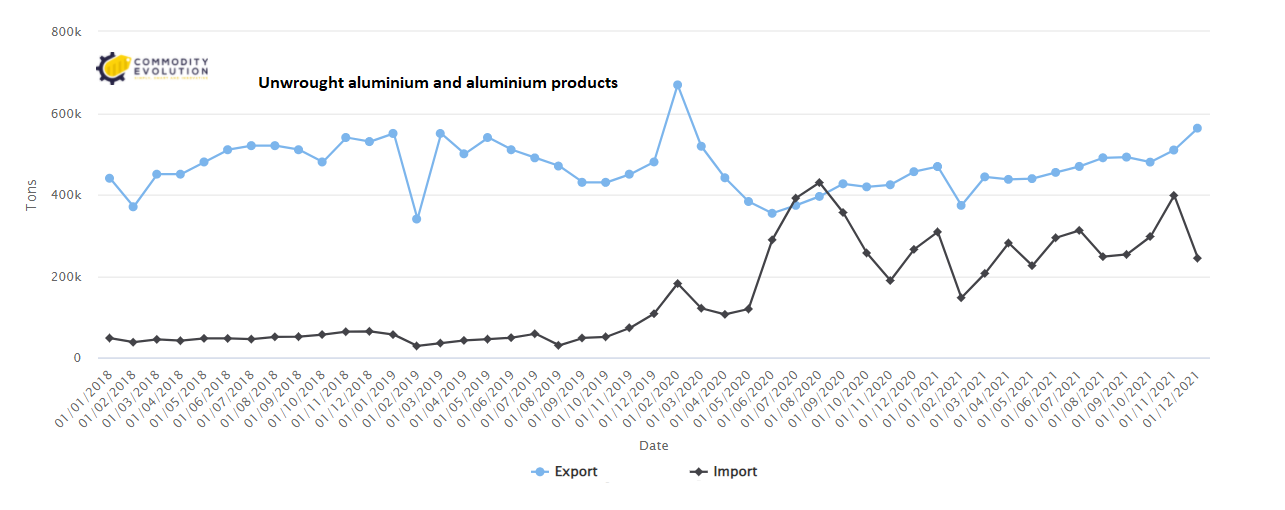

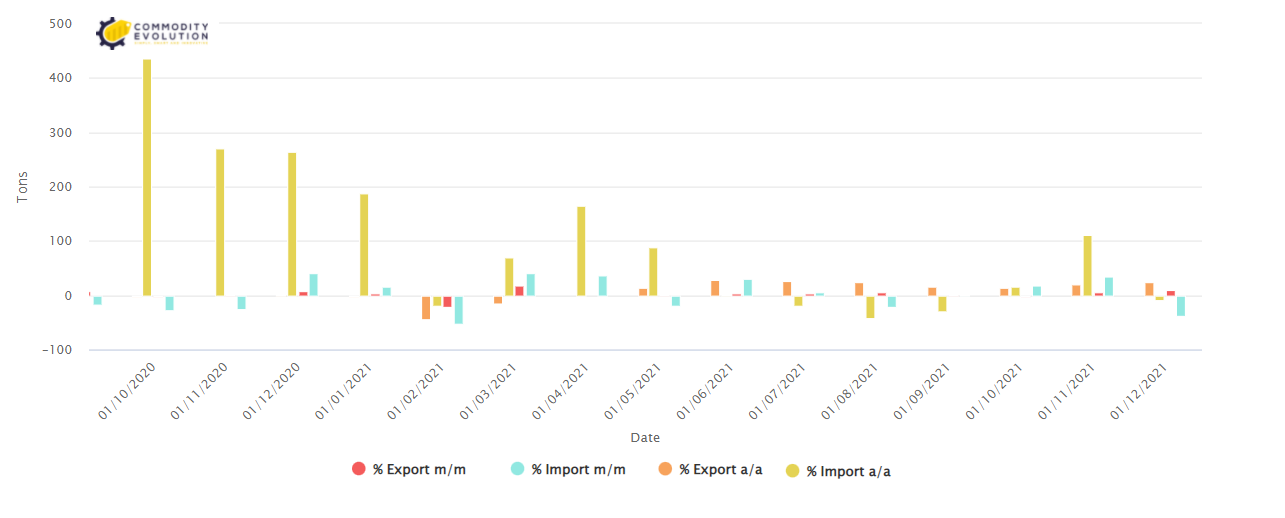

In the last survey month (December 2021), China’s imports of “Unwrought aluminium and aluminium products” plummeted by 38.75% compared to the previous month (November 2021) while compared to the same period last year, the figure showed a drop of 8.22%.

In the previous month, imports of “Unwrought aluminium and aluminium products” had been close to the highs of August 2020 (429,464 tons) at 397,915 tons. In December, on the other hand, there was a sharp drop to 243,729 tons, the lowest in the last 6 months.

On the export front, on the other hand, data showed a marked improvement. In December, imports stood at 562,975 tons, the highest figure in the last 21 months. The change on a monthly basis stood at +10.53% while on an annual basis the increase was 24.42%.

