Three of Egypt’s largest steel producers have announced that they have raised prices by up to 17%, or around LE 3,000 per tonne (EUR 150/mt), in what would appear to be the largest steel price increase in Egypt’s history.

Three of Egypt’s largest steel producers have announced that they have raised prices by up to 17%, or around LE 3,000 per tonne (EUR 150/mt), in what would appear to be the largest steel price increase in Egypt’s history.

Ezz Steel, Egyptian Steel and Suez Steel Company announced the price increase on Thursday, coinciding with the start of Ramadan, a month that typically sees a drop in demand for steel. The unprecedented price increase comes in the wake of Russia’s war with Ukraine, which has had repercussions across the global economy.

The price increase was essentially linked to higher production costs on two levels:

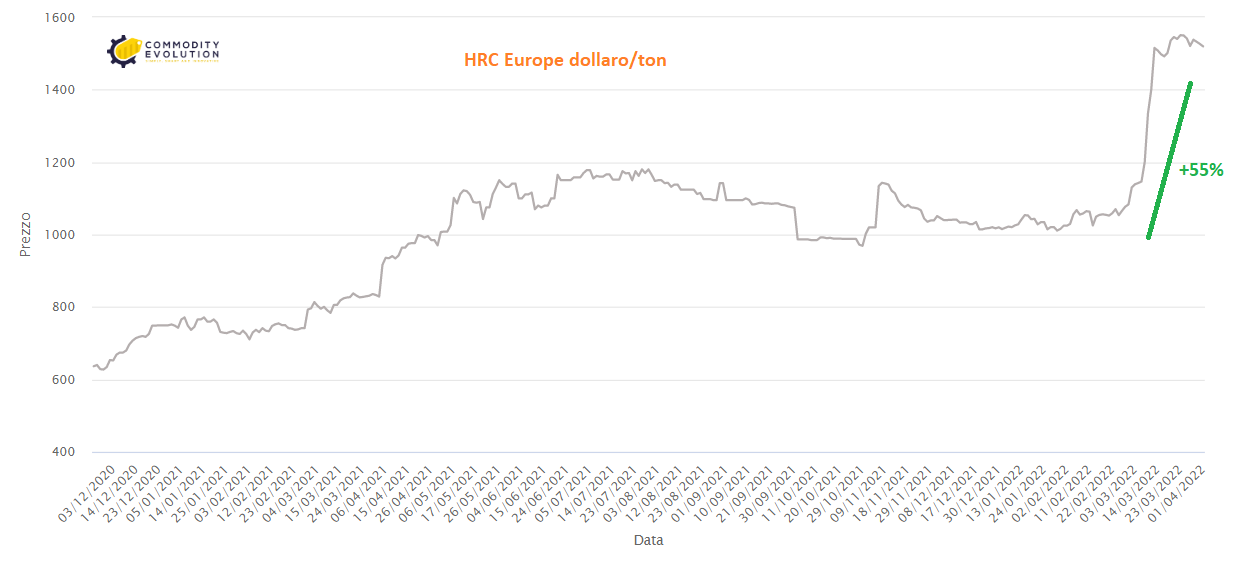

- Firstly, several production inputs that Egypt imports are scarce, including scrap metal, iron ore and billets. Egypt is dependent on imports from Russia and Ukraine, whose supplies have stopped globally due to the ongoing war. This leaves local producers with the Turkish market, which prefers to supply Europe. Yet Europe has also felt the impact, with European steel reference prices rising 51% in the three weeks after the invasion as shipments from Russia and Ukraine were disrupted;

- Secondly, higher production and import costs are linked to the rising price of the dollar in the local market. A fortnight ago, the Central Bank of Egypt raised interest rates by 1% across the board and allowed the value of the pound to float freely against the dollar in an attempt to tackle rising inflation and foreign capital flight exacerbated by the war in Ukraine, leading to a 14% drop in the value of the Egyptian pound against the dollar.

The impact of the crisis and the government’s measures implemented to deal with it have already spilled over to Egyptian industries. The listed shares of steel and cement companies fluctuated last week amid reports that the government is preparing to increase the price of subsidised natural gas it sells to these sectors.

Increases in the cost of producing construction materials are set to affect the domestic property market. Most property developers are already raising prices by 15-20% in response.

If the impact of the war in Ukraine continues, the steel market could experience further price increases after Ramadan, when demand will rise again.

In addition to central bank decisions, the Egyptian government has taken several emergency measures in an attempt to mitigate the economic fallout exacerbated by the war, including setting prices for unsubsidised bread and announcing a series of stimulus and social security measures.

.gif) Loading

Loading