European steel prices are set to extend their gains as the Russian invasion of Ukraine has disrupted logistics, spurred sanctions and driven up energy prices.

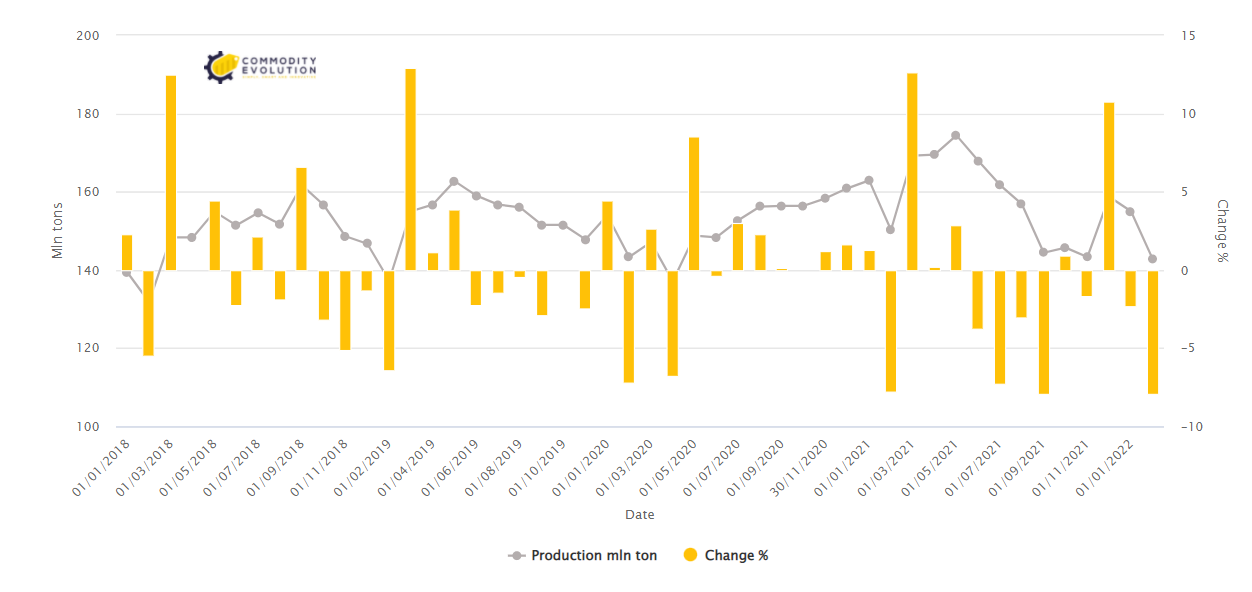

Russia is the world’s fifth-largest steel producer, while Ukraine ranks 14th. The two together account for a fifth of imports into the European Union.

