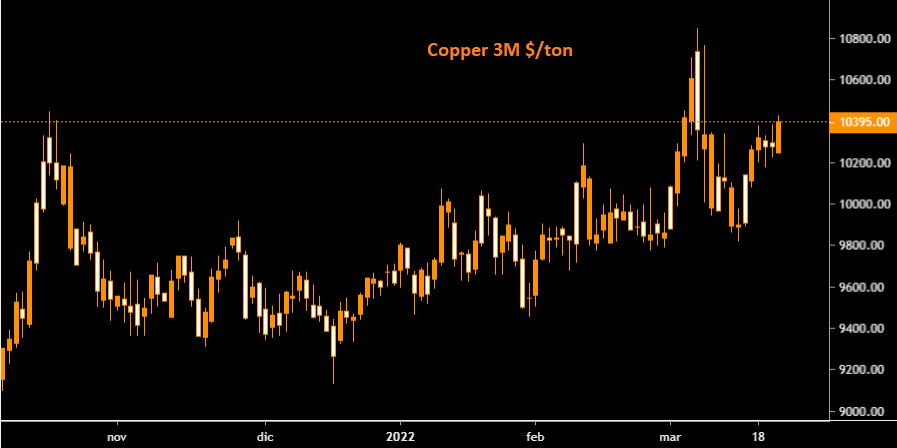

Copper prices have remained quite amid the chaos that has engulfed the London Metal Exchange (LME) this month.

The London copper market was briefly shaken by the collapse in margins that triggered the 8 March suspension of the LME nickel market, with a short-lived spike to a new all-time high of $10,845 per tonne.

But since then the LME’s three-month copper has done little more than float, last trading at $10,340 per tonne.

This is partly because the London copper contract was already subdued after its turbulent period in October last year, when the LME intervened to limit the strong backwardation that characterised prices in that time frame.

And also because copper seems much less exposed to a Russian supply disruption than other industrial metals such as nickel, which was shaken to the breaking point by the Russian invasion of Ukraine.

Russia is certainly a large producer of copper with a refined output of about one million tonnes per year, which represents about 4% of global production.

It is also a major exporter of both raw metal and copper wire, but does not have the same commanding position in Western supply chains as, for example, in palladium, where Norilsk Nickel alone accounts for 45% of global production.

Moreover, much of what is exported ends up in China, which absorbs around 400,000 tonnes of Russian copper per year. The assumption is that the rest of the world can live without Russian copper and that China will simply absorb what is displaced from Western markets.

This is probably one of the reasons why the LME’s copper committee, which represents a broad spectrum of consumers, producers and traders, felt able to vote for a ban on new deliveries of Russian copper to the exchange. However, the LME executive has made it clear that it is not in its business to pre-empt governments on the imposition of sanctions and has no intention of unilaterally banning any Russian metal.

Russian copper export flows are more nuanced than they appear at first glance and last year’s figures are a starting point. According to the International Trade Commission (ITC), the country’s exports of refined crude copper totalled 463,000 tonnes in 2021, the lowest annual flow since 2014.

This reflects significantly lower production at Norilsk Nickel due to flooding at the mine and trade disruptions caused by a temporary 15% tax on exports between August and December.

It is worth noting that exports in January were as high as 117,000 tonnes, compared to 35,500 tonnes in January 2021, attesting to the bulging effect of outflows around the tax.

Exports averaged around 700,000 tonnes in 2018-2020, supplemented by 150,000 tonnes of copper wire. However, last year’s trade data show a significant shift in the flow of Russian copper to China. Russia calculated 155,000 tonnes outbound to China, but China recorded 403,000 tonnes of Russian metal inbound.

It is clear that a significant amount of Russian copper shipped to the Netherlands, the second largest destination after China, is passed through physical/LME trading systems before heading to Shanghai.

Although there is a direct rail link between Russia and China, currently used to transport copper concentrates, it has little spare capacity for refined metal.

