The US dollar seems to be recovering against the euro, the renminbi and the other major currencies (Jby,Gbp, Cad, Sek and Chf – summarized in the dollar index).

The US dollar seems to be recovering against the euro, the renminbi and the other major currencies (Jby,Gbp, Cad, Sek and Chf – summarized in the dollar index).

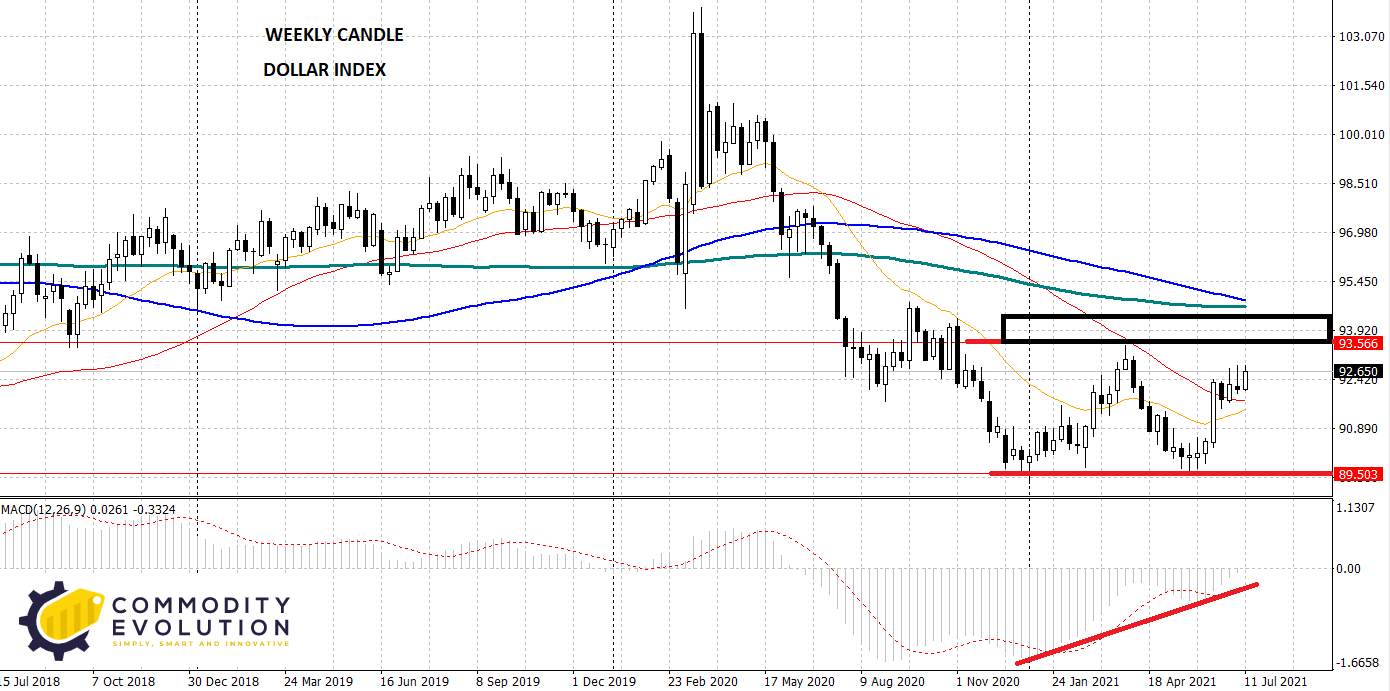

By graphically analyzing, on a weekly basis, quotations started to rise again from the fundamental support in the 89.50 area, returning towards the upper wall of the current sideways box in the 93.55 area. The evident positive divergence of the MACD indicator suggests a slowdown of the negative trend started in March 2020. However, an overcoming of 93.55 will be necessary to decree the restart in the medium term.

