A global push among automakers to expand their electric vehicle (EV) lineup just got a lot more expensive, thanks to rising prices for nickel and lithium, key raw materials in EV batteries.

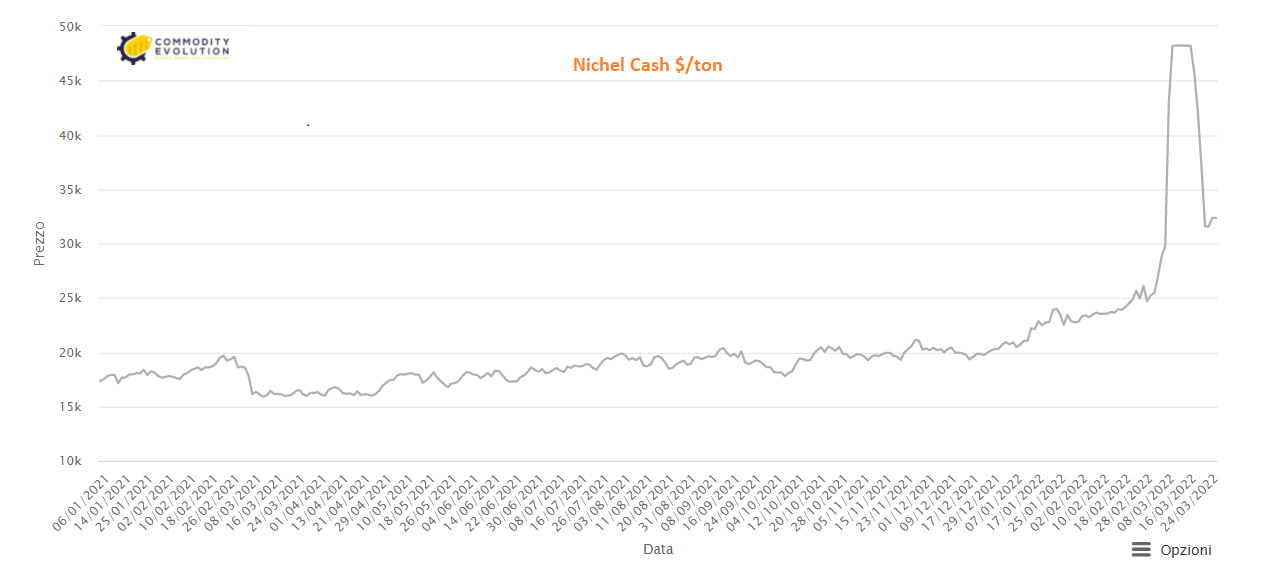

Nickel is caught up in war-induced supply concerns and the short-term squeeze that has sent prices to unprecedented levels. The London Metal Exchange was forced to suspend nickel quotations and cancel trading after prices doubled earlier this month to more than $100,000 a tonne.

Nickel prices have fallen since trading resumed, but at around $36,000 a tonne, the metal is still trading at 10-year highs.

The EV industry was already struggling to secure battery metals for an expected increase in demand. Elon Musk in recent years has cited the possibility of a structural deficit for nickel as one of his biggest concerns.

Soaring prices mean producers will have to redouble their efforts to find substitutes or alternative sources, one of which could come from Tsingshan Holding Group, the Chinese mining giant at the centre of the squeeze that last year introduced a way to produce nickel for batteries from low-grade ore.

Nickel is the largest component in terms of cost. So any change will have a significant impact. A 100 kWh battery needs about 145 pounds, or about 66 kg, of nickel. The average price last year was about $18,500 per tonne. That means about $1,200 worth of nickel in each battery. At $29,000 a tonne, that same battery needed more than $1,900 worth of nickel.

That’s not a huge increase, but car manufacturers don’t like to see the cost of a material go up by $700 per vehicle. They have long-term supply contracts and can avoid the price spikes on the spot market for a while, but if the high prices persist, they will pay more.

