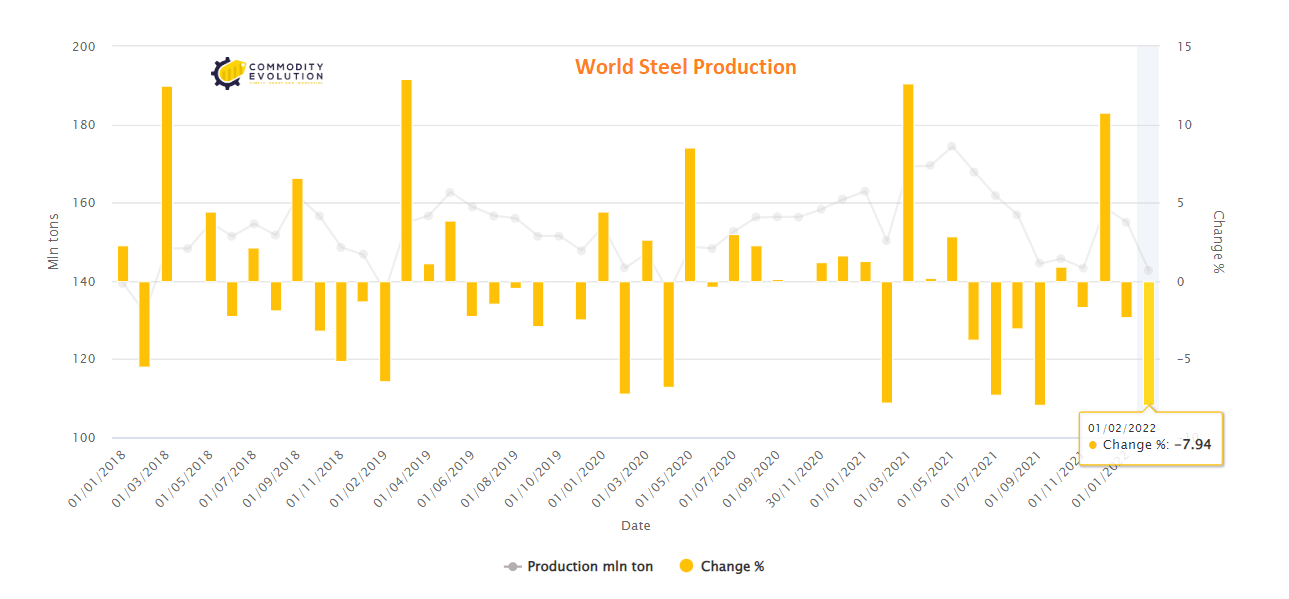

The Short Range Outlook, published on 14 April by the World Steel Association, forecasts that steel demand will rise by 0.4% in 2022 to 1.84 billion tonnes and grow by a further 2.2% in 2023 to 1.88 billion tonnes.

Steel demand rose 2.7% in 2021 to 1.83 billion as recovery from the pandemic was stronger than expected in several regions, although there was a sharper-than-expected deceleration in China.

For 2022 and 2023, the outlook is very uncertain. The expectation of a continuous and stable recovery from the pandemic has been shaken by the war in Ukraine and rising inflation.

The association expects reduced demand growth in 2022 due to the impacts of the war in Ukraine, with further downside risks from the continuing pandemic, especially in China, and rising interest rates.

Growth is expected to start in 2023 and this assumes that the war in Ukraine will end later this year and that at least by the end of this year we will start to see a recovery in steel use in those markets, but in all forecasts it has been assumed that steel use in Russia and Ukraine will be much lower than in previous years.

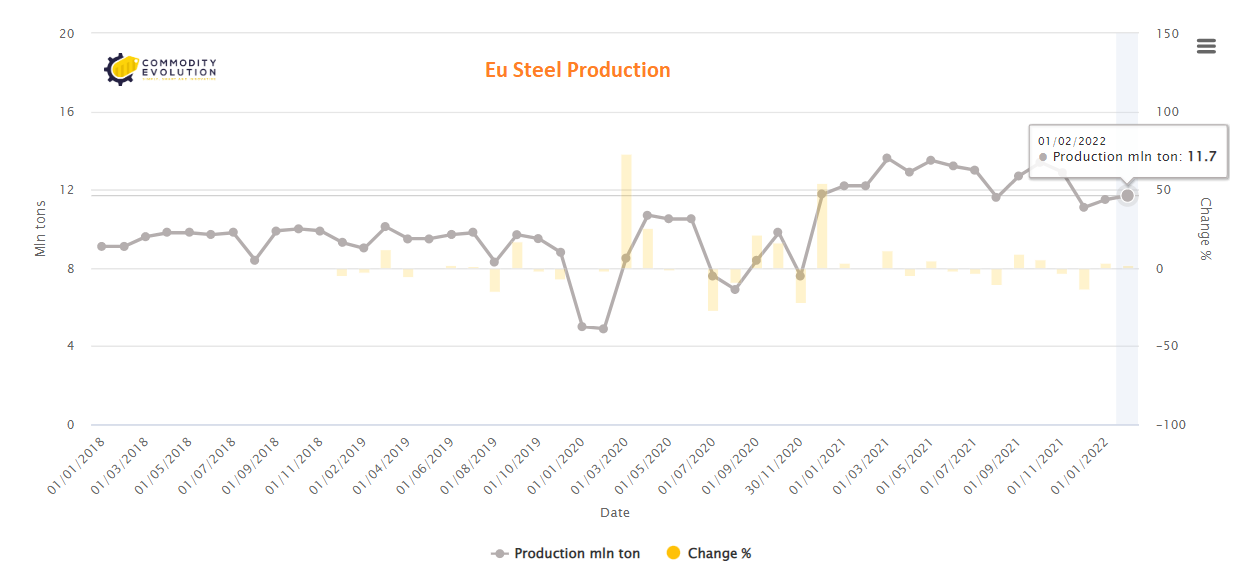

It is more likely that the war will have a greater impact on Europe due to its dependence on Russian energy and its geographical proximity, while other regions will see a smaller impact depending on their direct trade and financial exposures to Russia and Ukraine.

