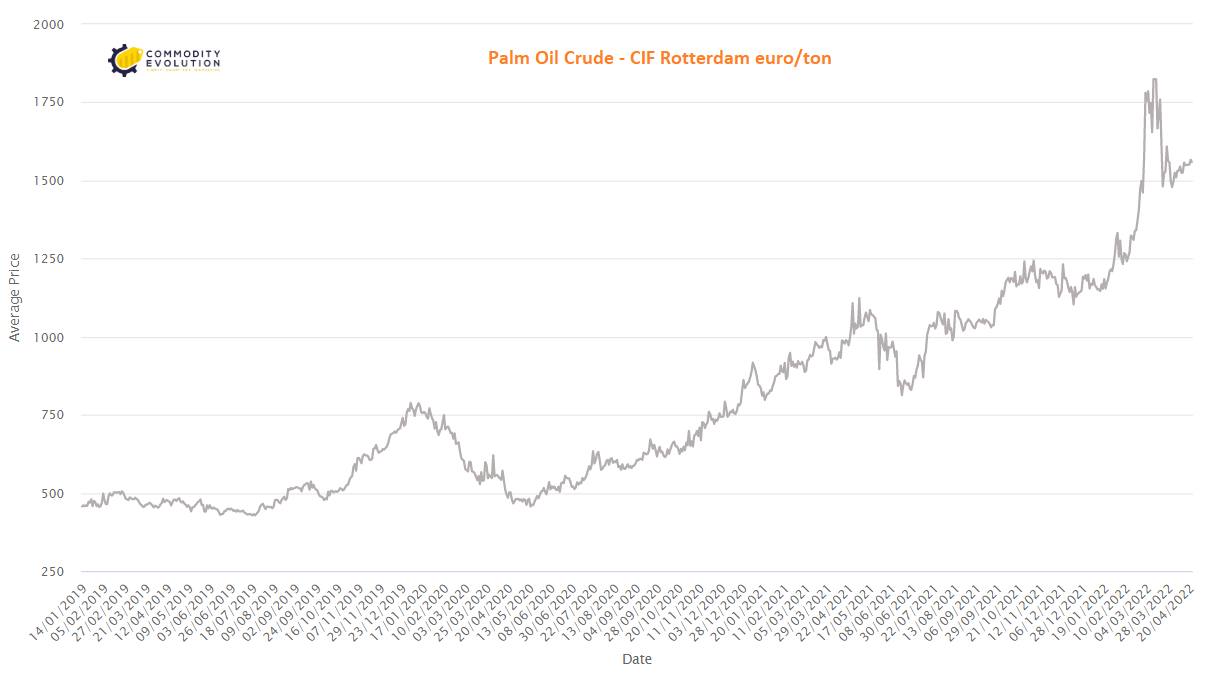

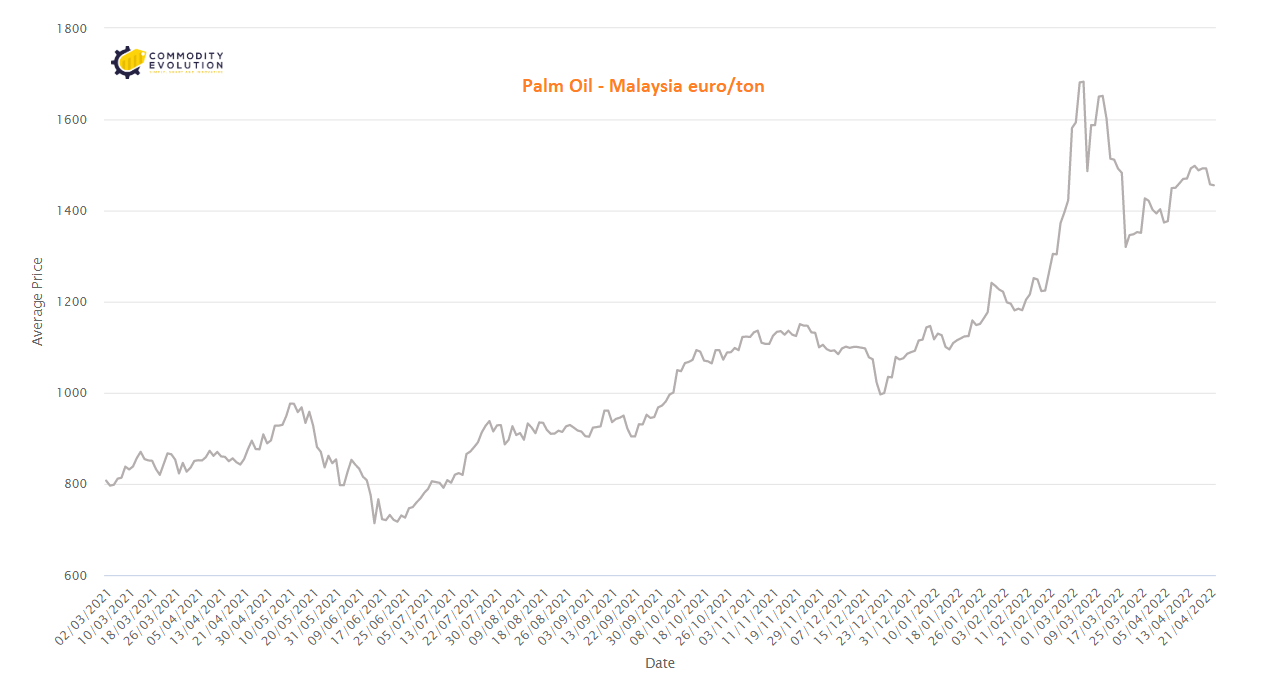

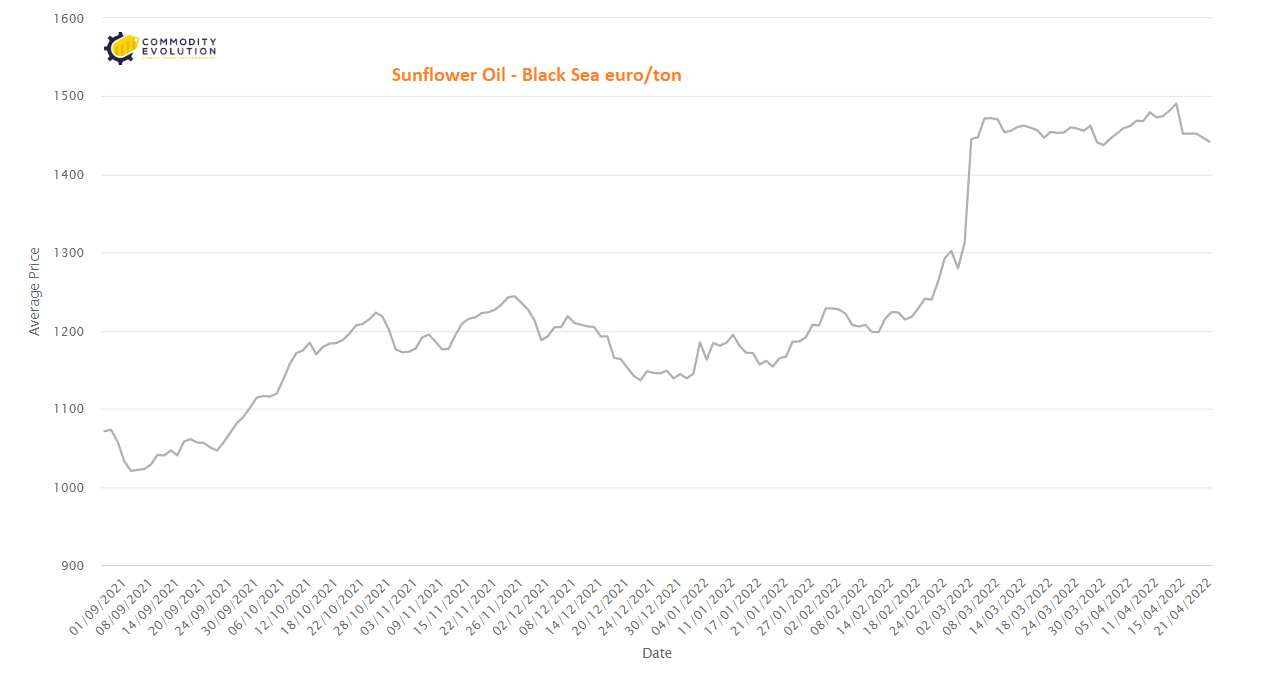

Higher demand for palm oil could lift Indonesian and Malaysian exports and bring down stocks, supporting prices, which have already risen 38% in 2022, as the war in Ukraine disrupted supplies of sunflower oil.

Higher demand for palm oil could lift Indonesian and Malaysian exports and bring down stocks, supporting prices, which have already risen 38% in 2022, as the war in Ukraine disrupted supplies of sunflower oil.

Palm oil has become profitable for refiners because it is available at a discount of $150 per tonne compared to soya. Refiners are giving preference to palm oil for May shipments.

Crude palm oil was offered in India at about $1,765 a tonne, including cost, insurance and freight (CIF), for May shipments, compared to $1,930 for crude soybean oil.

India’s palm oil imports in April are expected to rise to more than 600,000 tonnes from 539,793 tonnes in March, and in May the imported volume could exceed 650,000 tonnes.

Like India, Bangladesh and Pakistan are also buying more palm oil for May shipments. China could also increase purchases if the coronavirus outbreak is contained in the coming weeks.

Buyers have to choose between soybean oil and palm oil due to the limited supply of sunflower oil. Countries around the Black Sea account for 60% of global sunflower oil production and 76% of exports, while Indonesia and Malaysia account for the majority of global palm oil shipments. Argentina, Brazil and the United States are key suppliers of soya.

Palm oil supplies improved after Indonesia eliminated a local sales quota.

.gif) Loading

Loading