German steel producers, traders and buyers have been almost consistently bullish on prices in April, with the unanimous expectation that production and inventory levels may decline.

German steel producers, traders and buyers have been almost consistently bullish on prices in April, with the unanimous expectation that production and inventory levels may decline.

The inventory sentiment index stood at 18.75, suggesting that market participants expected steel inventory volumes for April to be significantly low. This followed market participants’ expectations in March, when the index stood at around 37, showing an expected decline in inventories compared to February.

Traders and producers agreed that inventory levels would be significantly lower in April, especially for long steel, where most mills would sell from stock.

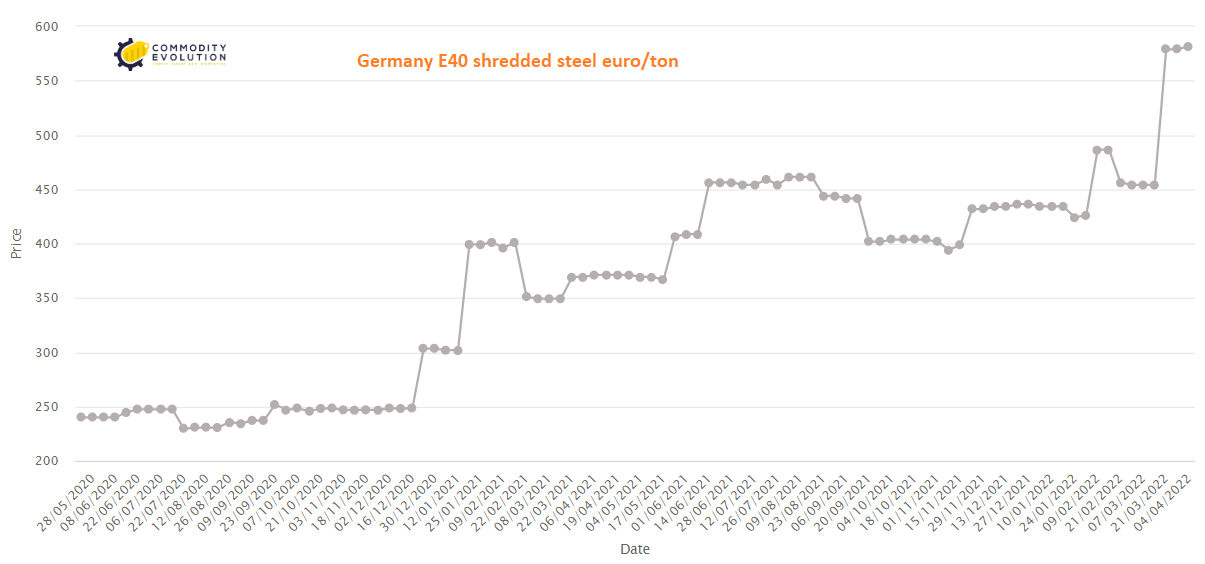

Some steelmakers may decide to stop production for a while amid rising costs and transport problems that could hamper their scrap supply.

Stopping production depends on the price of energy and the availability of scrap. Therefore, there are some indications that steel mills might stop production for a few weeks, but there are no official announcements yet.

