The various production cuts made before by the largest European smelter Aluminium Dunkerque Industries France (read the article here), by Hydro in its plant in Slovakia (read the article here), by Alro (read the article here) by Alcoa that will stop a Spanish plant for two years (read the article here) all characterized by the same common component: the increase in energy costs.

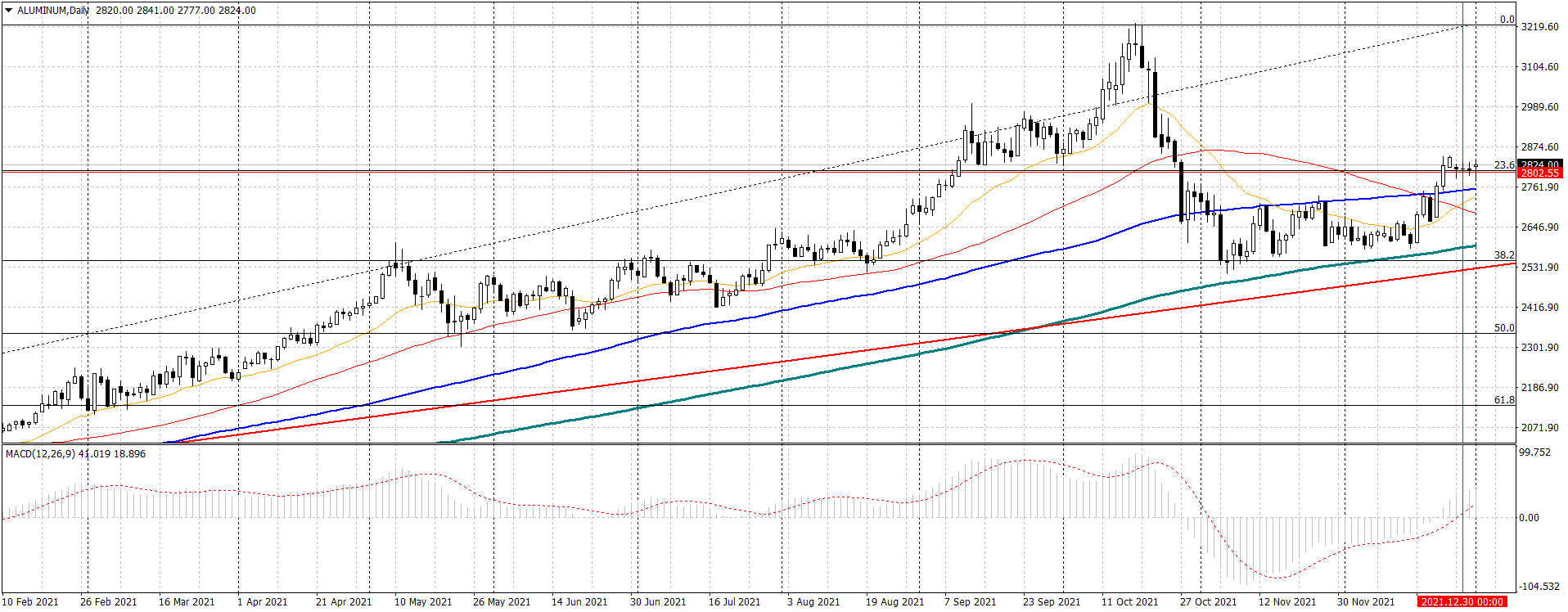

On the technical front, after the highs of October 18, prices have corrected by about 28.54% (lows of November 5). Since then the prices have assumed a positive lateral trend with an initial recovery phase.

All the main moving averages set by Commodity Evolution’s research office (100-day and 200-day average) travel below prices, providing a solid support while it should be noted that the shorter moving averages have shown an upward cross (21-day exp average on the 50-day simple average), suggesting a first signal of recovery of prices. Also the MACD indicator shows a return to positivity.

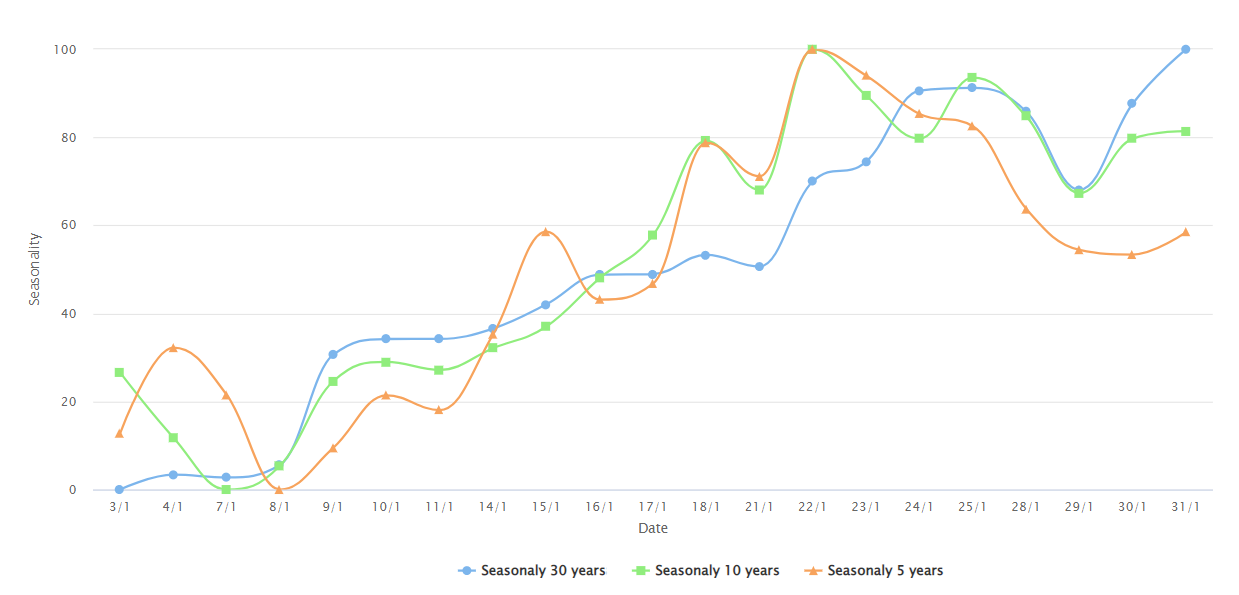

On the seasonal front, the month of January has always been historically positive for aluminum with a strong impulsiveness from January 8 onwards (considering a period of 30 years – 10 years – 5 years). In this case the possible short term targets are identified in the 2900 $/ton area.

Stay tuned with Commodity Evolution

.gif) Loading

Loading