Copper prices rose sharply after the Russian invasion of Ukraine, as disruption of trade routes and economic sanctions limited supplies.

Immediately after the invasion, the price fell to $9,918/ton, but then, with the announcement of sanctions, the price rose to $10,592/ton (highs on March 4, 2022). Russia produces about 3.5% of the world’s copper and sanctions will likely limit access.

Copper prices had fallen in January as the market was nervous about potential U.S. moves to raise interest rates and reduce spending, which shifted money from riskier assets to the dollar.

In addition to the war in Ukraine, industrial metals markets have become increasingly volatile with concerns over the effects of the Omicron variant on economic growth, energy supply restrictions in China reducing production, and the gradual relaxation of monetary policies in the United States. Copper is often considered a barometer of economic activity due to its extensive use in industries such as power generation and transmission, telecommunications, and automobile manufacturing.

Copper news has been dominated by the power shortage in China, which has prompted local governments to ration supply to industrial users. This, in turn, has reduced production of the metal. And high international energy prices have driven up production costs, with Brent oil hitting three-year highs and natural gas prices in Europe hitting record highs.

What are the factors that could lead prices to generate further highs

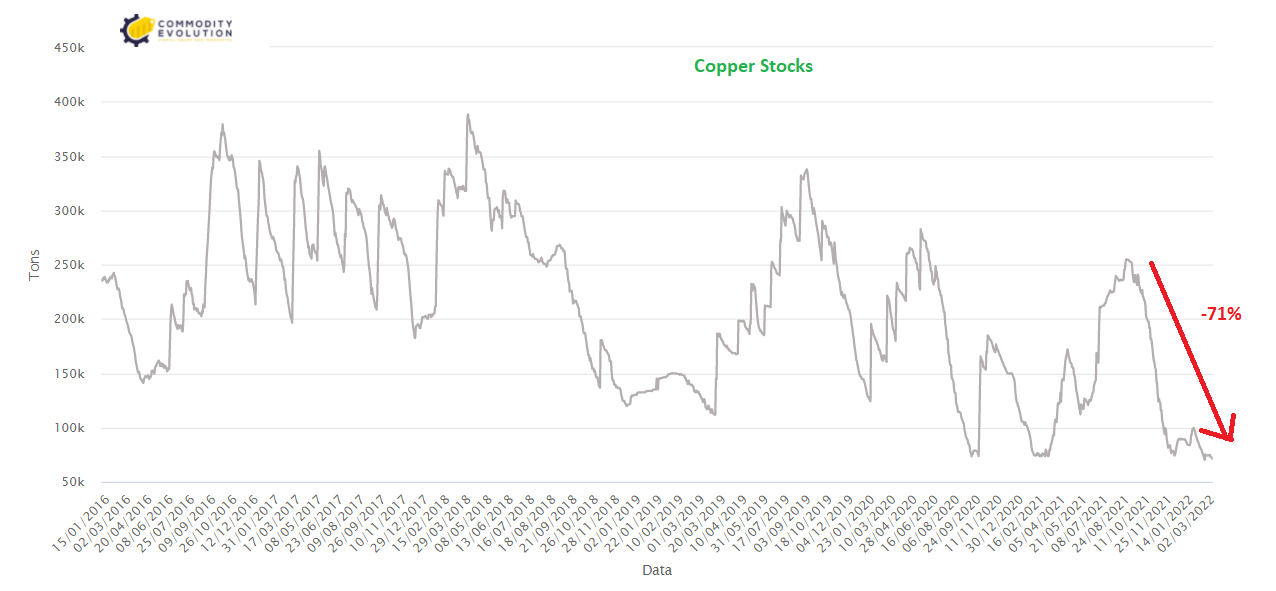

- Inventories at Lme warehouses at absolute lows: since September 2021, where inventories at official Lme warehouses were set at 253,000 tons, they have plummeted to absolute lows in the 71,375 tons area, a 71% drop.

- Continued potential strikes in South America’s mines: the Coporaque district community reported in mid-February that it would resume its anti-mining roadblock. The road to Las Bambas is a critical point of protests. Dozens of impoverished Andean communities lie along the 400 km of winding dirt road, who have often complained that the mine’s trucks pollute the environment while the company has failed to improve their quality of life. Since opening in 2016, the mining road has been blocked for more than 400 days by various groups, affecting the mine’s copper production. The recent blockades have become a major headache for the leftist government of Pedro Castillo, who has promised to prioritize the needs of marginalized Peruvians, but also requires tax revenues from the mines to fund social programs. Las Bambas alone accounts for 1% of the country’s gross domestic product and already suspended operations in December due to a blockade.

