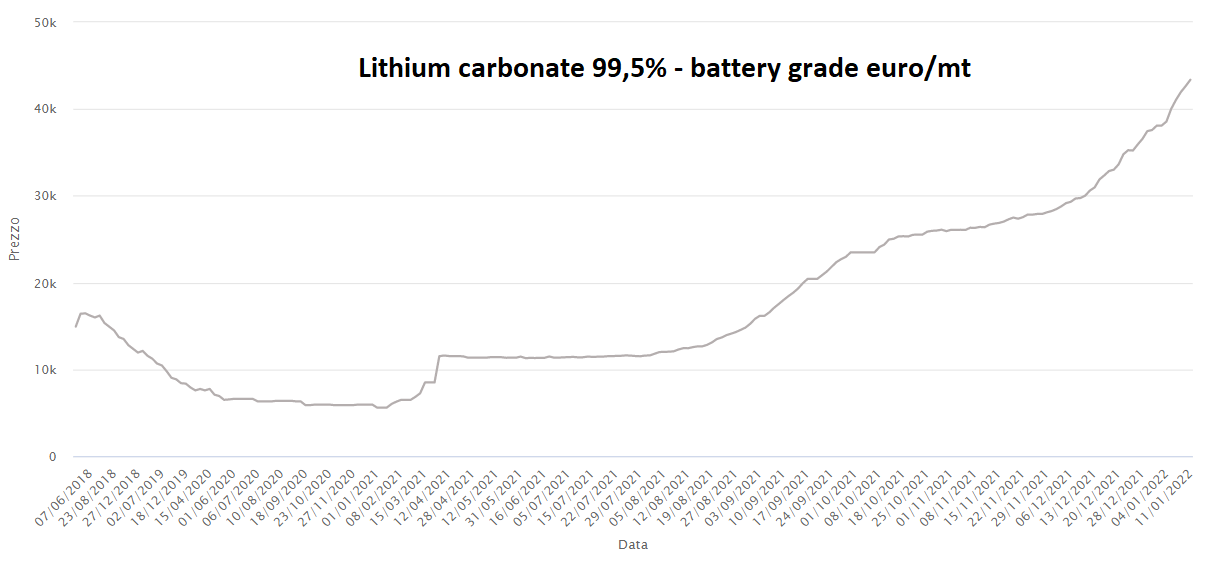

Lithium exploded in 2022 with a new price spike that warns electric vehicle manufacturers of even more acute cost pressures.

Lithium exploded in 2022 with a new price spike that warns electric vehicle manufacturers of even more acute cost pressures.

Supplies of the core battery material face a number of near-term risks that threaten deeper shortages just as demand accelerates as global EV adoption increases. An already strained market has been shaken by everything from facility maintenance and restrictions from the Winter Olympics in China to pandemic-related labor shortages in Australia.

That’s bound to increase pressure on EV manufacturers after a year that saw global lithium prices nearly quadruple. Lithium carbonate in China is already up 13% this year to a new record, adding up to a gain of more than 400% in 2021.

The lithium market is extremely tight right now, so spot prices are very sensitive to any supply disruption.

The lithium market is extremely tight right now, so spot prices are very sensitive to any supply disruption.

Lithium’s surprising start to the year echoes expectations for further price increases. Short-term supply disruptions add to a long-term picture in which the rapidly expanding global lithium industry is struggling to keep up with customer demand.

Gains for other raw materials mean battery costs this year could rise for the first time since 2010. Nickel, also an important ingredient in batteries, just rose to a nine-year high.

In China, a number of lithium plants are under regular maintenance, while some manufacturers in northern provinces such as Shandong and Hebei face anti-pollution restrictions around the Winter Olympics. The Games begin in early February. The arrival of the omicron variant of Covid-19 in China only adds to the risks.

Ahead of China’s Lunar New Year break week, refinery maintenance work will intensify as buyers look to stock up.

In addition, virus-related challenges have affected mining companies in Western Australia, with labor shortages resulting from government restrictions. Pilbara Minerals Ltd. recently reduced its forecast for shipments of spodumene concentrate, an intermediate product that can be processed into battery chemicals.

Beyond these short-term issues, there are challenges for lithium in the coming years. The Rio Tinto group will have to deal with environmental protests in Serbia, and there are growing concerns about the sustainability of South American brine-based production.

.gif) Loading

Loading