As the situation in Ukraine worsens, European and American countries have initiated several rounds of sanctions against Russia. Several manufacturers, including Boeing, Airbus and Rolls-Royce, are looking for new suppliers of key raw material titanium to hedge the risks to their supply chains, as a precaution against a potential export blockade.

As the situation in Ukraine worsens, European and American countries have initiated several rounds of sanctions against Russia. Several manufacturers, including Boeing, Airbus and Rolls-Royce, are looking for new suppliers of key raw material titanium to hedge the risks to their supply chains, as a precaution against a potential export blockade.

The lightness and high strength of titanium are not only extremely important for commercial aircraft, but are also used in the production of defence equipment, so they are crucial to national security.

Due to the complex melting technology and difficult processing, only four countries in the world – the United States, Russia, Japan and China – have complete industrial titanium production technology.

According to the United States Seismological Survey (USGC), in terms of titanium reserves, Russia is in third place with a share of 13.5%, after China and Japan.

Considering that titanium sponge production in Russia accounts for 22% of the world’s, its important position in the industrial chain is evident.

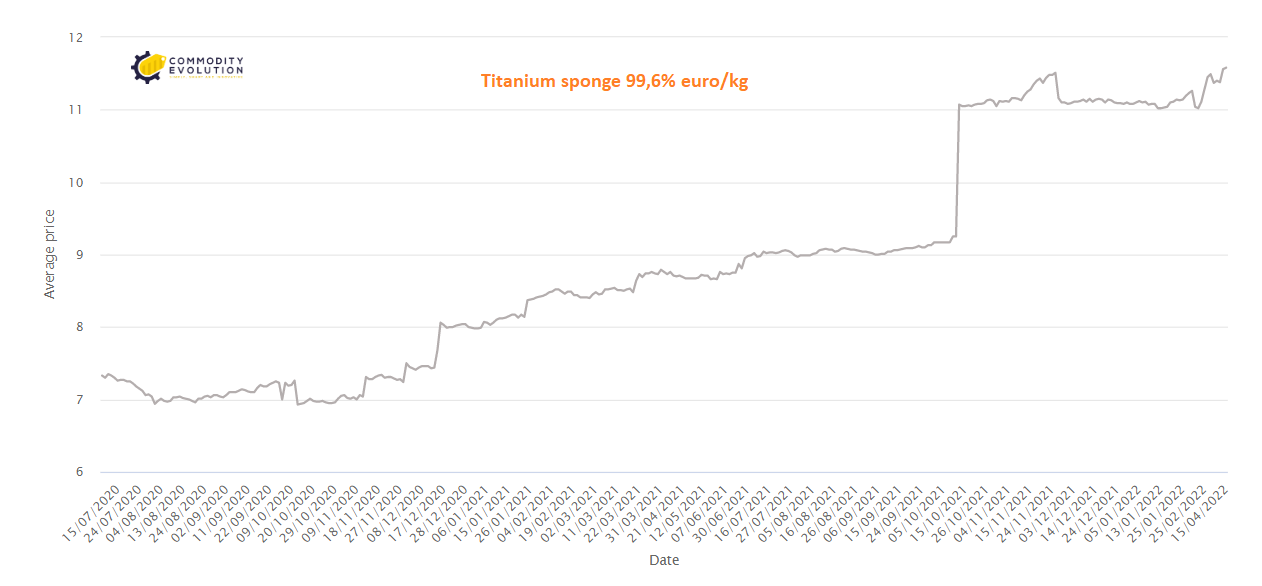

On a Boeing 787, about 15% of the weight is titanium or Ti-6Al-4V titanium alloy, which means that there are more than 19 tonnes of titanium on each Boeing 787. The price of “Titanium sponge 99.6%” is about 11.51 euro per kg, which means about 220,000 dollars worth of titanium per Boeing 787.

Considering that the Boeing 787-9 sells for around $135 million to $145 million, this seems like a small amount, but combined with the complex processing and production of actual parts, changes in the supply chain could raise overall production costs.

Russia’s Avisma (VSMPO-Avisma) is the world’s largest producer of titanium sponge, with a production capacity of 34,000 tonnes per year. The company is also Boeing’s largest supplier of titanium parts.

Over the years, Boeing and Russia have deepened their cooperation in titanium alloys. Boeing signed its first supply agreement with Avisma in 1997. In 2006, the introduction of the Boeing 787 increased the demand for titanium alloys, and the two parties decided to form a joint venture.

.

At the 2021 Dubai Air Show, Boeing signed a memorandum of understanding with Avisma confirming that the company will continue to be the largest supplier to Boeing’s commercial aircraft programme. So Russia’s involvement in Boeing’s supply chain is huge.

According to Stan Deal, head of Boeing Commercial Airplanes, the company has a very diverse supply of titanium, which would solve the problem of supply chain disruption related to titanium.

European aerospace manufacturer Safran obtains almost half of its titanium from Avisma. The company reported in a recent conference call that it has been buying titanium from German dealers due to increased military tensions. But given Avisma’s market share and the size of its product base, it is difficult to break away completely.

The company has been building up its titanium stock since the beginning of the year and the inventory supports several months of autonomy but it will take some time to find other sources of supply.

In terms of Rolls-Royce aircraft production in the UK, 20% of the titanium needed comes from Russia. Avisma supplies almost a quarter of the world’s titanium metal. Japan’s Toho Titanium, the US’s ATI Metals and RTI International Metals are widely seen as alternatives to the supply chain for titanium products.

As manufacturers face the risk of a titanium shortage, the priority now, in addition to finding new distributors, is to find suitable scrap sources. The supply of high-quality scrap has been scarce for several months and the Russian-Ukrainian conflict has made the situation worse.

.gif) Loading

Loading