Global commodities and materials trader Thyssenkrupp Materials Trading has signed a memorandum of understanding to purchase rare earth carbonate from Ucore Rare Metals, a Canada-based developer of rare earth processing projects.

Global commodities and materials trader Thyssenkrupp Materials Trading has signed a memorandum of understanding to purchase rare earth carbonate from Ucore Rare Metals, a Canada-based developer of rare earth processing projects.

Thyssenkrupp Materials Trading, a subsidiary of Thyssenkrupp Materials Services, will thus strengthen its position in the global distribution of rare earths, and help develop an independent rare earth supply chain in North America.

China currently dominates both the mining and processing of rare earths globally. However, the Asian giant has indicated that it does not intend to expand its production facilities substantially in the future, for environmental reasons.

Ucore Rare Metals is developing the Alaska Strategic Metals Complex, a plant for processing rare earths and other critical minerals, with production expected to start in 2024. For this, Thyssenkrupp Materials Trading will supply at least 1,000 mt/year of rare earth carbonate through its global network of suppliers from that date.

Rare earths are seen as key to the energy transition because of their use in the form of magnets in electric vehicle motors and wind farm generators. They are also used in special alloys, chemical catalysts, laser crystals, polishing agents for the glass industry and phosphors.

Automakers around the world are now struggling to establish sources of rare earths or permanent magnets to ensure they are equipped for the increased production of electric vehicles as internal combustion engine vehicles are phased out in line with government targets.

German automotive and industrial supplier Schaeffler reported on 19 April that it had signed a five-year contract with Norwegian company REEtec to purchase rare earth oxides in a bid to increase the sustainability of its production of electric motors for hybrid modules, hybrid transmissions and all-electric axle drives. The partnership will begin in 2024.

REEtec CEO Sigve Sporstøl says the new partnership will allow the company to build an industrial rare earth separation plant in Norway. The new plant in Herøya, near Porsgrunn in Norway, will process rare earth carbonates produced by Vital Metals in Canada.

