Iron ore prices rose on Wednesday as markets expect robust supply demand in China when covid-19 restrictions are removed.

Iron ore prices rose on Wednesday as markets expect robust supply demand in China when covid-19 restrictions are removed.

Prices rose despite China’s Dalian Commodity Exchange increasing trading limits and margin requirements for some of its futures products, including iron ore, ahead of the April 5 Tomb Sweeping Day holiday.

The changes to trading limits and margins will take effect from today, March 31.

Dalian’s most-traded iron ore for September delivery ended day trade 3% higher at 895 yuan ($140.90) a tonne, after touching 898 yuan, the highest since August 9.

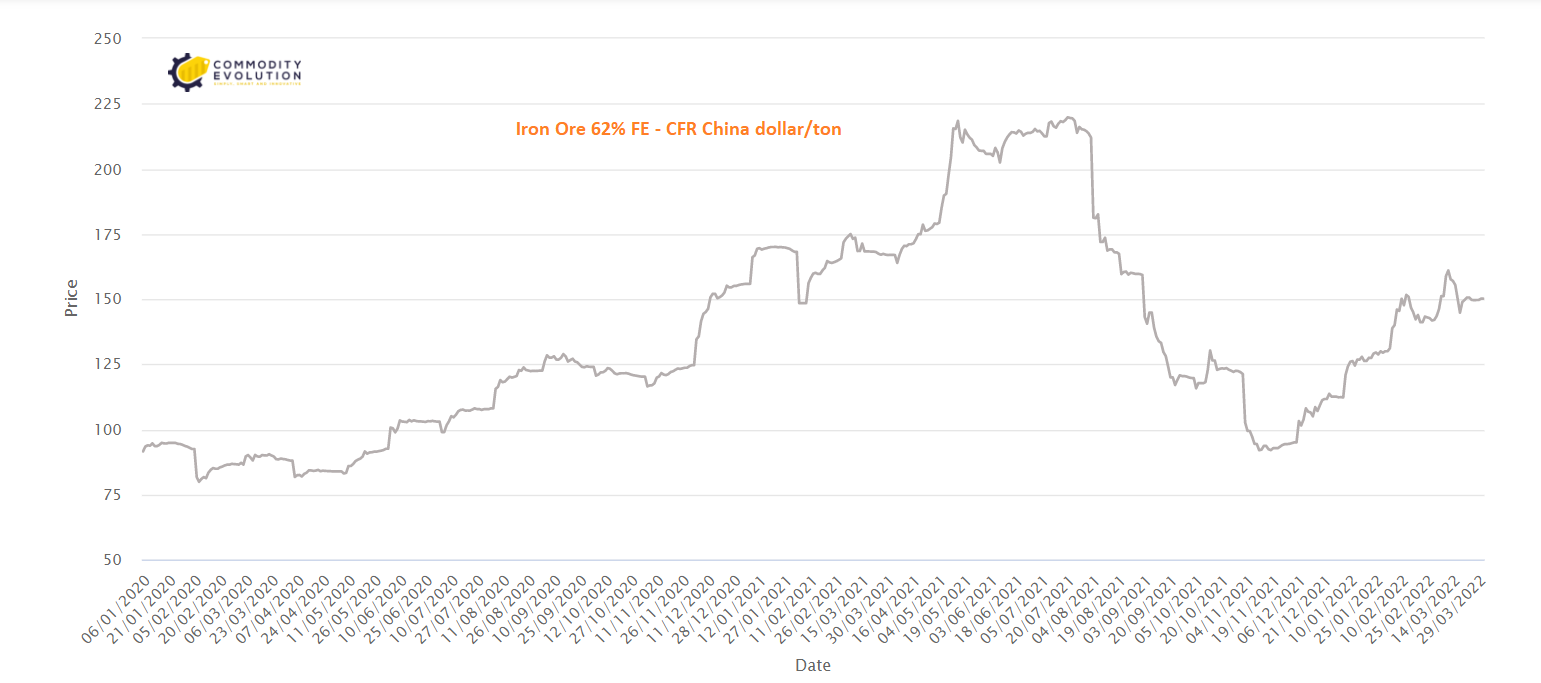

Iron ore 62% CFR China stood at $158.20 a tonne, up 3.4% from Tuesday’s close.

Optimism over the prospects of further policy support to bolster the world’s second-largest economy and biggest steel producer, and signs of a resilient Chinese industrial sector, provided strong support for iron ore.

Forecasts state that iron ore production across Asia Pacific will rise from 2.16 billion tonnes in 2022 to 2.27 billion tonnes in 2025 and then see a structural decline, falling to 2.17 billion tonnes by 2031.

In addition, the expected continued slowdown in the growth of the Chinese economy is expected to drive down iron ore and steel prices as investment in real estate will decline due to excessive leverage and financial risk; however, in the short term, the government appears to be increasing investment in infrastructure as a stimulus.

China and Australia will remain the dominant drivers of the regional supply and demand outlook. Australia’s wealth of high-quality deposits will continue to give Australian mining companies and projects a competitive pricing advantage, helped by strong policy support for green hydrogen for steel producers.

.gif) Loading

Loading