Since the end of March 2020, tin prices, as well as most commodities, have developed a sharp rise, performing an unbelievable +142% (from lows to highs).

What to expect then for June?

- Analyzing Uninterrupted Positive close: on a monthly basis, it is possible to observe how the pond recorded its seventh Uninterrupted positive close on April 30, 2021 (7th consecutive month, equaling its absolute maximum);

- Arbitrage of tin imports still negative by 5320$/ton: despite the fact that import arbitrage is still negative (it facilitates Chinese exports as the Shanghai price is lower than the Lme price) a partial recovery (+32%) has occurred since mid-May;

- On a seasonal basis, the month of June identifies a first week of potential price reaction to then leave room for decisive price retreats in the following sessions, with potential minimums at the end of the month;

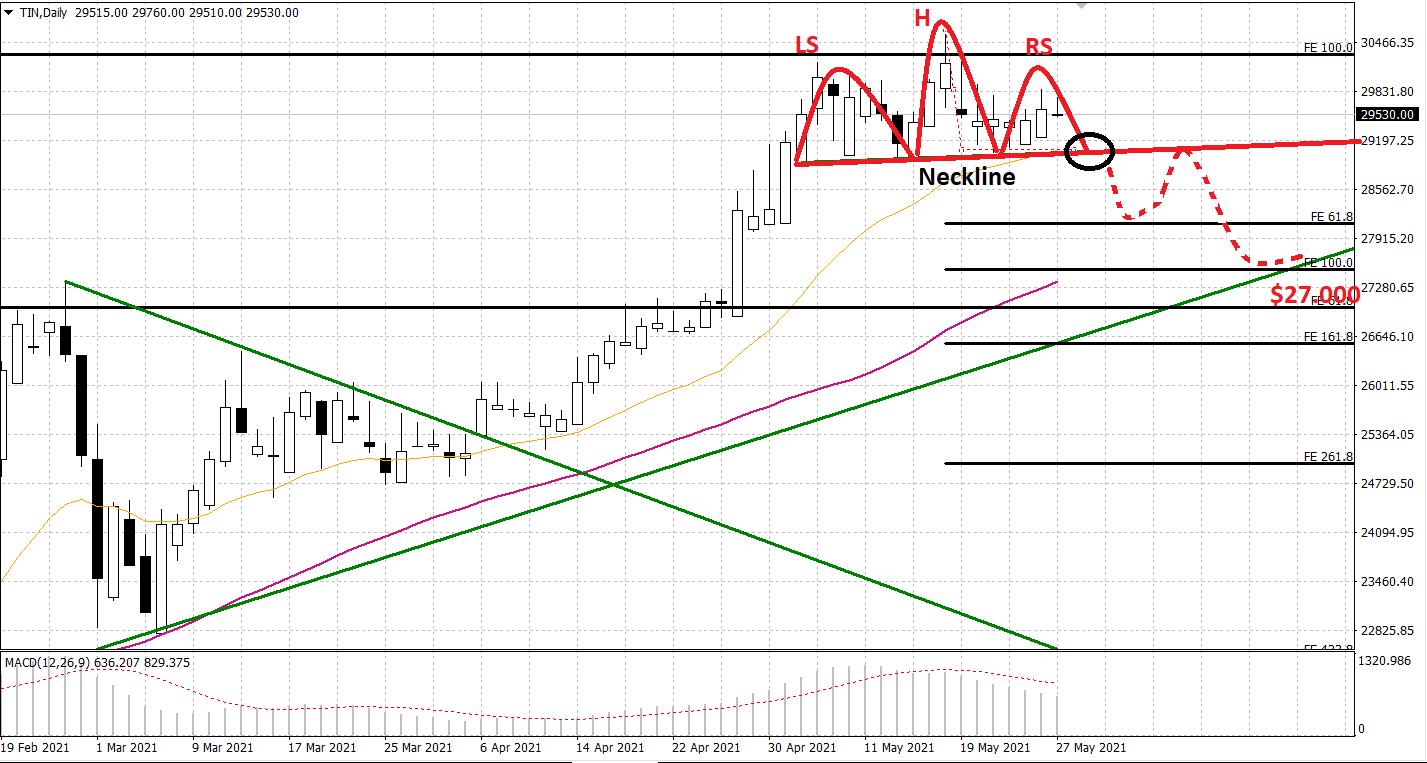

- Analyzing the chart sector in May, prices seem to be forming a head and shoulders with a reversal implication. In this case, the first confirmations will be sought after the break down of the neckline at 29,250 $/ton. Below this level the first downward targets are identified in the area of 27,500 $/ton, transit area of several support zones.

Our industrial market price estimates are for subscribers only. free trial

.gif) Loading

Loading