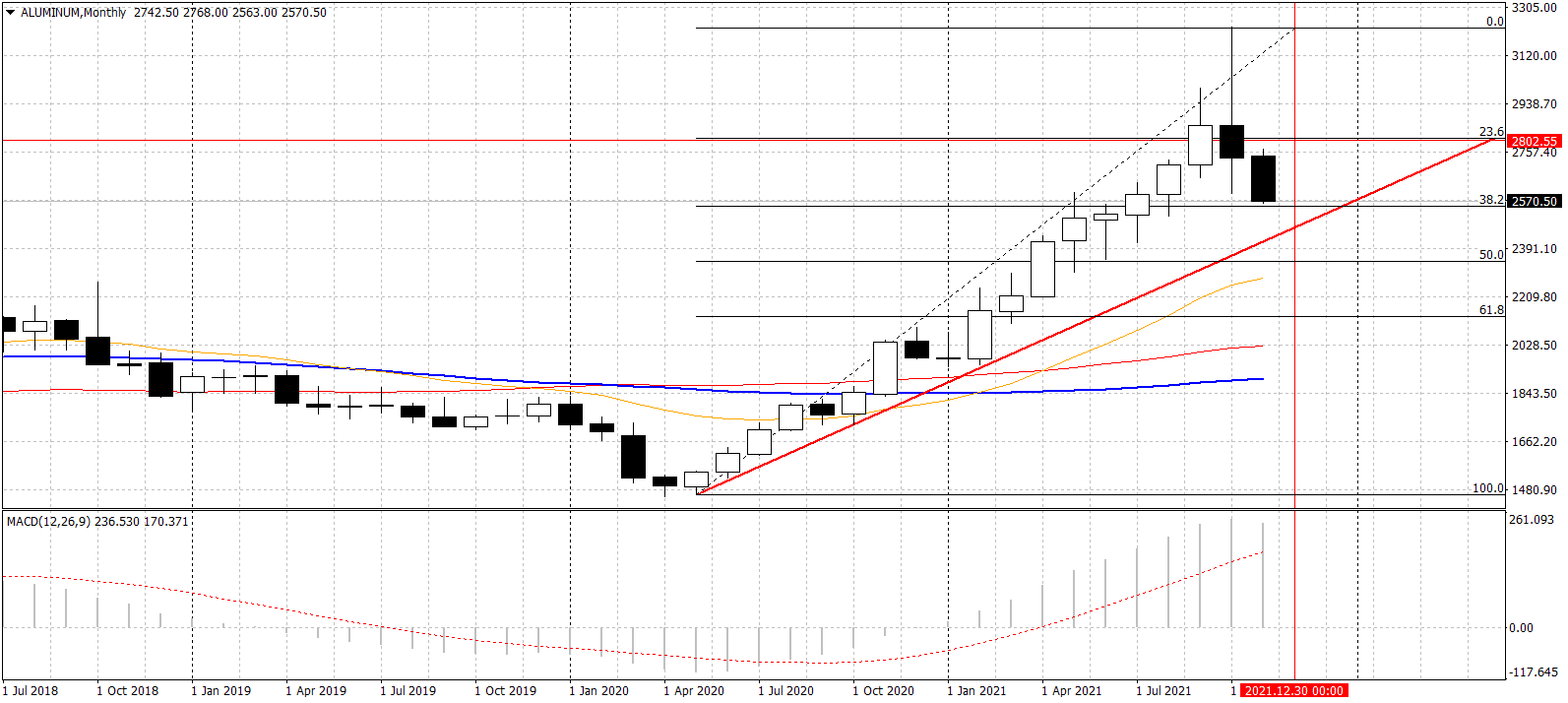

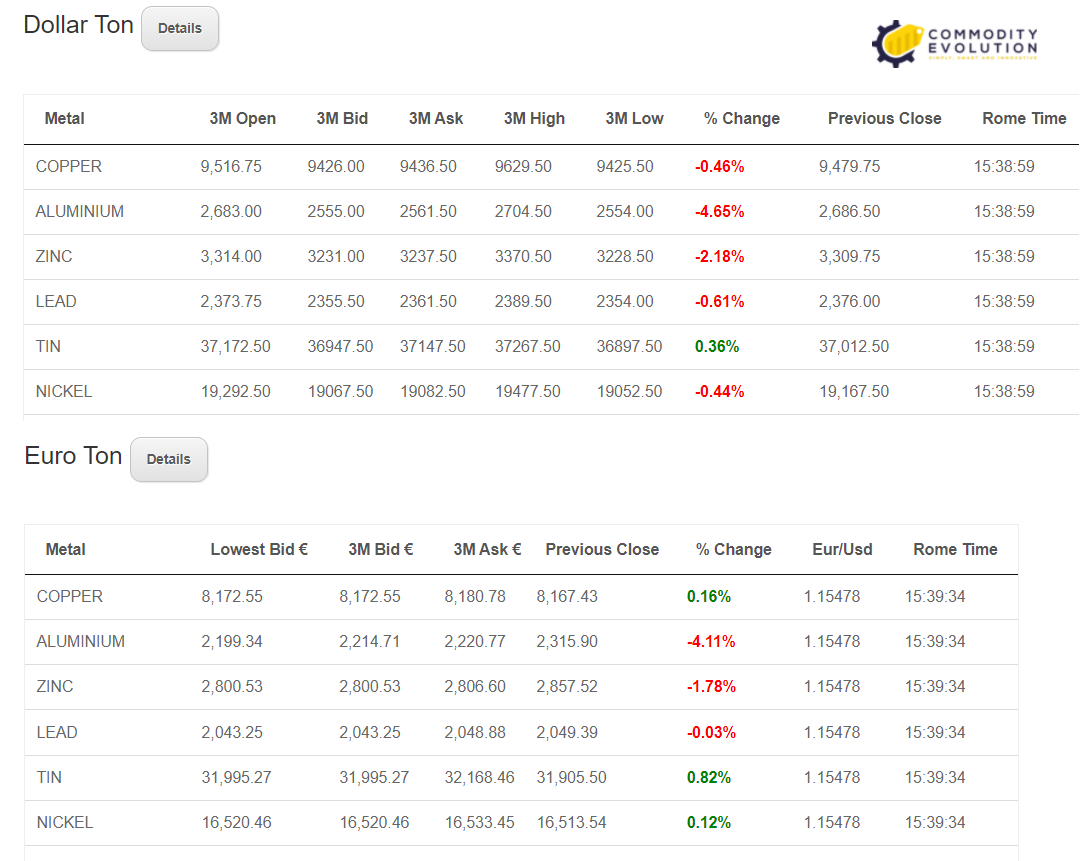

The aluminium price has been weakened by falling coal prices in China, following efforts by regulators to curb excessive speculation and profiteering from what remains a tight domestic thermal coal market.

If coal prices continue to fall, aluminium prices should, at least for the time being, follow suit.

SHFE aluminium inventory continued to rise in late October. It usually does this going into the winter months and then falls in the spring when demand picks up. But this year’s peak was at a multi-year low as the market went into deficit. This position is unlikely to reverse any time soon, even with the current slowdown in demand.

Downstream companies have suffered from the same energy rationing as foundries. As the energy market has stabilised and supply has become better organised, production has increased slightly. In addition, demand for primary metal and extrusion billets has increased, albeit modestly so far. Lower ingot prices are helping downstream operators, although they are pushing some smelters into losses.

For the moment, imports are still playing a role in undermining spot prices in China. However, this could change if the LME-SHFE arbitrage window closes due to rapid changes in Chinese domestic market prices.

For the time being, most aluminium consumers are rightly holding back from making purchases, waiting to see how the current dynamic develops. Much will depend on coal prices and the ongoing policy on energy rationing, both of which are likely to become clearer later this month.

In summary, these three factors have and will have an impact on the current and future dynamics of aluminium prices:

- The higher energy content of primary aluminium drove a price collapse that took many by surprise and still has the potential to go further.

- Aluminium prices have been undermined by falling coal prices in China, following efforts by regulators to curb excessive speculation and profiteering from what remains a tight domestic thermal coal market.

- For the time being, most aluminium consumers are rightly holding back from making purchases, waiting to see how the current dynamic develops.

.gif) Loading

Loading