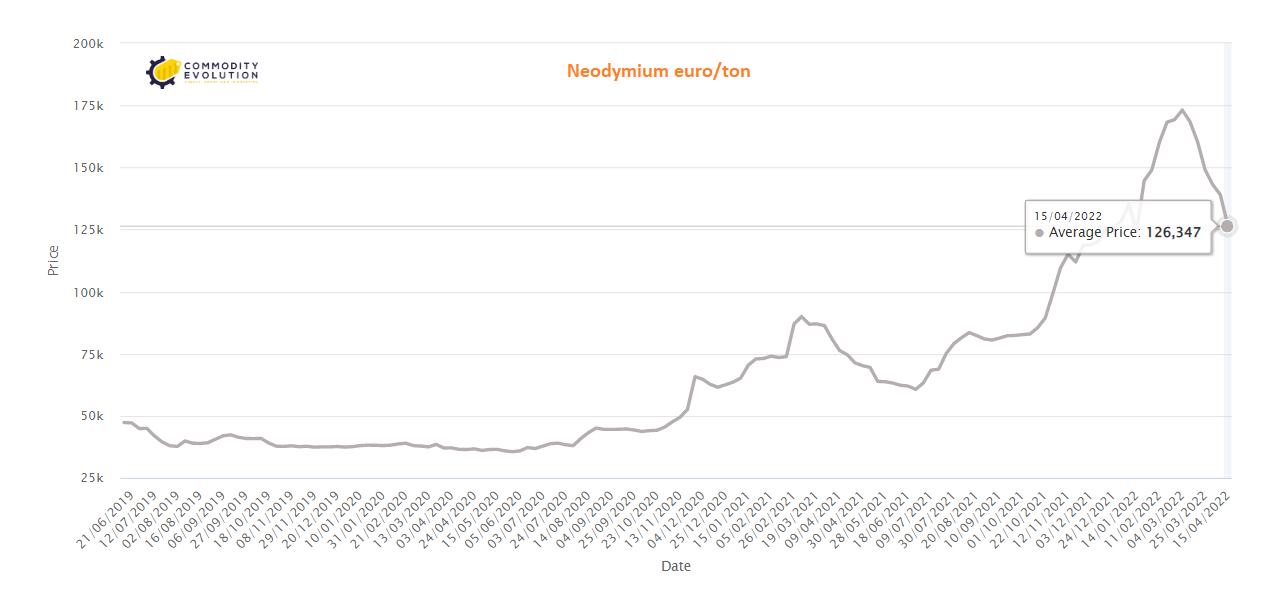

The market for magnetic rare earth oxides will increase threefold by 2035 due to the demands of the energy transition. According to Adamas Intelligence, with total demand for magnetic rare earth oxides forecast to increase at a CAGR of 8.3% and prices expected to rise at CAGRs of 3.2% to 3.7% over the same period, the value of global magnetic rare earth oxide consumption is expected to triple by 2035, from $15.1bn this year to $46.2bn by 2035.