- Chilean production down: Chile, the largest copper producing country, has just recorded its lowest January production since 2011 (429,923 tons), the latest bullish signal for global metal markets. Production fell 15% last month compared to December and 7.5% compared to January 2021. Chilean production is typically lower in the new year, and can reflow depending on whether mines are encountering higher or lower grade sections of ore. Some mines may catch up on earthwork and maintenance that was delayed during the pandemic. After more than a decade of drought, water scarcity may also play a role in central Chile’s operations. At the same time, seasonal rains during the so-called highland winter may have impacted some operations in the far north. Whatever the reason, the slump in Chilean production in January, after a 1.9% drop last year, offers little relief to a global market characterized by low inventories and high prices.

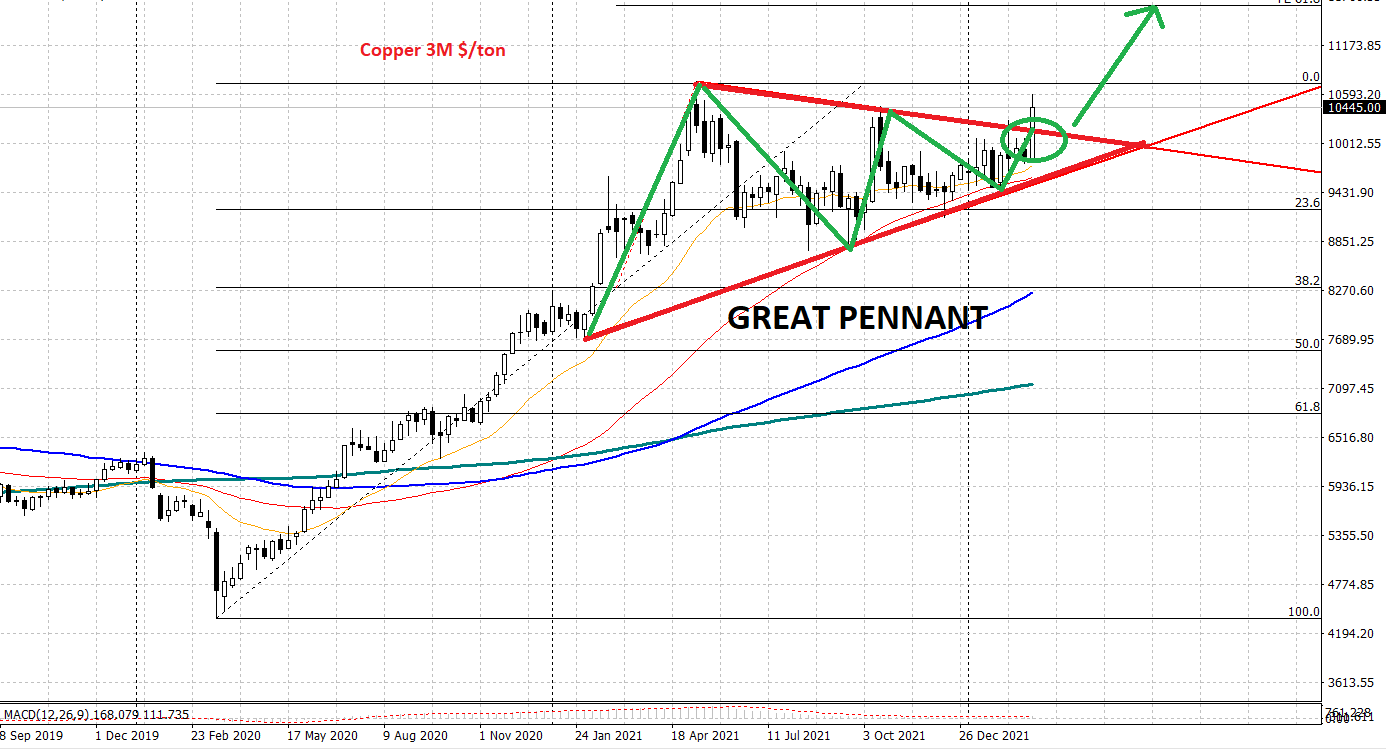

- On the technical chart side: the upside violation confirmed at weekly level of the upper part of the bullish pennant at 10,150 $/ton suggests a big breakout that could bring prices back to levels well above the highs of May 2021 at 10,730 $/ton.

Surely the latter level will be the first target in the short term that can be reached by prices, with possible high volatility spikes when approaching it. Once this barrier is also exceeded, prices will not have any further blocks, with potential extensions of the current uptrend towards $12,300/ton in the medium term.

Analysis by the Commodity Evolution Research Department

.gif) Loading

Loading