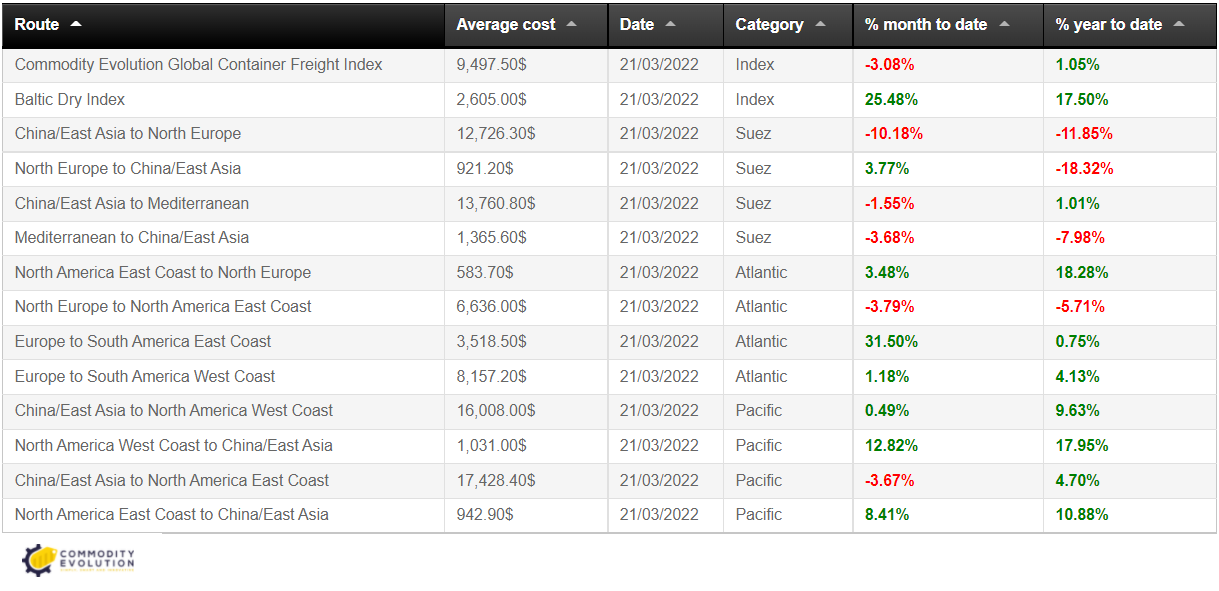

Most of the country’s refined copper exports to China flow via the Black Sea or through European ports such as Rotterdam. Both transport routes are becoming increasingly problematic as self-sanctioning logistics companies interrupt Russia’s maritime trade.

Until shipping constraints subside, these copper units are likely to be displaced from the market, implying a reduction of up to 50-60kt per month in copper supply to the ex-Russia refined market.

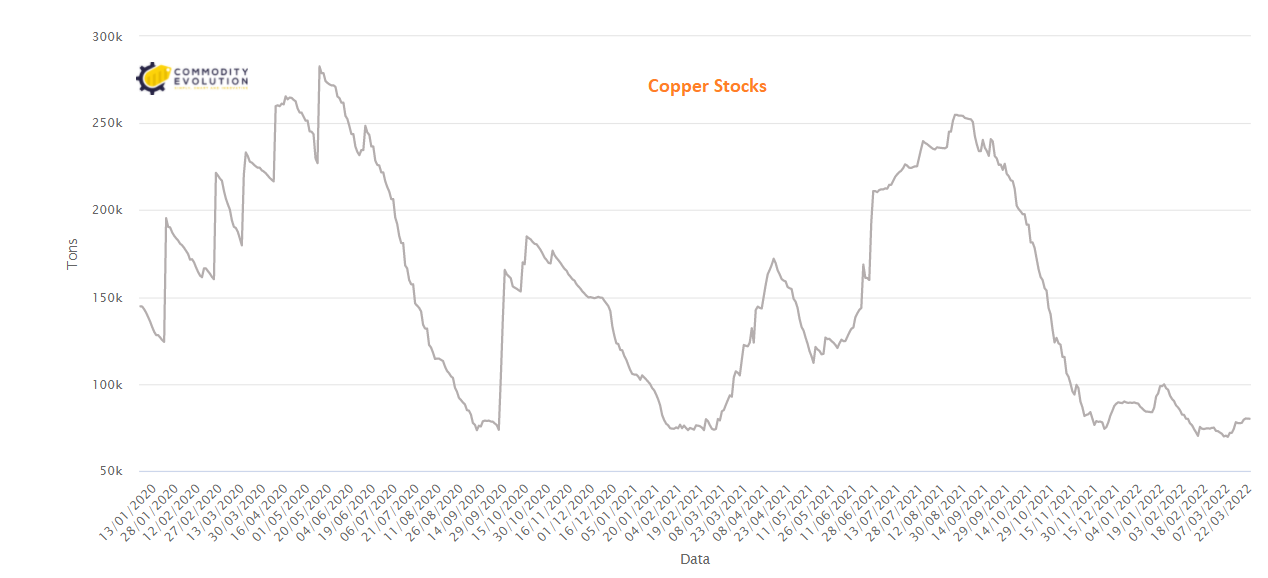

Global trading stocks are low. There are currently 276,000 tonnes of copper in the warehouses of the LME, Shanghai Futures Exchange and CME.

Total inventory has increased by 85,800 tonnes so far this year, but this is due to the seasonal build-up of stocks in China around the Lunar New Year holidays. Compared to this time last year, trading stock coverage is down 121,000 tonnes.

LME stocks have fallen by almost 9,000 tonnes since the start of the year and at 79,975 tonnes are equivalent to just over one day’s global utilisation.

By any historical yardstick, LME stocks are close to depletion and are highly vulnerable to any new buying, such as that seen in the run-up to last October’s squeeze.

Russian copper is not yet sanctioned and will not be banned from the LME, at least for now. And even if it were, there is no doubt that it would find a ready-made home in China. But getting it to China means transporting it through Europe, and that is becoming more difficult every day. A readjustment of Russian copper trade flows may not be as smooth as many might expect.

Stay tuned to Commodity Evolution for key industry market updates.

If you are not a subscriber and want to enjoy the full potential of the platform you can request a free trial of our services for 2 weeks Free trial or contact us to receive more information Contact us

.gif) Loading

Loading