Customs data from China indicate that the country was a net exporter of refined tin again in March. Net exports were about four times higher than in February.

Customs data from China indicate that the country was a net exporter of refined tin again in March. Net exports were about four times higher than in February.

The data reveals that refined tin imports fell to 102 tons in March, down about 78%. This is the lowest level of imports since August 2019 (97 tons). Exports, on the other hand, increased about 28% to 939 tons, the highest level since April 2019. Total net exports reached 837 tons, the highest level since April 2019.

The increase in refined tin exports during March is closely linked to export arbitrage. During the month, arbitrage averaged at around US$ -4,210/ton, strongly incentivizing companies to ship the metal to the international market.

This trend will only be reversed if the Chinese price can show a strong steady performance and outperform the LME price. However, the Chinese price is already considered high and is reportedly suppressing demand to some extent. In addition to this, Chinese authorities have announced that they will follow commodity prices more closely, and are ready to take measures to stabilize commodity prices.

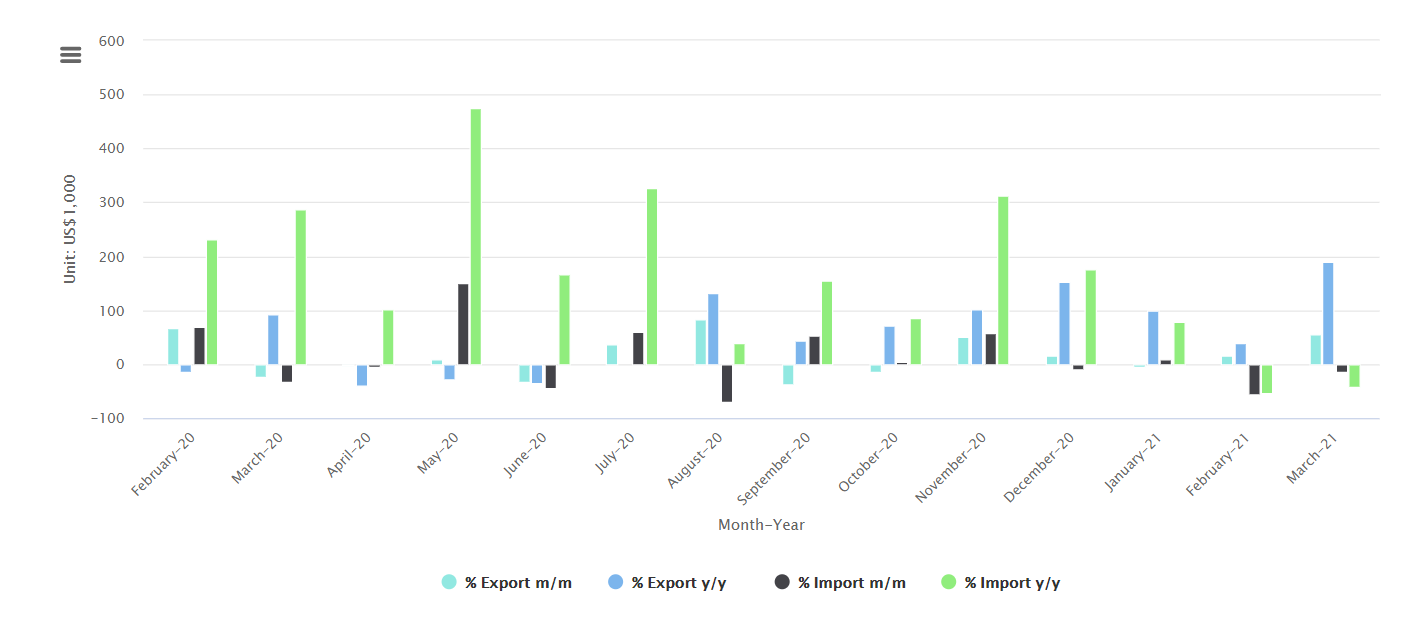

The decline in tin imports by China continued in March 2021, going from $18.81 million in February to $16.53 million in March 2021, with a monthly drop of 14.15% while on a yearly basis (March 2021/March 2020) the drop was 41%.

