are for a downward trend in prices for hot rolled coil as demand has remained subdued due to the holiday period. Some market sources report a quiet market with subdued demand and most traders preferred to wait and see if prices would correct from current levels.

Buyers prefer to wait, with most looking ahead to the third quarter. We may see buyers return next week for June orders.

As for price directionality, the market is divided. Some traders report that production costs are too high for a price collapse and that producers would choose to reduce production rather than cut price levels. Others, however, say that producers will be able to lower prices (and will do so), and will not cut production yet because the current drop does not justify it. Steel mills have higher costs, but not so much that they raise the prices of what they have in stock.

Demand is very low, especially from the automotive industry, with mixed expectations for the sector’s comeback. One trader reported a potential recovery towards the end of May while a second source reported that there was no hope of the automotive industry recovering this year.

Several sources pointed to the need for prices to soften further to stimulate demand, with a maximum tradable value of €1,200/mt ex-works being considered.

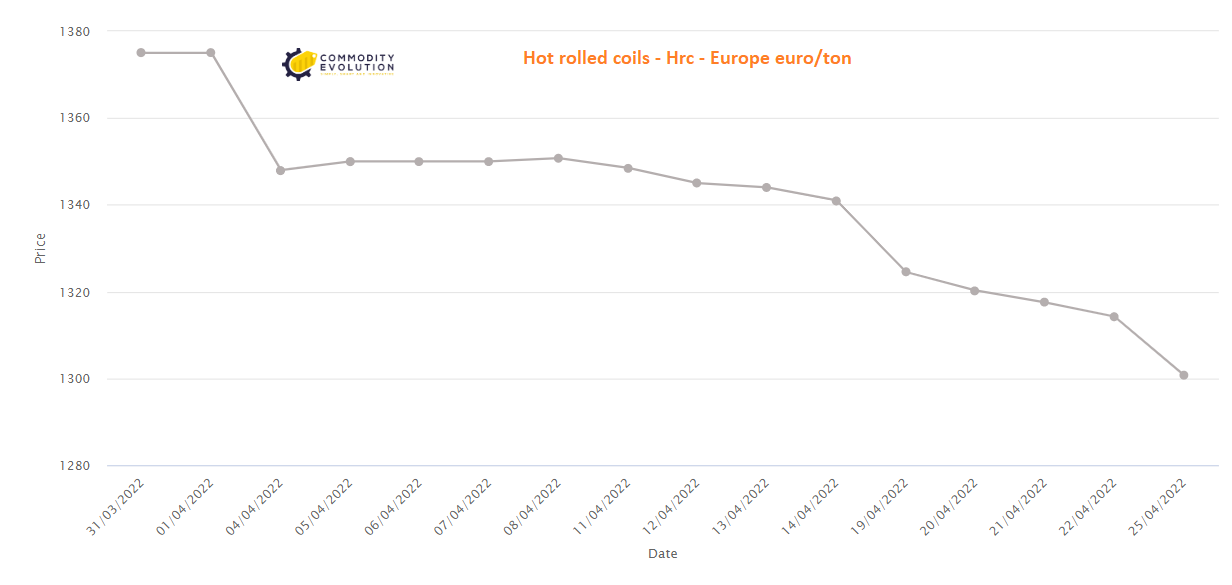

Northern European HRCs were estimated to fall by 15 euro/ton per day to 1,300 euro/ton ex-works.

.gif) Loading

Loading