Aluminum prices fell today to 17-month lows and most other metals lost ground as faltering global economic growth weakened the demand outlook and strengthened the dollar.

Aluminum prices fell today to 17-month lows and most other metals lost ground as faltering global economic growth weakened the demand outlook and strengthened the dollar.

The dollar has strengthened in 2022 more than in any year since 1981 and reached a 20-year high on Wednesday, making dollar-priced metals more expensive for buyers with other currencies.

Global stock markets fell as weaker-than-expected trade data in China, the largest metals consumer, added to the negative picture for the global economy.

Benchmark 3-month aluminum on the London Metal Exchange (LME) is down 0.66 percent at $2,244 a ton at 4 p.m. GMT+2 after hitting its lowest since April 2021 at $2,234.50 a ton.

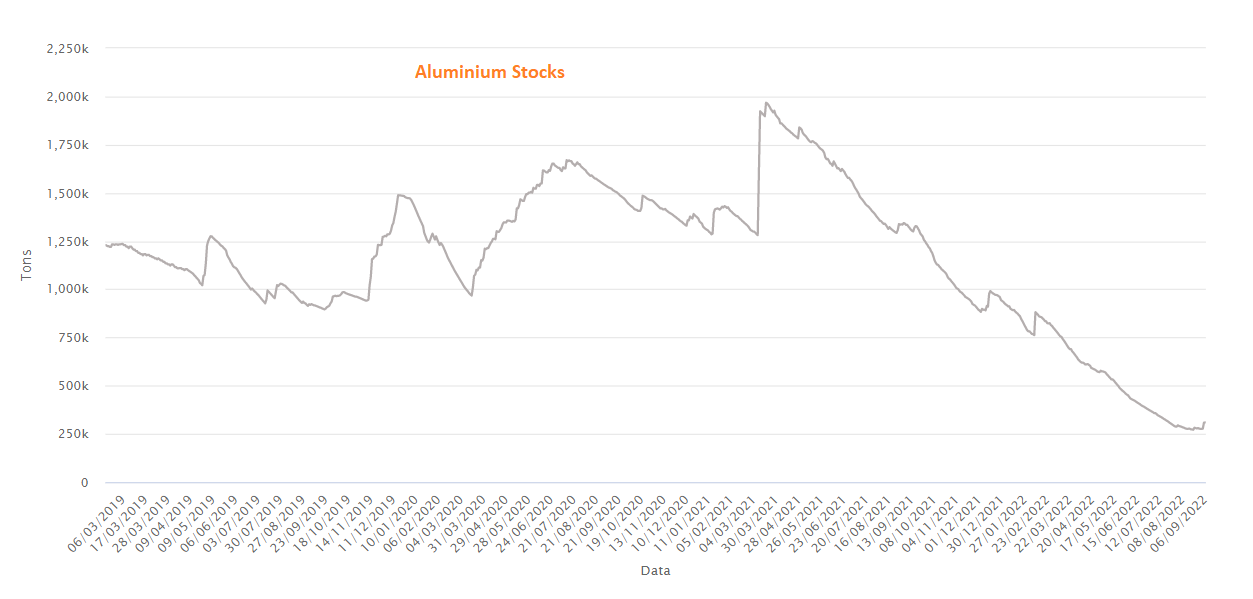

The price of metal used in transportation, packaging and construction has lost 20 percent this year. Supply of aluminum and other metals is tight and inventories are low, but the market is more focused on weakening demand and a rising dollar.

Large inflows of aluminum into warehouses recorded by the LME have alleviated supply concerns, shifting cash aluminum with prompt delivery from a premium to a discount to the three-month contract.

LME inventories increased to 309,500 tons from 277,050 on Monday, but are still well below recent levels. The amount of aluminum held at Japanese ports and Shanghai Futures Exchange (ShFE) warehouses has also increased in recent weeks.

Due to weakening demand, global aluminum producers offered Japanese buyers lower premiums for primary metal shipments.

.gif) Loading

Loading