New sources are coming in from Indonesia, and Russian nickel will find its way to China and other nations that are not applying sanctions.

Last year, Tsingshan, the world’s largest nickel producer, began shipping its first shipments of the nickel matta. This is a new way of making nickel for batteries that could open up a major supply route from low-grade mines for electric vehicles.

While capacity is limited at the moment, Tsingshan has shipped its first batch of nickel matte for EV batteries from its plant in Indonesia, with three lines producing up to 3,000 tonnes per month. The new process, if followed by other nickel-iron producers, is likely to add more nickel supply for batteries.

The conversion from nickel iron to nickel matt is expected to accelerate, although this requires nickel prices to remain high for the medium to long term, as this would require additional capital to be invested in changing existing furnaces.

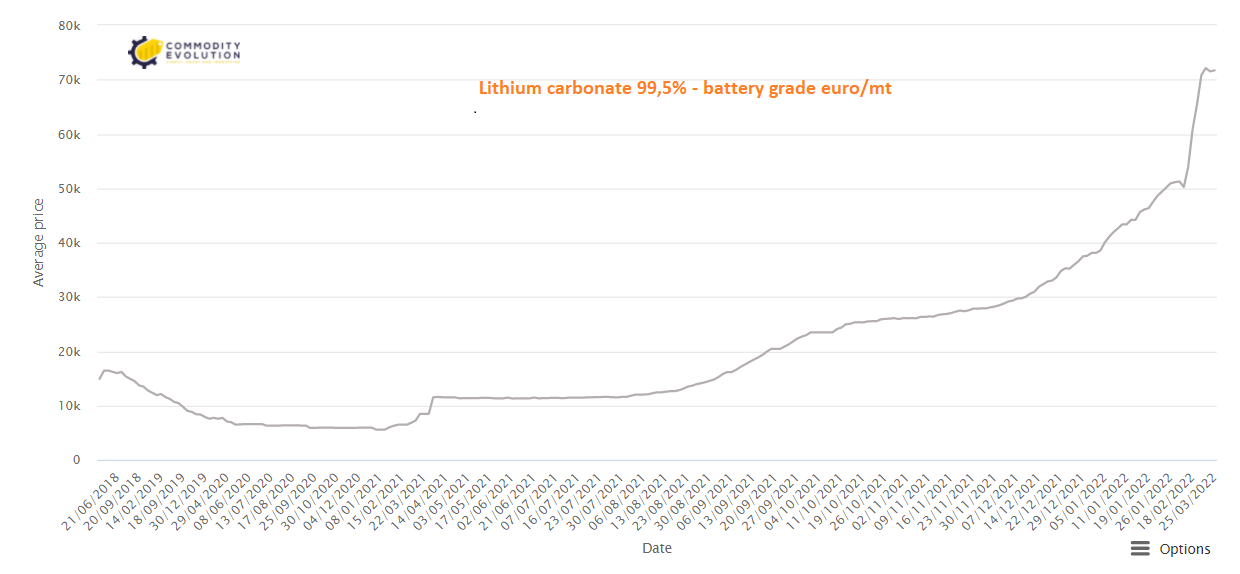

Meanwhile, China, the world’s largest EV market, would like to see lithium prices return to sustainable levels, thereby boosting its supply chain for electric car batteries.

The government convened a series of market participants last week, from lithium producers to the main association of car manufacturers, to discuss “a rational return” for lithium prices. Lithium has risen nearly 500 per cent in the past year, adding to cost pressures for EV makers.

Beijing’s call underscores how China is getting nervous about the prolonged lithium surge. It is also in line with a broader push to deal with soaring commodity prices.

China’s lithium carbonate prices are now at nearly 500,000 yuan ($107,000) a tonne, an all-time high and an 80% gain so far.

If prices of these key raw materials continue to remain high, predictions that electric vehicles will reach price parity with combustion-engine equivalents by 2025 could be delayed.

.gif) Loading

Loading