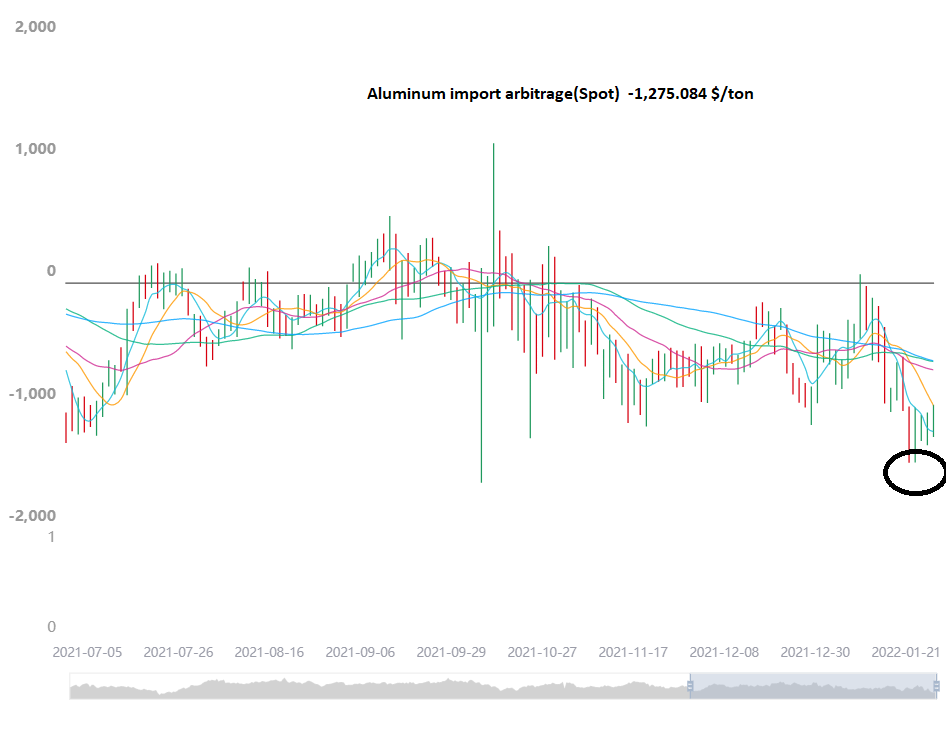

The rise in Chinese exports was essentially dictated by negative arbitrage (the difference between the LME price and the price of the metal once imported into China), where aluminum prices quoted on the Shanghai market are lower than those of the London market (lowest in the last 4 months).

Similar movements (negative arbitrage) have already occurred in the recent past (2020), with aluminum prices subsequently recovering (reducing arbitrage or taking it to positive).

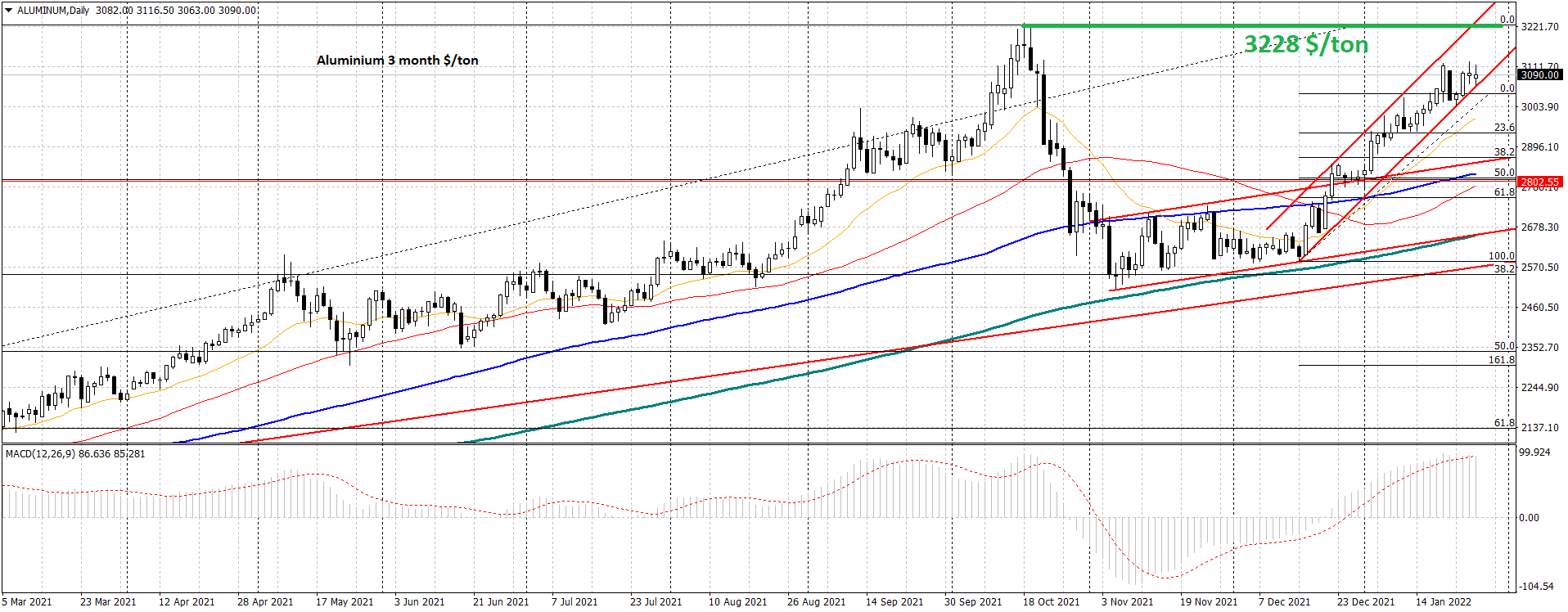

As well as the ratio of Shanghai aluminum to Lme is at the lowest since 2020, suggesting a possible recovery of Lme prices compared to Chinese ones. All chart/technical indicators suggest a continuation of the rebound triggered by the November 2021 lows (with a current recovery of 24%), with European prices expected to reach at least the first interesting levels set at the October 2021 highs at 3228 $/mt.

.gif) Loading

Loading