Aluminum costs for European consumers are reaching record levels as soaring energy costs and production cuts have exacerbated deficits in the metal used in the energy, construction and packaging industries (as described in this article on January 4, 2022.

Consumers who buy aluminum on the physical market typically pay the London Metal Exchange’s benchmark price, about $2,950 per ton Tuesday, plus a market premium that typically covers transportation costs and taxes.

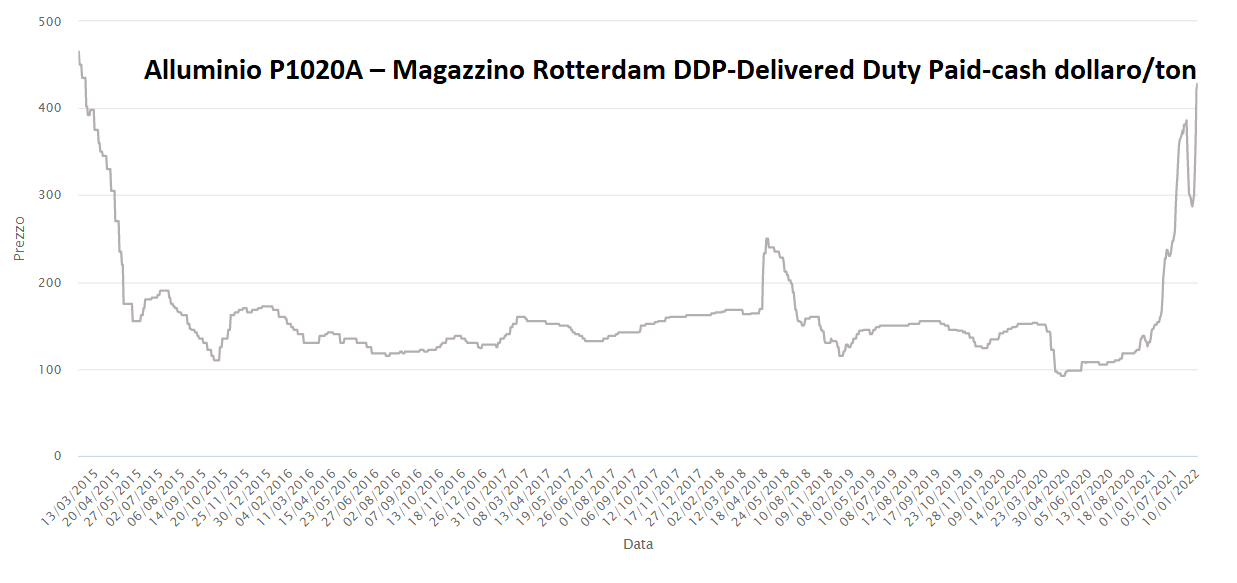

But shortages commanded a significantly higher premium, which in Europe rose nearly 30% to a record $428/ton (Aluminum P1020A – Warehouse Rotterdam DDP-Delivered Duty Paid-cash dollar/ton on 11/01/2022).

According to Michael Widmer, an analyst at BoA Securities, with about 650,000 tons of capacity cut so far in Europe, an additional 900,000 tons of production is at risk.

According to Michael Widmer, an analyst at BoA Securities, with about 650,000 tons of capacity cut so far in Europe, an additional 900,000 tons of production is at risk.

Widmer predicts Western European aluminum demand of 8.5 million tons this year and a deficit of five million tons. He predicts global consumption of 72 million tons and a deficit of 254,000 tons.

Before the energy crisis, energy accounted for up to 40 percent of aluminum smelting costs. Depending on coverage and energy sources, that figure has risen to 50% or more for many producers.

Production cuts in Europe include those at Alcoa’s San Ciprian plant in Spain, American Industrial Partners’ Dunkirk smelter in France, and Norsk Hydro’s majority-owned aluminum plant in Slovakia.

As we enter 2022, European producers are still plagued by high energy costs and there seems to be no sign of a quick fix to the problem.

Aluminum shortages since early last year have seen inventories in LME warehouses more than halve since mid-March last year.

.gif) Loading

Loading