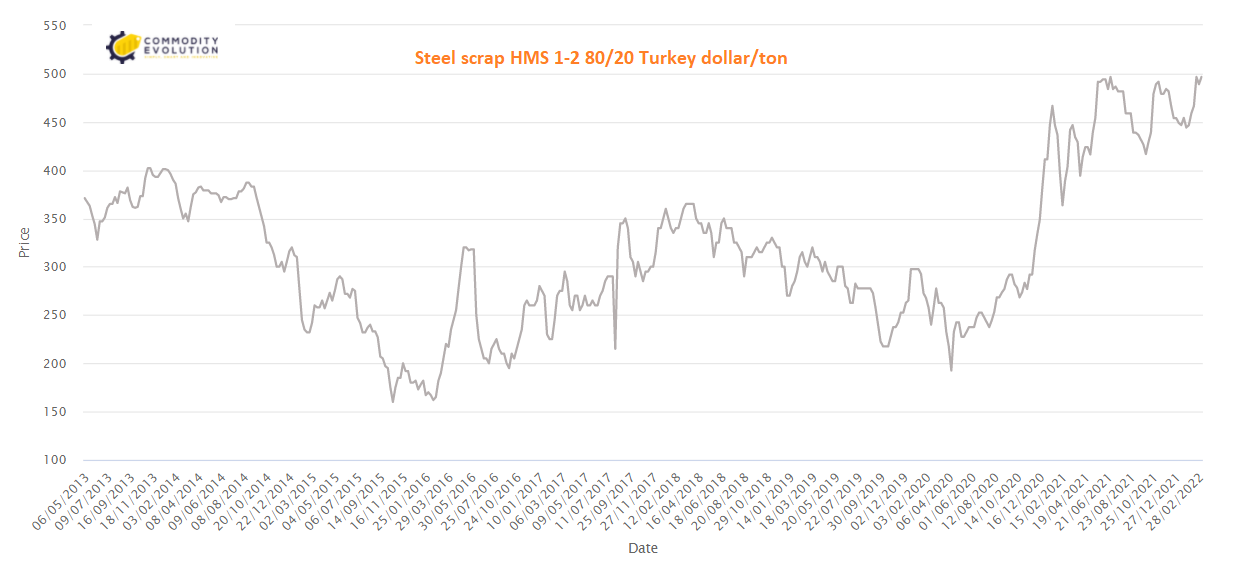

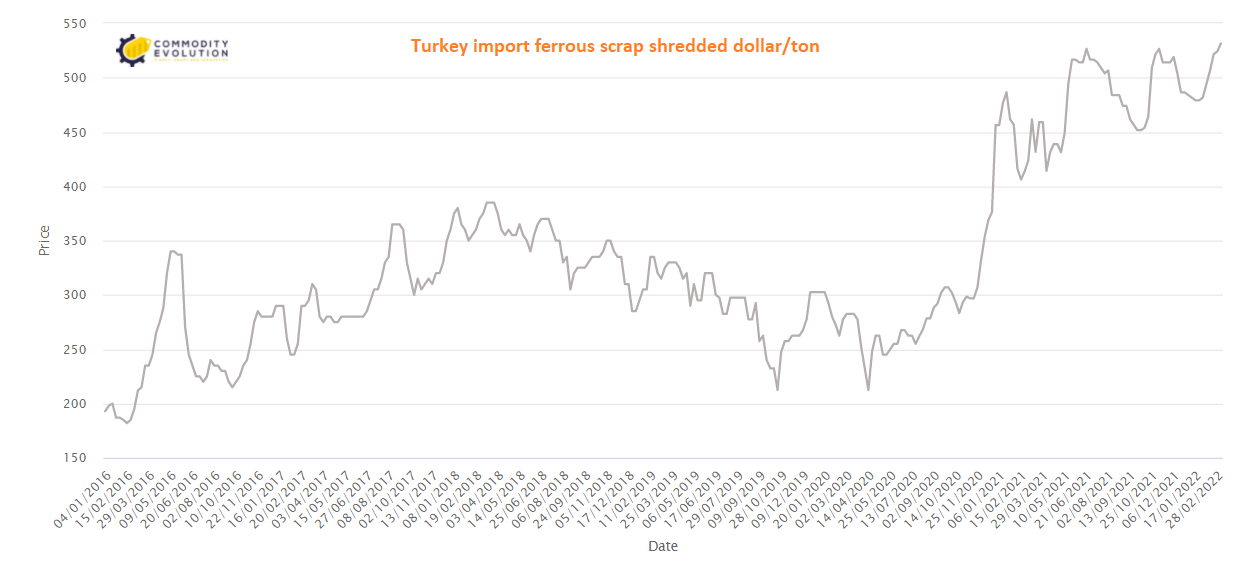

Considering the ongoing trade tensions between Russia and Ukraine, prices of imported scrap in Turkey have risen to record highs. Moreover, supply has become difficult for exporters through the Black Sea.

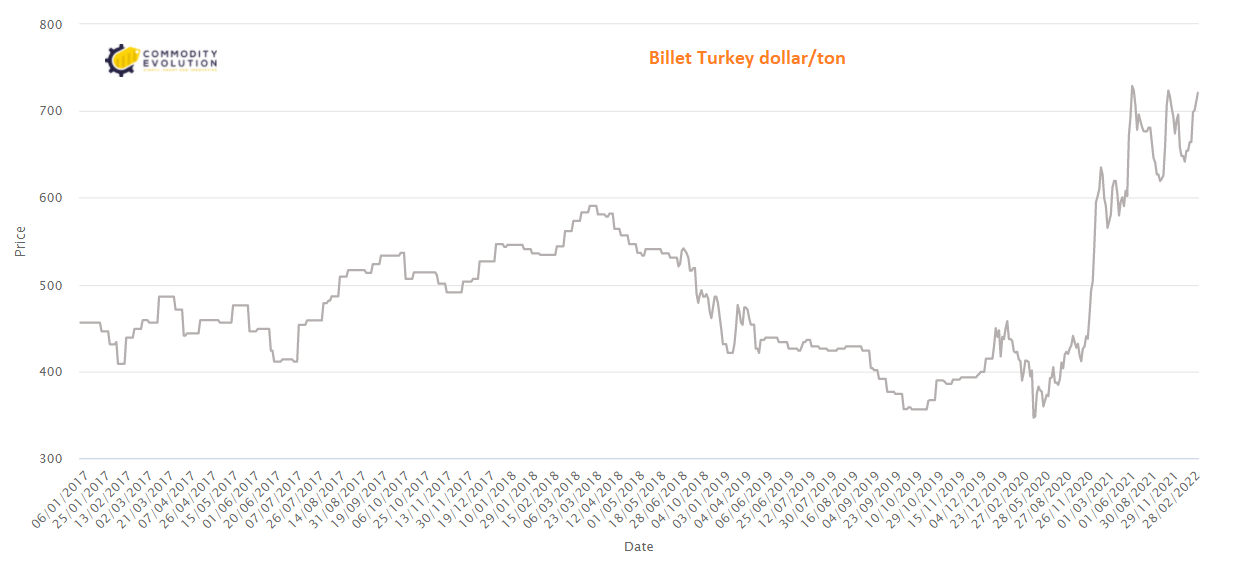

The sharp rise in raw material prices has led to a strong domestic market and higher prices for semi-finished and finished steel products.

Steel mills in the country have continued to raise scrap purchase prices due to strong demand from end users, following a surge in prices of imported scrap and semi-finished and finished steel products. The aftermath of Russia’s attack on Ukraine continues to drive up Turkey’s domestic and export prices.

Domestic billet prices continued to rise. The shortage of semi-finished products from the CIS due to the market panic caused by the Russia-Ukraine war has made trade unpredictable.

The nation has continued to adjust its energy tariffs amid global tensions. While no direct changes have been announced for industrial users, the recent revision is expected to indirectly affect the steel industry.

Turkey’s ferrous scrap imports remained largely stable at 2.46 million tons in January 2022 compared to 2.49 million tons in November 2021. Ukraine was the main exporter to Turkey with 0.34 million tons in January, followed by the US and Russia with 0.31 million and 0.22 million, respectively. On a year-on-year basis, scrap imports saw a 27% increase from 1.93 tons in January 2021.

Market participants believe that prices of imported scrap will increase further due to rising geopolitical tensions. The country imported around 24.36mnt, while imports from Russia and Ukraine were recorded at 1mnt and 0.34mnt, respectively.

.gif) Loading

Loading