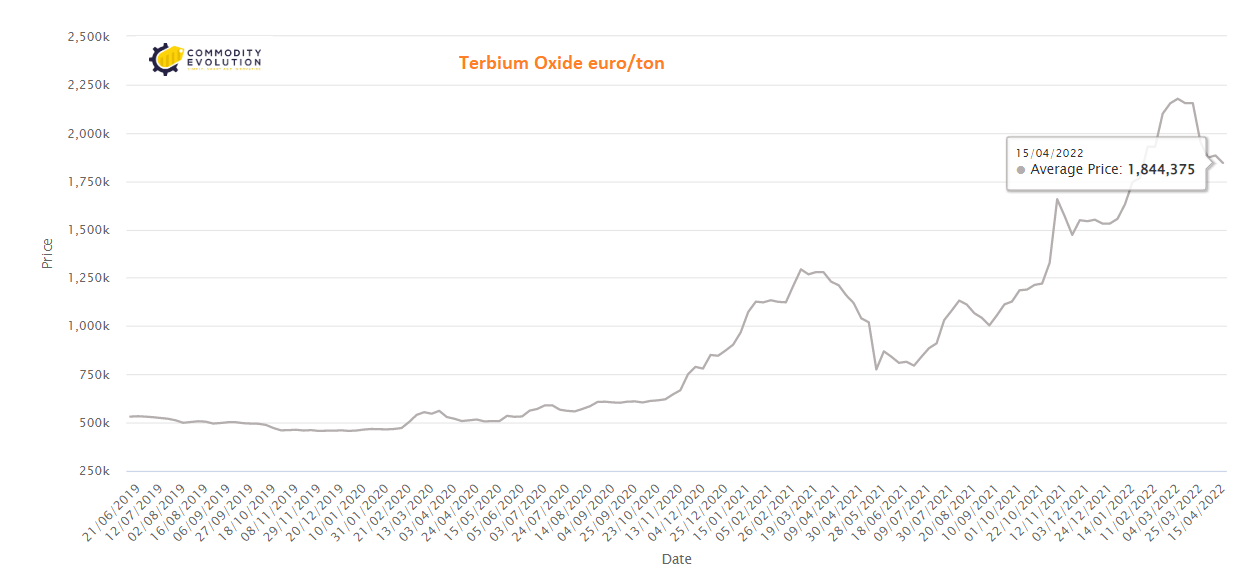

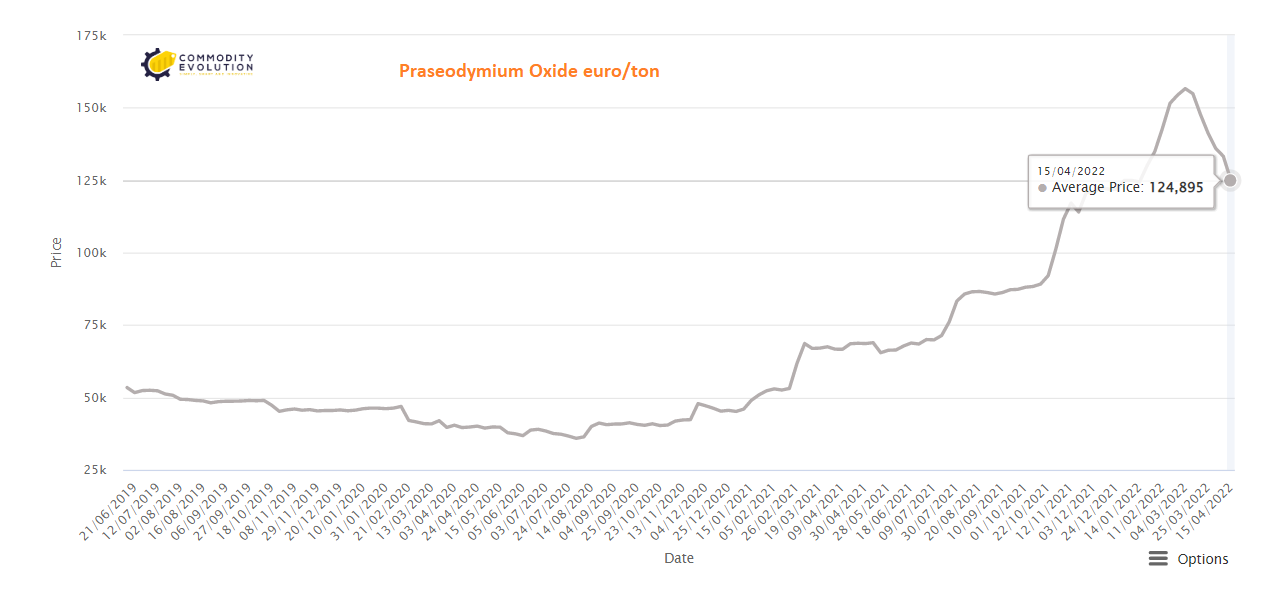

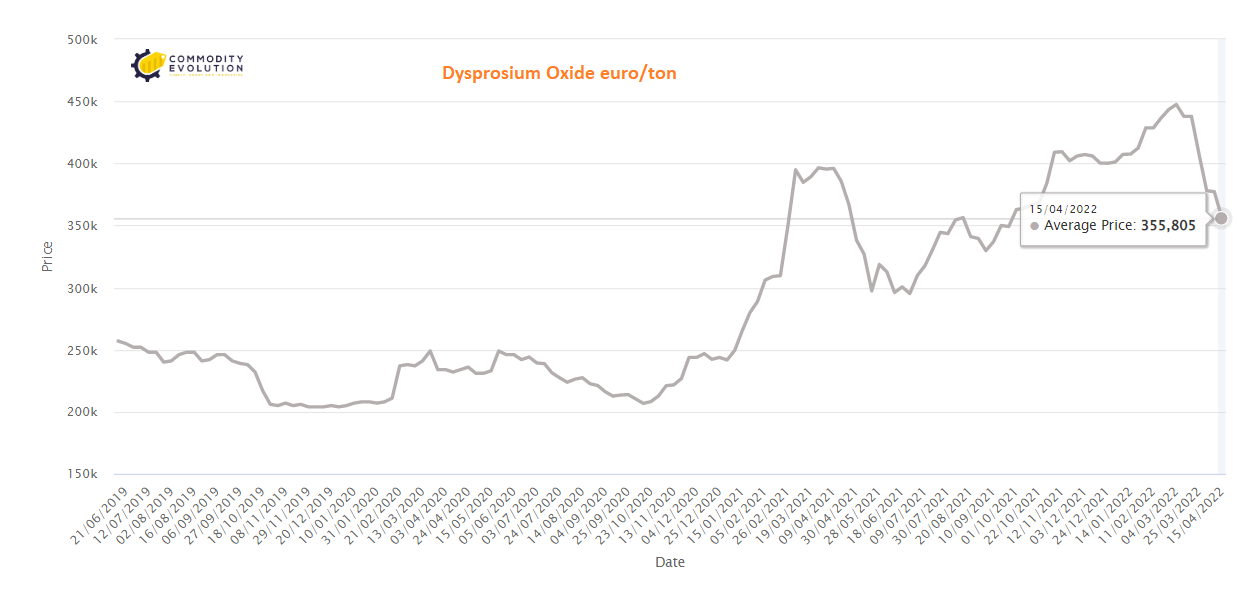

In addition, the research firm predicts annual shortages of NdFeB rare-earth alloys and powders of 206,000 tonnes by 2035, or nearly a third of the market, due to an expected shortage of neodymium, praseodymium, dysprosium and terbium oxide starting this year. In addition, an annual shortage of NdPr oxide of 68,000 tonnes is expected by 2035: an amount roughly equal to China’s total production last year.

.gif) Loading

Loading