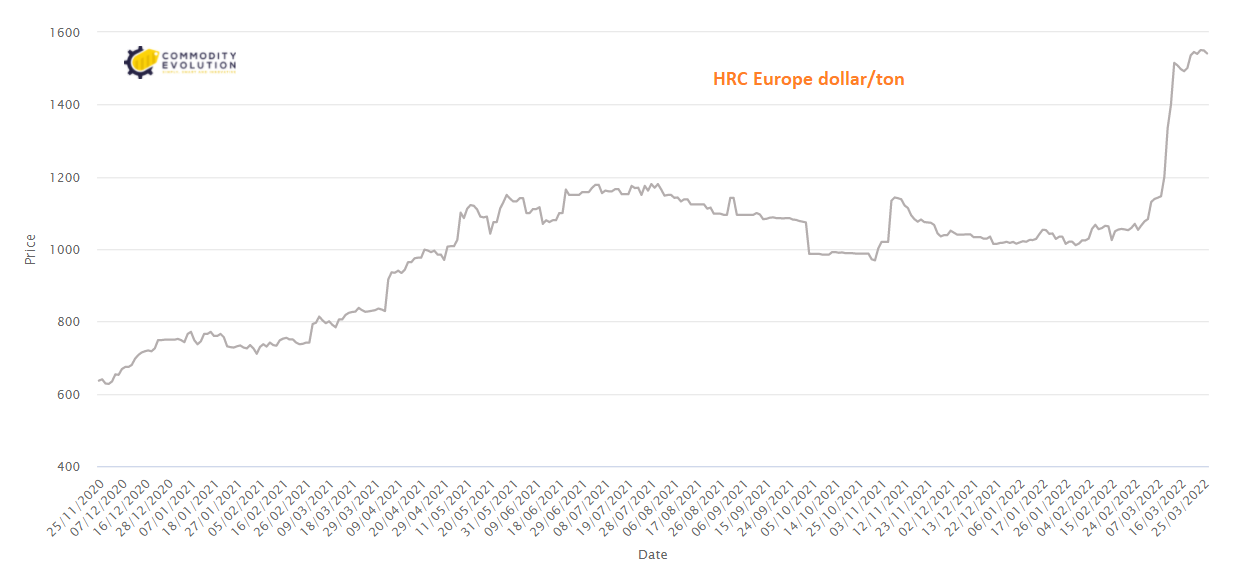

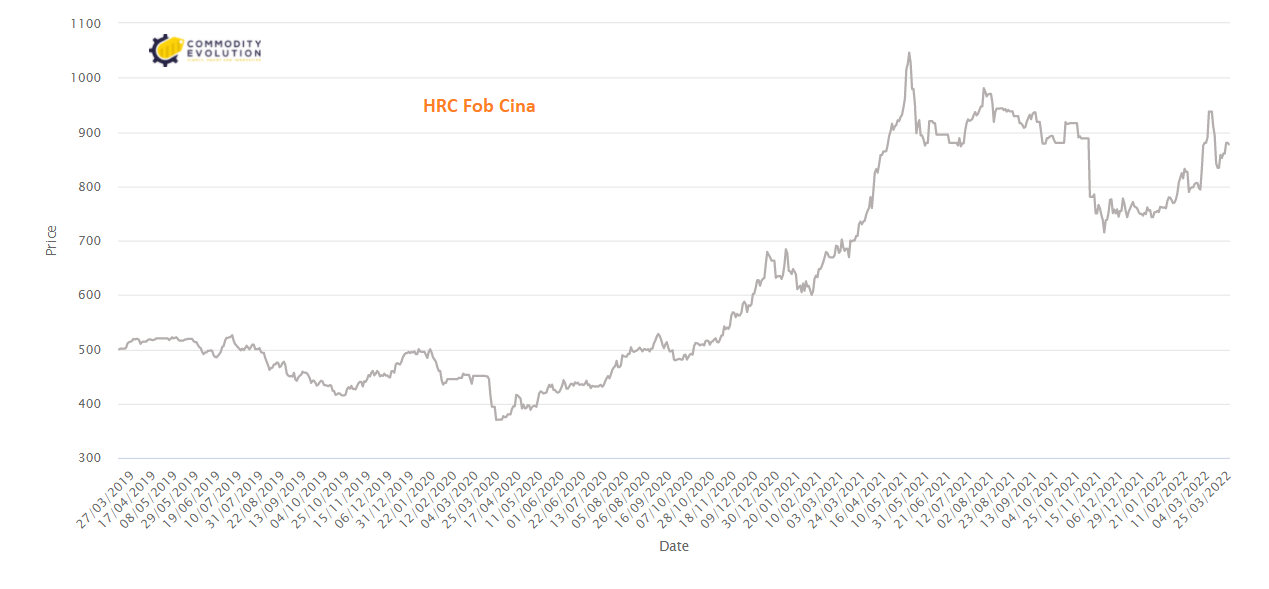

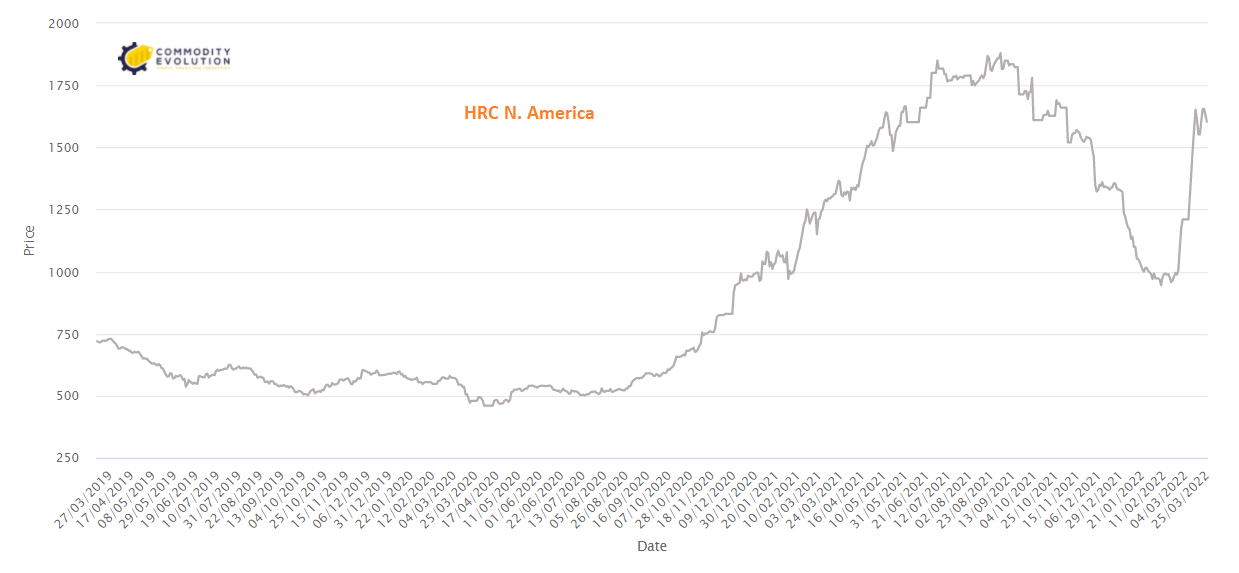

European prices of hot rolled coils (HRC) have increased by almost 40% in the last three weeks. Prices in North America and China have also gained, but much less, around 7-8%.

It certainly seems that prices will continue to rise in the short term. The supply side has been massively disrupted in Europe, and it will take some time to restore it.

Russia and Ukraine have a greater weight in the global steel market due to strong exports, especially to Europe. In Europe, pricing power is clearly still in the steel mills as the loss of around 20% of finished steel imports from Russia/Ukraine restricts the market.

Although Western nations have not specifically targeted Russian steel companies with sanctions, logistical problems and the knock-on impact of sanctions have disrupted business and shipments.

In addition to the fear of losing supplies from Russia and Ukraine, Europe is also facing soaring energy prices due to the conflict.

Its steel sector was already struggling with high energy costs when the Russian invasion of Ukraine at the end of February triggered another surge in oil and gas prices, driving up electricity prices.

Electric furnaces for steel production account for just over 40% of European production, higher than in other regions. After the outbreak of hostilities, steel producers in Spain such as ArcelorMittal MT.AS and stainless steel producer Acerinox ACX.MC cut production, while Germany’s Lech-Stahlwerke stopped production in Bavaria.

.gif) Loading

Loading