In April, prices of most Chinese steel products could reach new highs for this year. Central government policies to stimulate economic growth should start to take effect, domestic steel demand should recover from the COVID-19 disruptions, and demand for Chinese steel from overseas buyers should be on the rise.

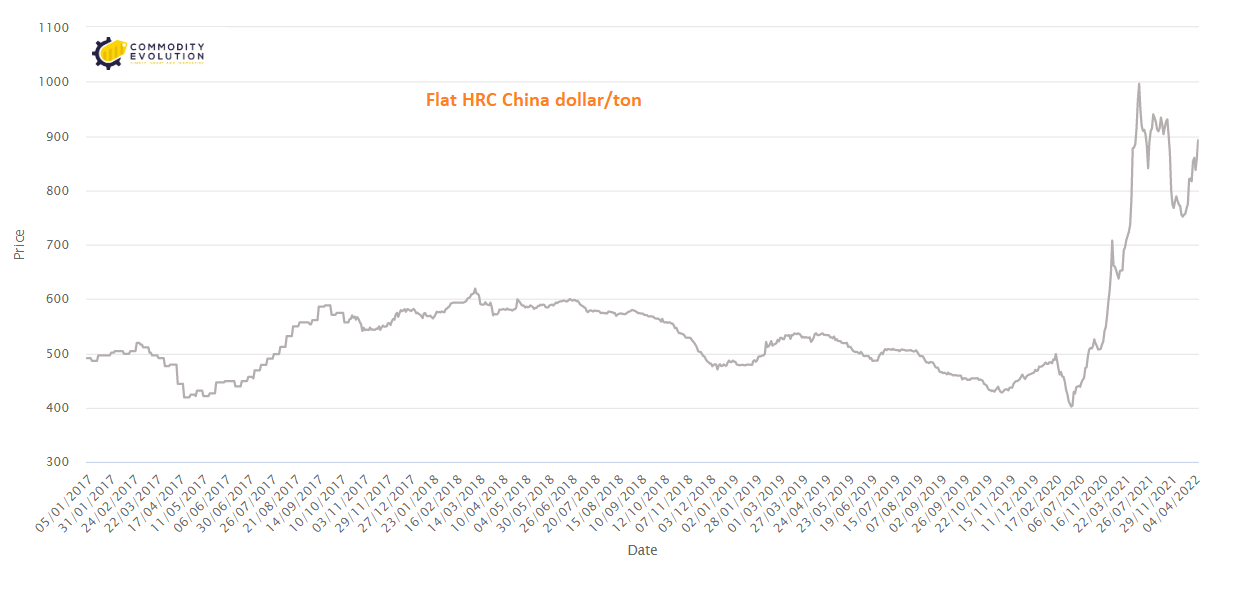

The price of Chinese rebar (Long Rebar) has already reached $857/mt, while the price of hot rolled coil (Flat HRC) has settled at $892/mt.

At the beginning of March, Beijing set the country’s economic growth target for this year at 5.5%, and this month will be a crucial time to achieve it. The effect of supportive policies, already evident in the infrastructure sector, will boost steel demand and market confidence this month.

On March 30, data from the China Public Private Partnerships (PPP) Center of the Ministry of Finance (MoF) showed that 21 PPP projects were added to the system in February, with total investment of 10 trillion yuan ($1.6 billion) up a whopping 212% on the month or 298% on the year.

PPP projects form the central pillar of China’s overall infrastructure and public works activities. In addition, 51 PPP projects started construction in February, with a total investment of 10.4 billion Yuan, 74.4% higher on the month or 133.8% higher on the year. This shows that “the infrastructure sector is gaining momentum in supporting China’s economic growth.

However, China’s real estate sector, a key component of domestic steel consumption, has shown no clear signs of improvement, despite the government’s continued loosening of controls for more than half the year.

Beijing will therefore need to continue its efforts to loosen restrictions on the property sector and to generate more liquidity in the market.

From 1 to 24 March, sales of new residential properties in 60 key cities in China fell by 50 per cent year-on-year, a much faster rate than the 28 per cent recorded in February. Meanwhile, sales of previously owned homes also fell 39% year-on-year, a drop just as steep as the 38% year-on-year decline in February.

Under pressure from the outbreak of the Russia-Ukraine conflict and the resurgence of COVID-19 within China, the country’s economic growth has already slowed, with many national institutions estimating first quarter growth at 5.1%, below Beijing’s target of 5.5% for the full year.

This means that growth in the remaining three quarters will have to be strong to reach the annual growth target.

In addition to the support the steel sector can expect from macroeconomic policies this month, the recovery in steel consumption, which was delayed by the COVID-19 restrictions imposed in March, is expected to take place this month.

In March, China’s apparent steel consumption was estimated at 48.6 million tonnes, down significantly by 6.5 million tonnes or 11.7% from a year earlier, as the pandemic hampered domestic steel consumption and finished steel deliveries.

March and April are expected to be the peak months for Chinese steel consumption, with the end of the cold winter weather making outdoor construction activity possible again. Therefore, after the disruptions in March, steel consumption this month could recover 3-4 million tonnes compared to last month.

Although in some provinces restrictions (to prevent the spread of the virus) will last until early or even mid-April, in other regions such as south China’s Guangdong, north China’s Tangshan, and east China’s Jiangsu and Zhejiang, the pandemic is gradually under control and restrictions have been eased.

The global steel market is rebalancing its demand with the absence of steel supplies from Russia and Ukraine, resulting in increased demand for Chinese steel products.

On the supply side, China’s domestic steel supply is expected to recover only 3.6 million tonnes this month, even though restrictions on steel mills in northern China were removed after the end of the Paralympic Games and annual political meetings in Beijing in March.

The slow recovery in production is partly a consequence of electric arc furnace (EAF) producers reducing output due to losses, while imports of slabs and billets from abroad are expected to be lower as domestic prices are much lower than those overseas.

Soaring steel production costs and poor profits at Chinese mills will continue to support steel prices this month. In addition, the actual production costs of Chinese steel mills may rise further this month due to increases in iron ore, coke and energy prices in March. The hiccup costs “will not only support prices, but also push them higher.

The fundamentals of the domestic steel market, the price gap between China’s steel market and foreign markets, the support the industry can get from the infrastructure sector in particular, all these factors create room for steel prices to rise. However, caution is advised, as domestic supply could increase faster than expected, the fight against the pandemic could last longer than expected, and demand for steel abroad could be lower than expected.

.gif) Loading

Loading