Prices of hot-rolled coil, rebar and ferrous scrap in Asia are expected to remain stable in the second quarter, following a surge in the first quarter, as supply chains gradually recover and markets continue to assess the impact of Russia’s invasion of Ukraine.

Prices of hot-rolled coil, rebar and ferrous scrap in Asia are expected to remain stable in the second quarter, following a surge in the first quarter, as supply chains gradually recover and markets continue to assess the impact of Russia’s invasion of Ukraine.

Suppliers from India, Japan and South Korea have increasingly focused on European markets following the invasion, while Chinese mills are emerging as dominant suppliers in Asia. This trend is likely to continue in Q2, after the EU increased quota volumes for HRC imports from India by 62% and from South Korea by 27% as of 1 April.

The absence of coils of Russian and Ukrainian origin is estimated at around 19% of global supply. Given the absence of flat steel from Russia, Ukraine, India and South Korea in the Asian market, a return to dominance by Chinese hot rolled products in the second quarter is very likely. India and South Korea accounted for 10% of the observed HRC offerings in Asia in Q2 2021 and their shift on exports in the current quarter is likely to see Chinese cargoes fill the gaps.

Another reason supporting Chinese HRC export growth is weak domestic steel demand due to a slump in the property market that has been exacerbated by a COVID-zero strategy, along with logistics disruptions that have weighed on the manufacturing sector.

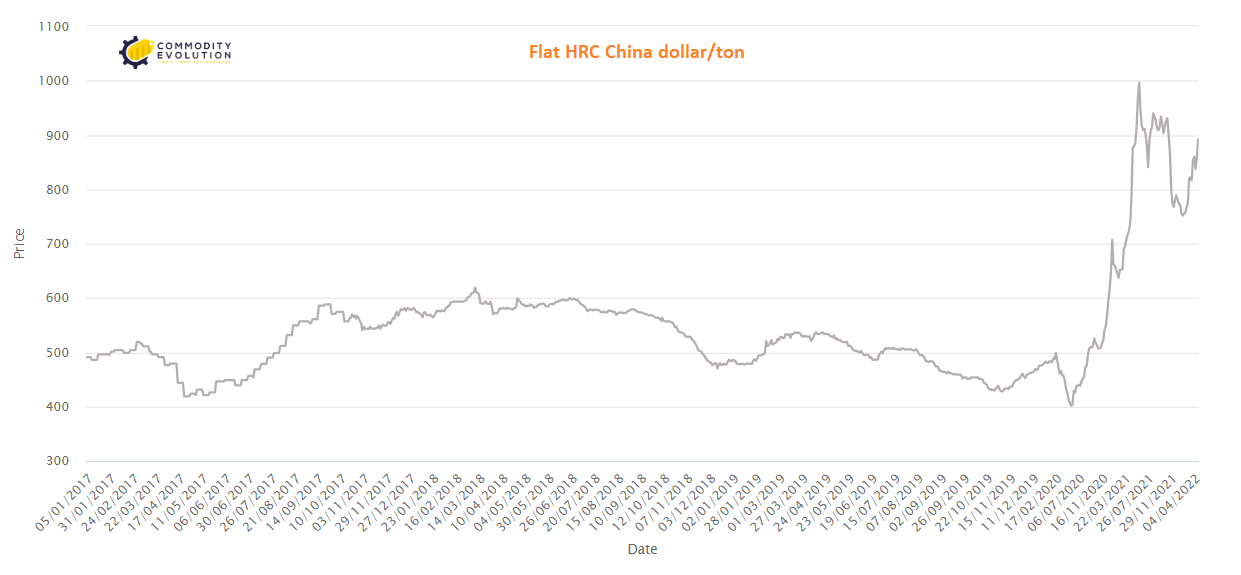

The spread between Chinese HRC exports and domestic prices widened to $52.59/mt on 31 March from minus $17.55/mt on 4 January, indicating that prices were significantly more attractive in the export market.

Despite the blockades in Tangshan and Shanghai, the impact on steel production, which has been rising steadily since the February Winter Olympics, has been limited so far.

In addition to expectations of a growing maritime market in Q2, the outlook for Chinese HRC prices is bullish as domestic demand is expected to increase after the easing of COVID-19 restrictions. However, demand recovery and prices remain subject to any further supply chain disruptions due to the war in Ukraine and China’s handling of COVID-19.

In the billet market, unmitigated supply concerns and higher production costs due to higher energy prices will define prices in the second quarter. Billet prices in Tangshan rose 13% from the start of Q1 to the end, while they rose 33% on a CFR Southeast Asia basis over the same period.

Seeking to avoid the risks and sanctions associated with buying Russian billets and the risk of shipping Ukrainian billets from the Black Sea, Asian buyers have had to look for alternatives. This brought the number of observed CIS trades to just one in March, from three in February and six in January.

While domestic steel supply in the first quarter was reduced during the Winter Olympics, pandemic blockades in several Chinese cities led to a reduction in overall activity and a disruption in logistics. Market participants expect demand to recover adequately in Q2 if the pandemic situation improves.

As the Russian-Ukrainian conflict has shown no signs of abating, billet market participants expect supply shortages to continue in Q2, at a time when demand for construction and infrastructure is recovering in parts of Asia.

.gif) Loading

Loading