As for exports, the latter definitely exploded upward, reaching $28.343 mln, with growth of 56.43% (on a monthly basis) and 190% (on a yearly basis).

LME time spreads remain heavily stressed. Some parts of the world appear to have run out of essential metal for circuit soldering.

China is stepping up as a supplier of last resort, the country in fact has gone from being a net importer to a net exporter of refined tin, at least in the first quarter of 2021 (as noted in the first chart the green line representing the difference between exports and imports has shifted into the positive in favor of exports).

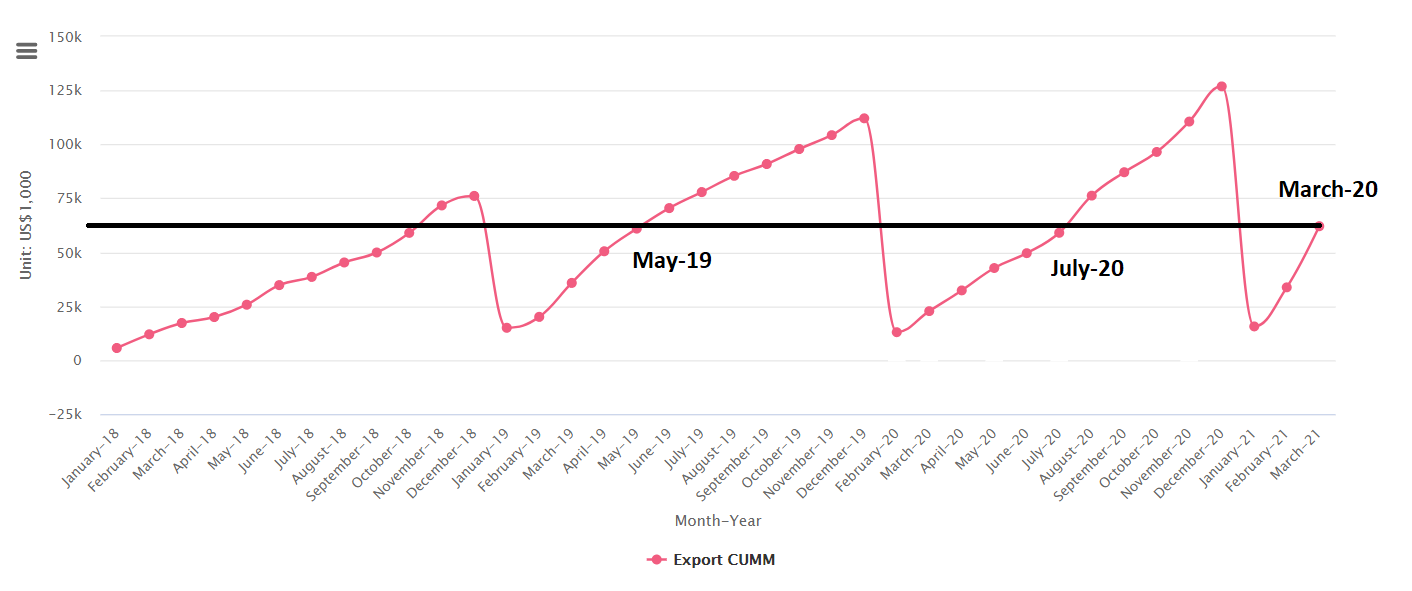

China is the world’s largest producer of tin, but was a consistent net importer for most of 2019 and all of 2020.

If we look at exports on a cumulative basis (January+February+March 2021), it is possible not to notice that China in the first three months of 2021 already exported more than half of the previous year’s exports (2020).

Another favorable event for Chinese exports has been the strong arbitrage between the Shanghai Futures Exchange (ShFE) tin contract and the LME.

As long as this arbitrage window remains open, further export rises can be expected.

.gif) Loading

Loading