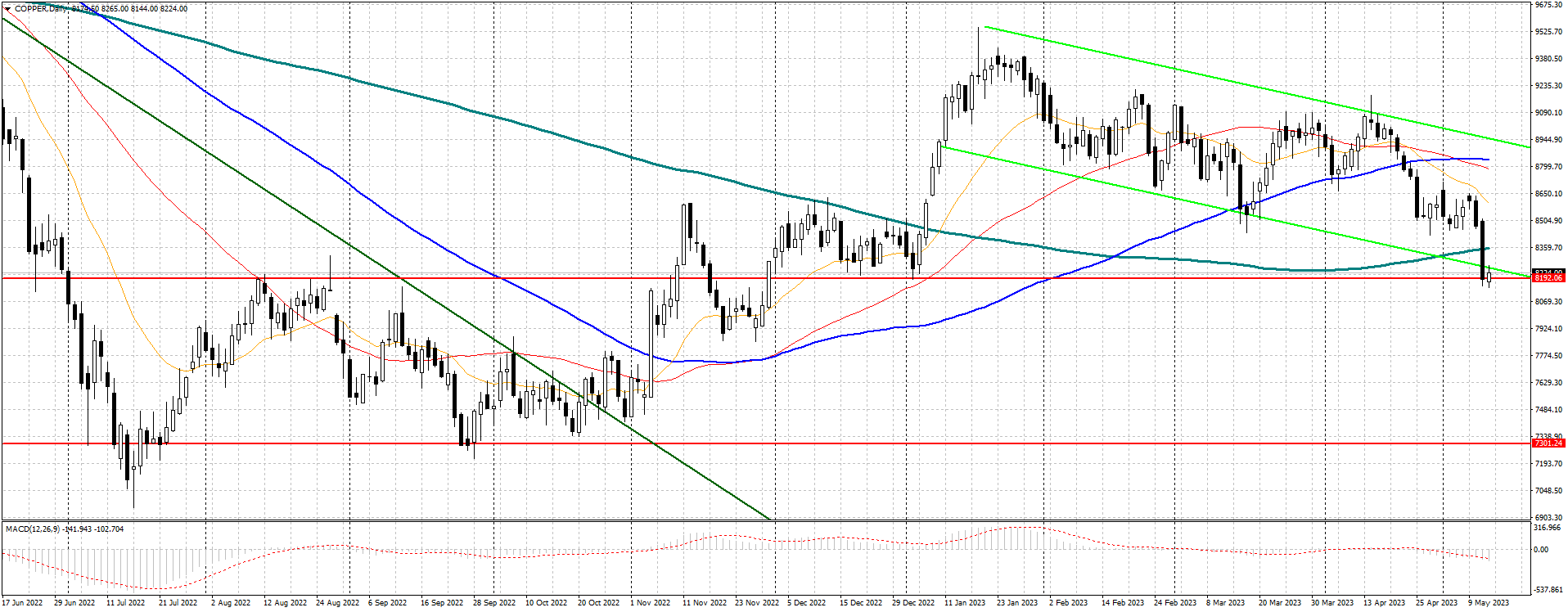

LME copper fell sharply on Thursday, 11 May, dropping -3.70 percent, with prices set to suffer their biggest weekly decline since November, as gloomy global economic trends overshadowed the outlook for metal demand as supplies increased.

LME copper fell sharply on Thursday, 11 May, dropping -3.70 percent, with prices set to suffer their biggest weekly decline since November, as gloomy global economic trends overshadowed the outlook for metal demand as supplies increased.

Three-month copper on the London Metal Exchange is now in mild reaction mode (+0.46%) at $8,226/mt (10:50 a.m. Italian time), after hitting a five-month low in the previous session.

The contract lost 4.3 percent this week, the biggest weekly drop since last November. The most-traded June copper contract on the Shanghai Futures Exchange fell 2.5 percent to a four-month low of 64,700 yuan ($9,360.40) a tonne.

Industrial metal consumption in China remained subdued in the second quarter, traditionally a peak demand season, due to the slow economic recovery and weak export market.

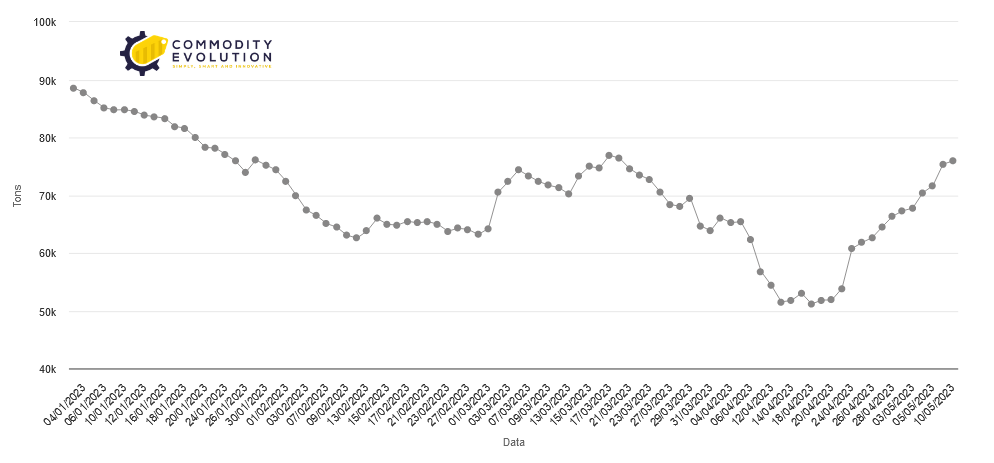

A string of negative data this week suggested a slow economic recovery in the world’s second-largest economy, exacerbating concerns about the outlook for metal demand amid rising metal inventories.

Production at the 22 smelters, with a total capacity of 11.12 million tonnes, was 886,700 tonnes last month, up 18.5 per cent from a year ago.

Copper stocks in LME warehouses rose to a near two-month high on Thursday. The risk-on tone of markets, triggered by weak economic data, weighed on sentiment at the complex, exacerbated by the strengthening US dollar, which dented investor appetite.

The US dollar held close to more than a week’s highs as data pointed to a slowdown in the US economy and investors bet that the Federal Reserve would further suspend interest rate hikes.

.gif) Loading

Loading