The global cobalt supply chain is likely to remain highly geographically concentrated in the coming years, in the Democratic Republic of Congo for mining production and in China for refining, which will likely pose supply challenges for battery manufacturers.

The global cobalt supply chain is likely to remain highly geographically concentrated in the coming years, in the Democratic Republic of Congo for mining production and in China for refining, which will likely pose supply challenges for battery manufacturers.

Yet the global cobalt industry is set to receive a significant boost from the global shift to a green economy, as the ferromagnetic blue metal is a key component of rechargeable batteries and is valued for its stability, hardness, anti-corrosion and high-temperature resistance characteristics.

Historically used as a pigment due to its bright blue color, the metal is now primarily used in the precursors and cathodes of rechargeable batteries (56% of total consumption as of 2021). The use of cobalt as a cathode in rechargeable batteries effectively improves their energy density, power and performance compared to batteries without cobalt.

Cobalt is also used in the production of nickel-based alloys (13% of total consumption) that are widely used in the aerospace industry, in tool manufacturing (8% of total consumption), and finally in smaller amounts in pigments, soaps, and as catalysts.

The end use of cobalt is mainly in portable electronics (36.3% of global consumption), such as smartphones and laptops, while automotive applications also account for an important share (23%) that will drive cobalt demand in the coming decades.

Cobalt is recovered primarily as a byproduct of copper and nickel mining, and its availability depends on the ongoing mining of the metals that host it. Copper-cobalt deposits hosted in stratigraphic sediments, mainly in the DRC and Zambia, represent the world’s largest source of cobalt, followed by nickel-cobalt laterite deposits (found mainly in Australia, Cuba, New Caledonia, Madagascar, Papua New Guinea, and the Philippines) and finally by magmatic nickel-copper-cobalt-PGM deposits (mainly in Canada, Russia, and South Africa).

While cobalt-rich crusts on the ocean floor could contain up to 1bnt of cobalt resources, deep-sea mining is still in its infancy, given the obvious technological and economic limitations.

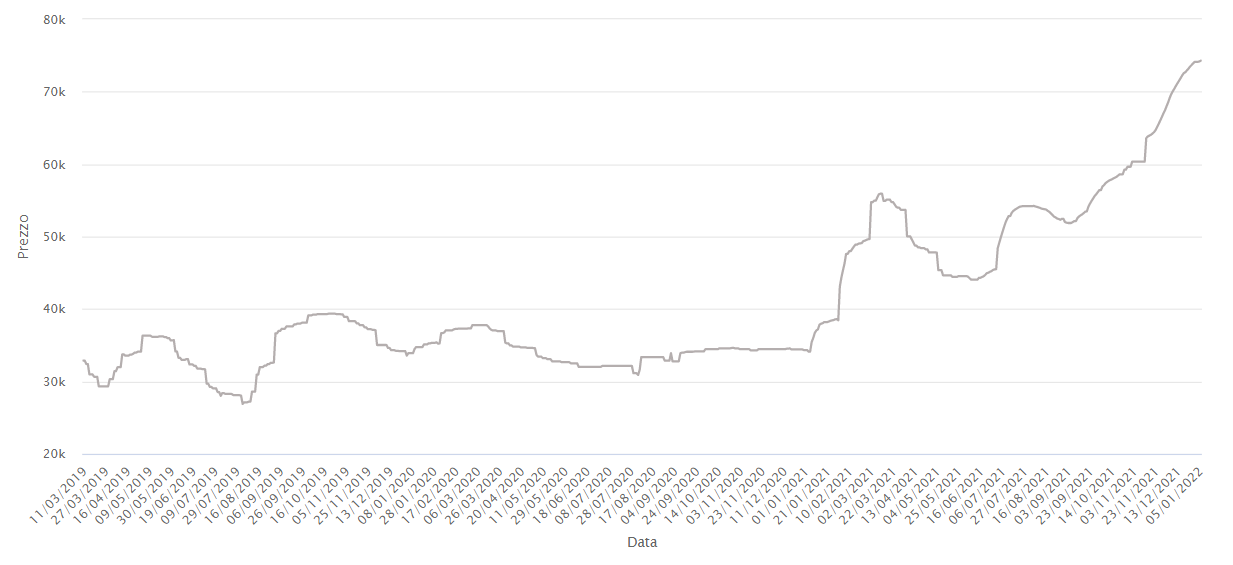

Cobalt sulfate prices are expected to be on an upward trend over the next 2-3 years as demand from battery manufacturers continues to outstrip supply.

China’s acceleration of new electric vehicles will largely drive global cobalt sulfate demand in the short to medium term while Europe’s growing electric vehicle penetration over the next decade will support demand in the long term.

Australia holds significant growth potential in the cobalt producer landscape, with multiple integrated cobalt projects. Production growth will be limited in Europe and North America over the next few years due to a lack of resources and projects. The battery revolution will increasingly dictate trends in cobalt production, with the majority of global refined cobalt being converted into chemical forms that are used in rechargeable batteries as opposed to metallic cobalt that is primarily used in other industries.

The outlook remains optimistic on new cobalt projects expected to go online in the next decade. Many are still in the pre-feasibility stage, especially in Australia, and may not make it to the end due to lack of funding or environmental opposition.

.gif) Loading

Loading