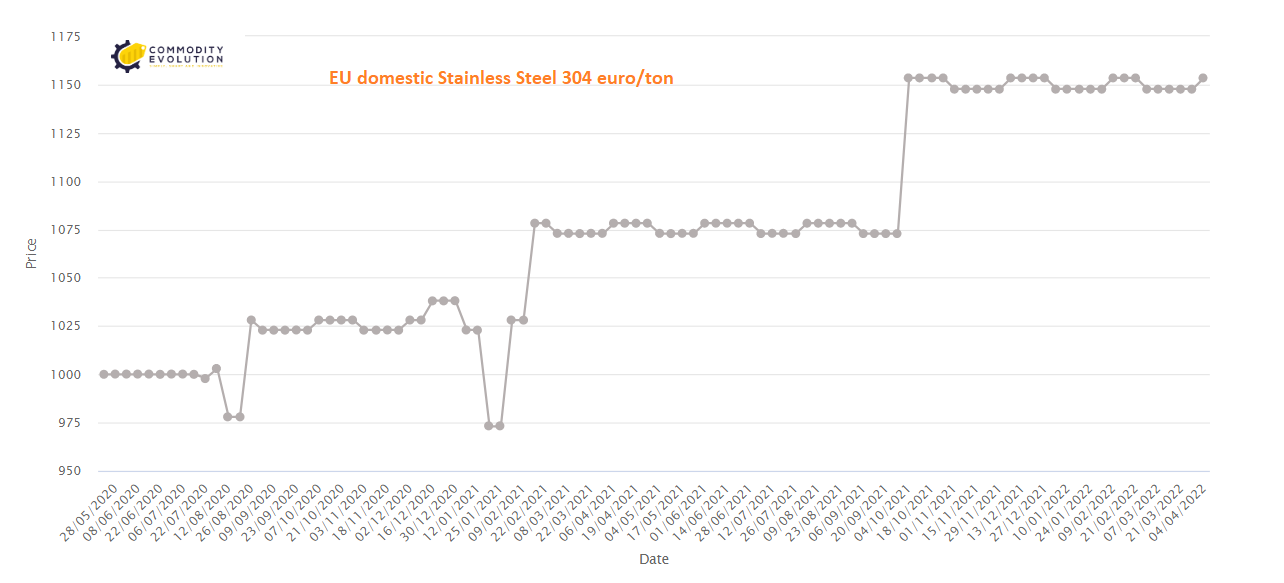

In flat steels, capacity is almost unanimously expected to be reduced in April due to soaring energy costs related to the war in Ukraine, with some Electric Arc Furnace mills limiting production to three days per week and energy surcharges imposed on some existing contracts.

The outlook for production declined from March, with the index falling 13 points to 29 for April, again suggesting that mills are in no hurry to produce. Steel mills continued to operate at a low level of capacity utilisation, following several production cuts in Europe in recent months.

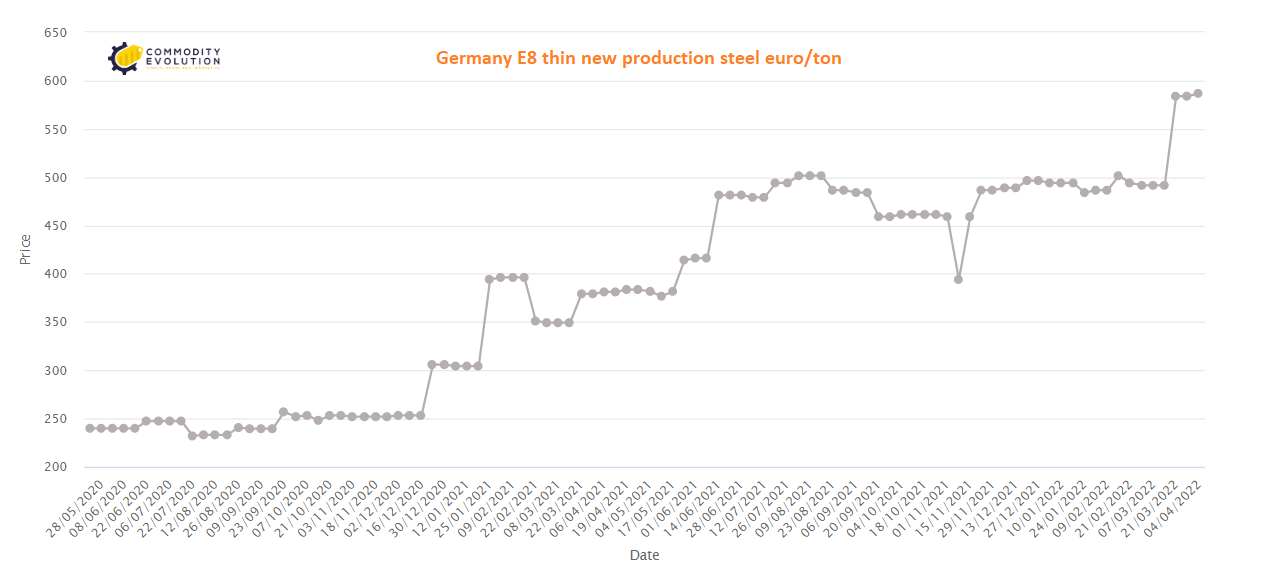

Traders and producers are equally optimistic about long product prices while the market expressed mixed sentiment for flat steel, with the April index at 75 points, down 2.5 points from March.

Meanwhile, domestic mills are adjusting to rising energy costs and scrap availability issues, amid transport strikes caused by high fuel bills.

Some market participants in the flat steel industry have reported that the panic buying is subsiding and that the market has already peaked. As a result, price levels will be stable or declining in April, while most have remained bullish on price trends.

The EU flat steel market saw a weakening of prices during the week ending 1 April, due to buyer resistance to further increases, insufficient credit lines and high levels of existing inventories for buyers across the market.

Trading activity has been limited due to high levels of buyer inventory, with most mills and buyers in wait-and-see mode, avoiding high-cost supplies.

.gif) Loading

Loading