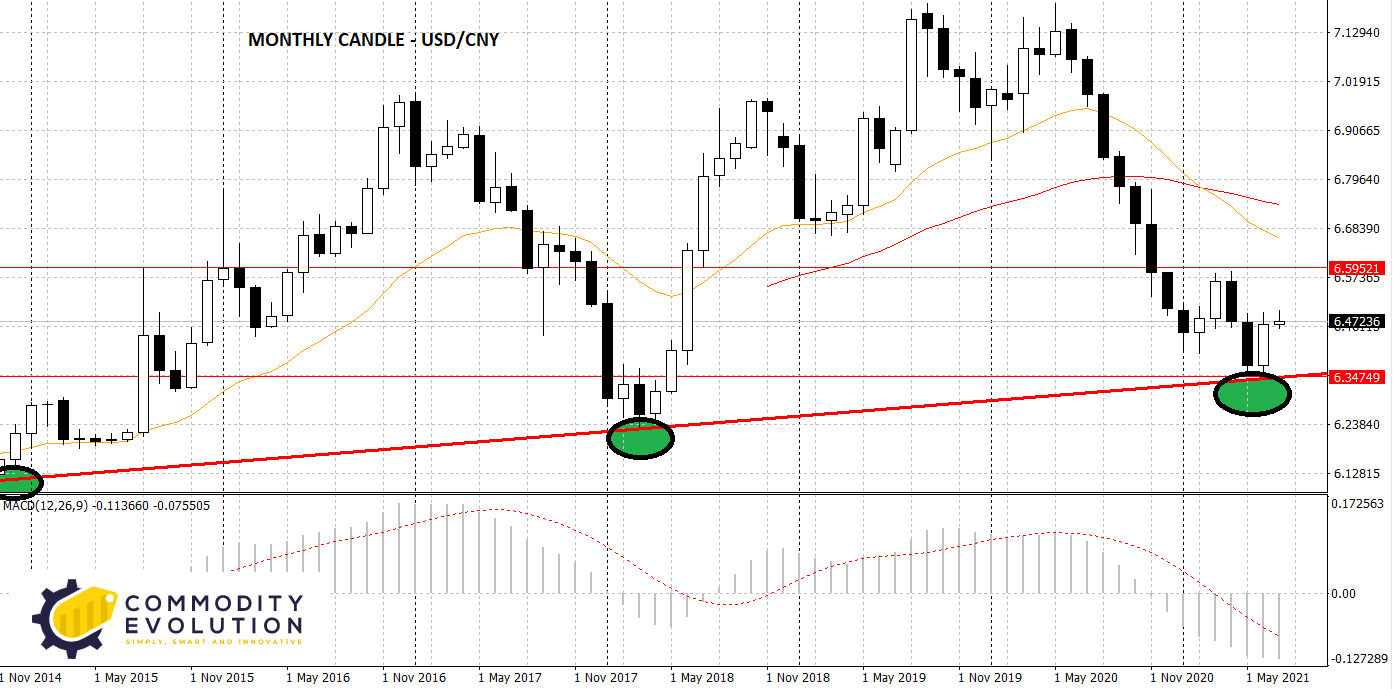

Similar situation also for the US dollar against the Chinese currency (Usd/Cny).

On a monthly basis, it is possible to observe how prices have always rebounded from the dynamic support offered by the bullish trend started from the September 2014 lows. Just in the month of June we can observe the last price rebound from these levels (penultimate white candle). At the weekly level, a positive divergence is also observed on the MACD, suggesting a slowdown of the descent triggered by the May 2020 highs (as for the dollar index).

Conversely, the dollar’s strength against the euro ran into the bullish trend initiated from the November 2020 lows, with a third attempt for the euro to regain ground.

What does all this information tell us referring to industrial metals?

That most likely the dollar, if it were to exceed certain levels, could return to strength, with a negative impact on industrial metals (instruments quoted in $). However, the strength of the $ could find a strong resistance on the demand side, which is currently particularly high, especially in the commodities sector.

Surely it will be important to observe the movement of the U.S. dollar expressed by the Dollar Index and U.S. Dollar/Renminbi instruments and monitor any bullish signals sent by prices, keeping under control the effect it may have on the industrial metals sector (in case of dollar strength, commodity prices should fall unless the demand for this sector is very strong).

Our industrial market price estimates are for subscribers only. free trial our services

.gif) Loading

Loading