In the West, steel demand is expected to increase by 1.1% in 2022 and 2.4% in 2023, following a 16.5% increase in 2021.

A global impact from the war was expected to cause continued supply chain disruptions, higher energy and raw material prices, especially for steel, and volatility and uncertainty in financial markets undermining investment.

The geopolitical situation surrounding Ukraine has significant long-term implications for the global steel industry. These include a possible readjustment of global trade flows, a shift in energy trade and its impact on energy transitions, and a continuing reconfiguration of global supply chains.

Emerging economies outside China will face the challenges of a worsening environment, war and US monetary tightening, leading to low growth of 0.5% in 2022 to 484.4 million tonnes and 4.5% in 2023, from 10.7% growth in 2021.

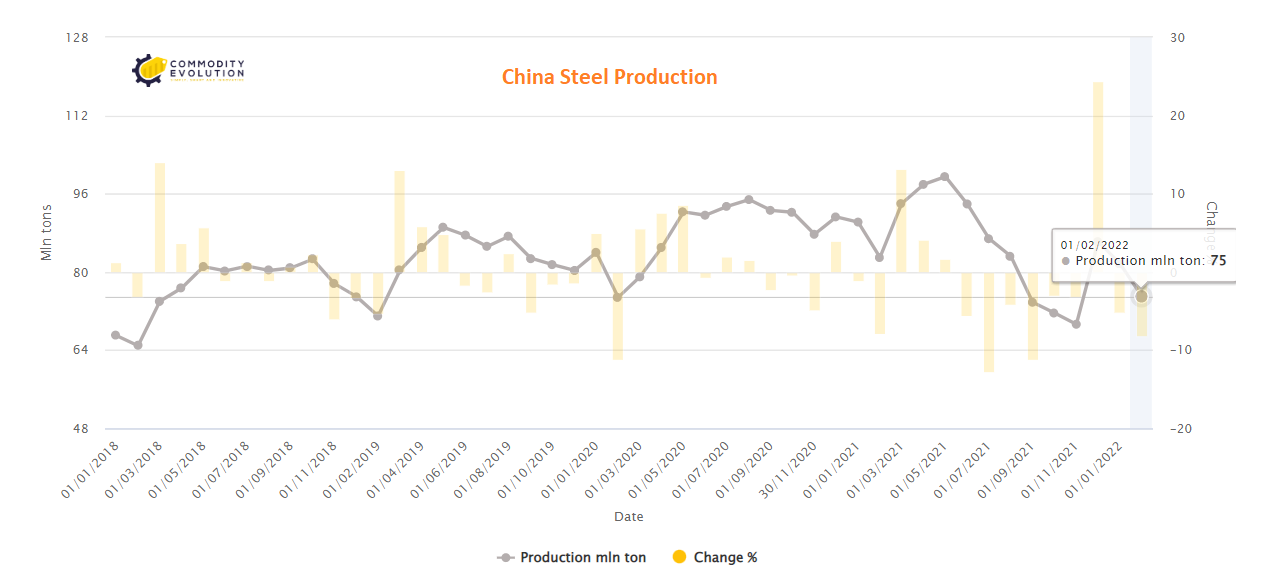

Chinese steel demand slowed in 2021 due to government measures on real estate operators and Worldsteel expects demand in 2022 to remain stable at 952 million tonnes as Beijing sought to stimulate infrastructure investment and stabilise the property market. These stimuli are then expected to support steel demand growth of 1% in 2023 to 961.6 million tonnes.

There is no sign of a strong recovery in China, so the stabilisation expected in the second half of 2021 in China may continue for most of 2022. Despite the contraction in China, the global construction industry recovered in 2021 to a record 3.4% growth as many countries required infrastructure as part of their pandemic recovery programmes, with the energy transition expected to drive growth in the sector for many years.

Inflation is an issue in many markets and could have a dampening effect on steel use, particularly in construction markets.

The global automotive industry has been disappointing in 2021, hit by supply chain bottlenecks, with the war in Ukraine likely to delay any return to normalcy, especially in Europe.

The continuing supply chain bottleneck, particularly in the automotive industry, still had an impact in the early part of 2022, but as the rest of the year unfolds, expect the situation to dissipate and demand to normalise in those markets, with the automotive sector consuming around 12%-13% of all steel used, or around 200 million tonnes.

Global sales of electric vehicles almost doubled year-on-year in 2021 to 6.6 million units, or an 8.6% share, from 2.5% in 2019. According to Basson: “what we’re seeing so far is that EVs are using the same technology as previous vehicles and in some cases using a little bit more steel to make the cars stronger for the heavier batteries, so, so far we haven’t seen any impact on the use of steel from EVs and I think that will most likely be the trend for the next few years.”

The use of steel is also expected to play a role in automated vehicles in the future. “Steel, if anything, will play a stronger role in the future than it has in the past, so we are quite optimistic about the role of steel in the automotive market and we are not worried about the EV market in the steel industry,” Basson concludes.

.gif) Loading

Loading