Tin prices jumped to a record high on Friday as inventories in warehouses fell and supply problems persisted.

Tin prices jumped to a record high on Friday as inventories in warehouses fell and supply problems persisted.

Benchmark tin on the London Metal Exchange rose to a record $36,770 a tonne, and by early afternoon was trading 2.4 percent higher at $36,310.

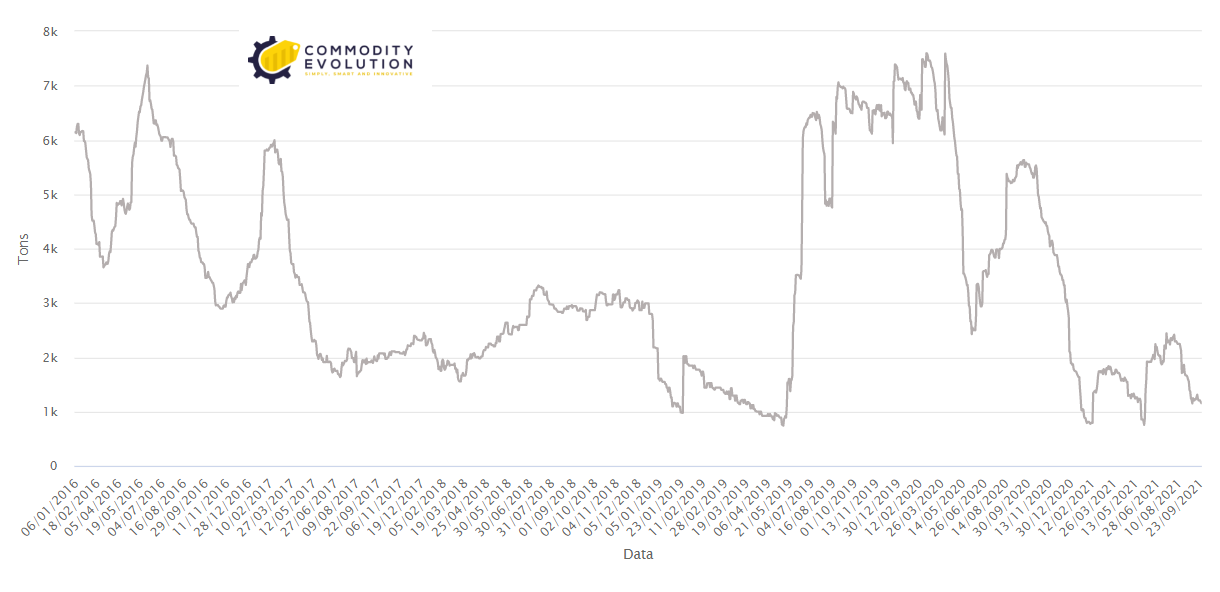

Metal prices were fuelled by supply disruptions in major producing countries and booming demand for electronics, where the metal is used for soldering to connect components. A combination of supply problems and a recovery in demand means that stocks are very low.

The global tin market deficit is expected to rise to 12,700 tonnes in 2022 from 10,200 tonnes this year. Malaysia’s top producer Malaysia Smelting Corporation has been hit by a combination of equipment problems and covid-19 controls that culminated in the smelter’s declaration of force majeure in June.

It is a good time, especially for producers, and the production problem at MSC, the world’s third largest producer of refined tin, has been a major factor this year.

Prices may still rise based on supply and demand, although a rate hike by the US Federal Reserve is likely to suppress the rally.

.gif) Loading

Loading